Aayush Jindal

Forex market outlook 2018

2017 mostly followed a bearish US Dollar theme as majors such as EUR/USD and GBP/USD recovered from all-time lows. Similarly, the Japanese Yen faced a lot of selling pressure this past year as it declined versus most other major currency.

Both fundamentally and technically, 2017 was one of the most eventful years.

Here are a few key takeaways:

- Rise of Donald Trump as the US President, leaving a major impact on the US Dollar.

- Increase in interest rates by the Fed and their hawkish stance for 2018.

- Heightened tensions from North Korea and a looming war.

- A substantial recovery in the Euro Zone’s macro fundamentals, which helped the Euro

- in moving higher versus its peers.

- UK exit from the Euro Zone and a slow and steady recovery in GBP/USD.

- Signs of economic recovery in Japan, BOJ’s negative stand and an increase in bearish pressure on the Japanese Yen.

- Cryptocurrency markets’ rise, gained market share and its impact on the Forex Market.

How did USD, EUR, GBP, JPY perform in 2017?

The US Dollar weakened in 2017. The combined overall decline versus the Euro, GBP, JPY, CHF, CAD, AUD and NZD was above 45%.

The Euro was the best performing currency in 2017. The combined overall increase in the price versus the USD, GBP, JPY, CHF, CAD, AUD and NZD accounts more than 60%.

The British Pound recovered nicely with gains of around 25%.

The Japanese Yen was under a lot of pressure in 2017 as it declined roughly 18%.

Donald Trump’s rise and impact on the US dollar

The last year started with a bang. Donald Trump was elected as the US President, and his rise as one of the top positions raised a lot of attention of investors all over the world. The Forex market witnessed a lot of volatility, but the main theme since January 2017 was the bearish US Dollar.

Trump mentioned on a couple of occasions about the US Dollar rise and its negative impact on the US companies which majorly export goods and services. Given that this is the first time the US President spoke strongly about the strength of the US Dollar, it has made a remarkable an impact on the greenback.

Tax Reform: One of the most talked about events was the Tax Cuts and Jobs Act introduced by the President Trump in December 2017. The New policy brings down the corporate tax rate from 35% to 21%, and the top individual tax rate will be cut to 37%.

The President presented an argument that the tax cuts will boost investments in business and increase in wages, which could result in higher GDP rate. It is a bold move, but the Feds are not sure how it can impact the US economy in the long term.

Such bold steps suggest that the impact Trump can force is immense. Looking ahead to 2018, more such moves are possible from his desk. It would be interesting to see how the greenback reacts going forward.

Political Tensions: Trump faced many geopolitical issues lately as tensions from North Korea and Russia escalated. The Russian President Vladimir Putin confronted the US on many occasions and the recent rise of Russia’s strength in the Middle East through its two-year intervention in Syria is raising eyebrows. The fading United States presence in the Middle East and Russia’s inclination to fill the gap suggest a power shift in the region.

More importantly, there is a war like situation emerging from the North Korea as their leader Kim Jong-un, on many occasions threatened a nuclear attack on the US. Donald Trump responded with headed messages, and tensions do not seem to over soon.

There was another important region that disappointed Trump – China. Xi Jinping failed in many areas in terms of expectation from the White House, especially when it comes to pressuring Pyongyang for their nuclear program.

Overall, Donald Trump faces a lot of political challenges in 2018 from Russia, China and North Korea. If tensions continue to rise, there are chances of safe havens such as the Japanese Yen gaining traction in the medium term.

Fed’s policy and their hawkish stance

Trump’s negative stance is completely in contrast with the Fed policies since the central bank increased interest rates three times in 2017 to 1.50% and the central bank is likely to increase it further in 2018.

Ultra-low Unemployment: The most important fundamental that is pushing the fed to normalize policy is the drop in the unemployment rate toward 4%. Furthermore, there was a steady rise in the jobs creation.

Therefore, it could lead to more interest rate hikes. Many experts believe that the central bank could even increase rates at least four times during 2018 to 2.5%, coupled with a strong economic growth and improvements in the inflation toward the fed’s target.

To summarise

If the U.S. economy continues to show signs of solid growth in 2018 and fed decides to raise interest rates further, we could see the Forex market moving accordingly. It’s true that a weaker dollar is good for the economy, especially when it comes to manufacturing and exports.

However, it’s hard to keep the dollar down with negative talks. Despite what Trump says about a weaker dollar being preferable for its economy, if the economy continues to improve and grow at a fast pace, the Dollar would gain more strength against its peers.

Technically, the Dollar index registered a decline of more than 8% in 2017. The market sentiment was positive, but the oversold conditions and risk boost ignited upsides in the pairs such as EUR/USD.

EUR/USD’s recovery and Euro zone’s political challenges

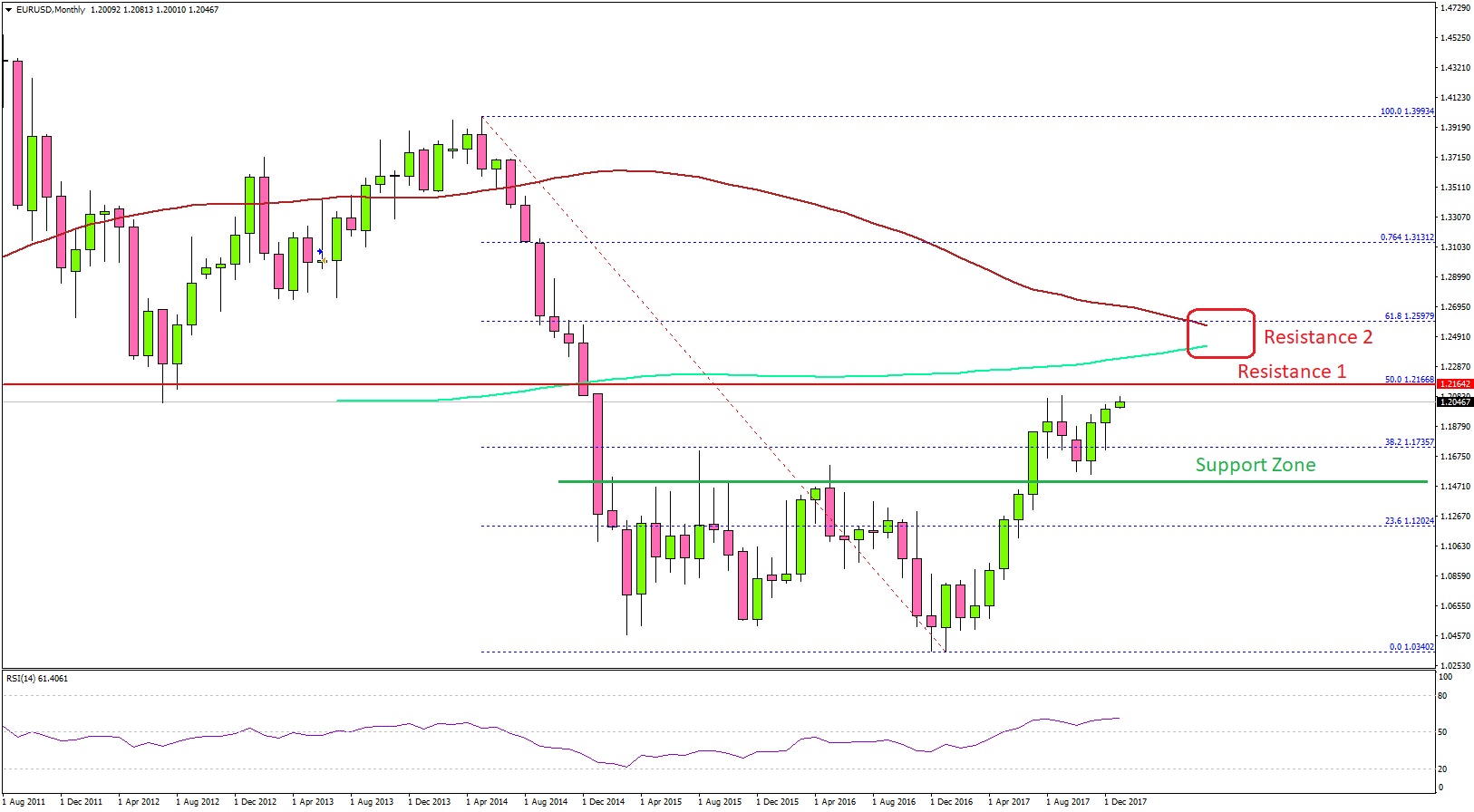

Technical analysis

Considering the long term perspective, let’s look at the monthly chart of EUR/USD. Clearly, a major low was formed around 1.0400 in January 2017. It sparked an upside recovery and the pair was able to surpass the 23.6% Fibonacci retracement level of the last major decline from the 1.3993 high to 1.0340 low.

The recovery seems to be very positive, but it looks like the Euro buyers are facing an uphill task near 1.2200 and 1.2500. The mentioned 1.2200 level was a support earlier and now it is likely to act as a resistance since it coincides with the 50% Fibonacci retracement level of the last major decline from the 1.3993 high to 1.0340 low.

Above 1.2200, two key simple moving averages (100 and 200) are positioned around 1.2500 to act as a major barrier for buyers.

Therefore, if the current recovery extends, EUR/USD will most likely face two major hurdles – 1.2200 and 1.2500. On the flip side, there is a decent support base forming around 1.1500, which will continue to serve as a major inflection point.

Fundamentals

On the fundamental front, the ECB sees an upside risk to the Euro. The shared currency already rose more than 12% during the past 12 months. Therefore, any further appreciation could trigger negative talks from the ECB to keep upside in EUR/USD in check.

The central bank has no plans to raise interest rates during the next 5-6 months and they seem to be unwilling to scale back Quantitative Easing. Therefore, any major upside move in EUR/USD faces a lot of challenges, both technically and fundamentally.

Overall, 2017 was a positive year for the Euro despite bigger political challenges in the Euro Zone. Going forward, there are many important events lined up in 2018 such as elections in Italy, which may have a negative impact on the shared currency.

Brexit and UK’s economic plus political outlook

2017 saw one of the most unexpected events as the UK launched the process to leave the Euro Zone. It had a major impact economically and politically, which pushed the Great British Pound down versus most other major currencies.

However, GBP/USD formed a bottom around 1.2000 during the mid-2017 and started an upside recovery. Another event in June 2018 was Prime Minister Theresa May losing majority in the house. Looking at the key economic indicators, the UK GDP is widely expected to remain subdued. On the other hand, there can be upward spikes in the inflation, but trade figures may continue to disappoint in the medium term.

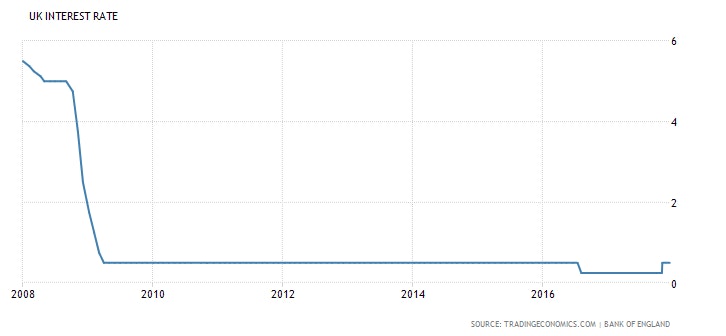

The GBP is trading at a lot lower levels, which may help exporters trading with the US. Still, they may not benefit much trading with the Euro Zone considering the fact that the Euro too remains weak. On the positive front, the Bank of England increased interest rates for the first time in many years from 0.25% to 0.50%.

The chances are very high that the central bank could opt to increase it further to 0.75% during 2018. Thus, the market sentiment will most likely favor upsides in the GBP.

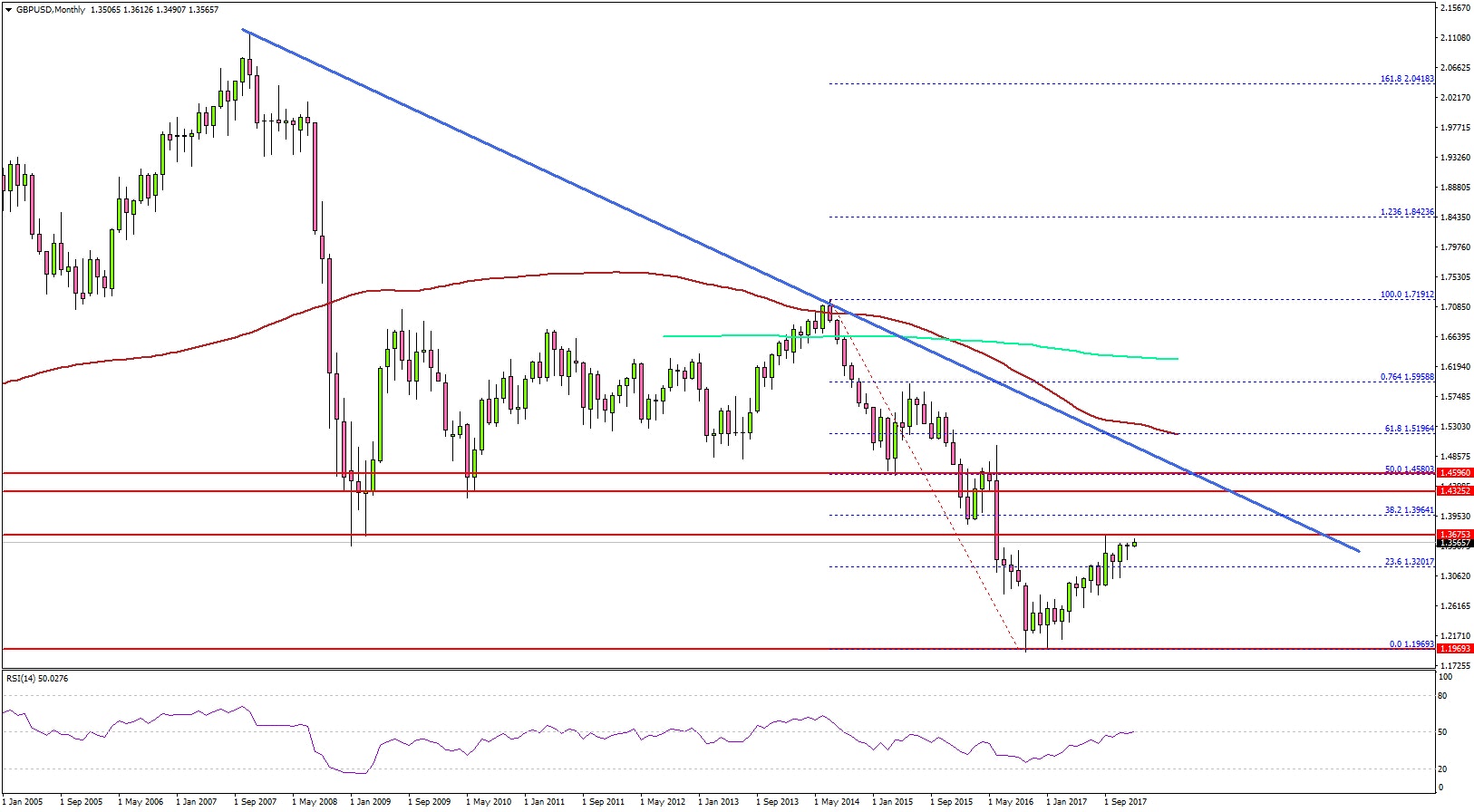

GBP/USD major upsides remain capped

Technically, GBP/USD is showing a lot of positive signs from the 1.2000 swing low. It has recovered above the 23.6% Fibonacci retracement level of the last major drop from the 1.7191 high to 1.1969 low.

The monthly chart suggests that the pair is slowly moving towards a few major resistances such as 1.3700, 1.3950 and 1.4200. There is also a key bearish trend line with resistance at 1.4150 on the same chart.

Therefore, any major upside move in 2018 is likely to face a strong selling interest around 1.4000, which can be also seen as a sell zone in the medium term.

Japan’s economy in 2018, BOJ impact and Japanese yen

2017 saw heavy downsides in the Japanese Yen versus the Euro and the British Pound, whereas it remained stable with small gains against the US Dollar.

Fundamentally, there was no major change in the interest rates from the Bank of Japan from -0.1%. There are a few positive signs emerging, which suggest a recovery in the Japanese economy. The inflation in 2018 is very likely to pick up in Japan, but the upsides are likely to be limited since it struggled to even reach 0.4% in 2017. In addition, it is very far from BOJ’s target of 2%, which is even harder to achieve by the end of 2019. Therefore, the overall bearish pressure on the Japanese Yen is likely to remain intact in the medium term.

The stimulus that accounts more than 5% of Japan’s GDP will decline slowly. It could have a slight negative impact on the growth rate in 2018, which may add to the bearish pressure on the JPY. The central bank’s efforts to keep 10-year sovereign bonds yield close to zero coupled with low inflation and subdued GDP points to a weaker Yen in 2018. In addition, there will be a major divergence between Fed’s and BOJ’s policies. The fed will continue to increase rates, and on the other hand, the BOJ may not make any changes in their stand.

Market moving toward safe havens

The only thing that could work in favor of the Japanese Yen is risk aversion, considering its safe haven status. Increased tensions in the US, North Korea, China and Russia could be one of the main triggers. Another reason could be political uncertainty in the Euro Zone and the UK.

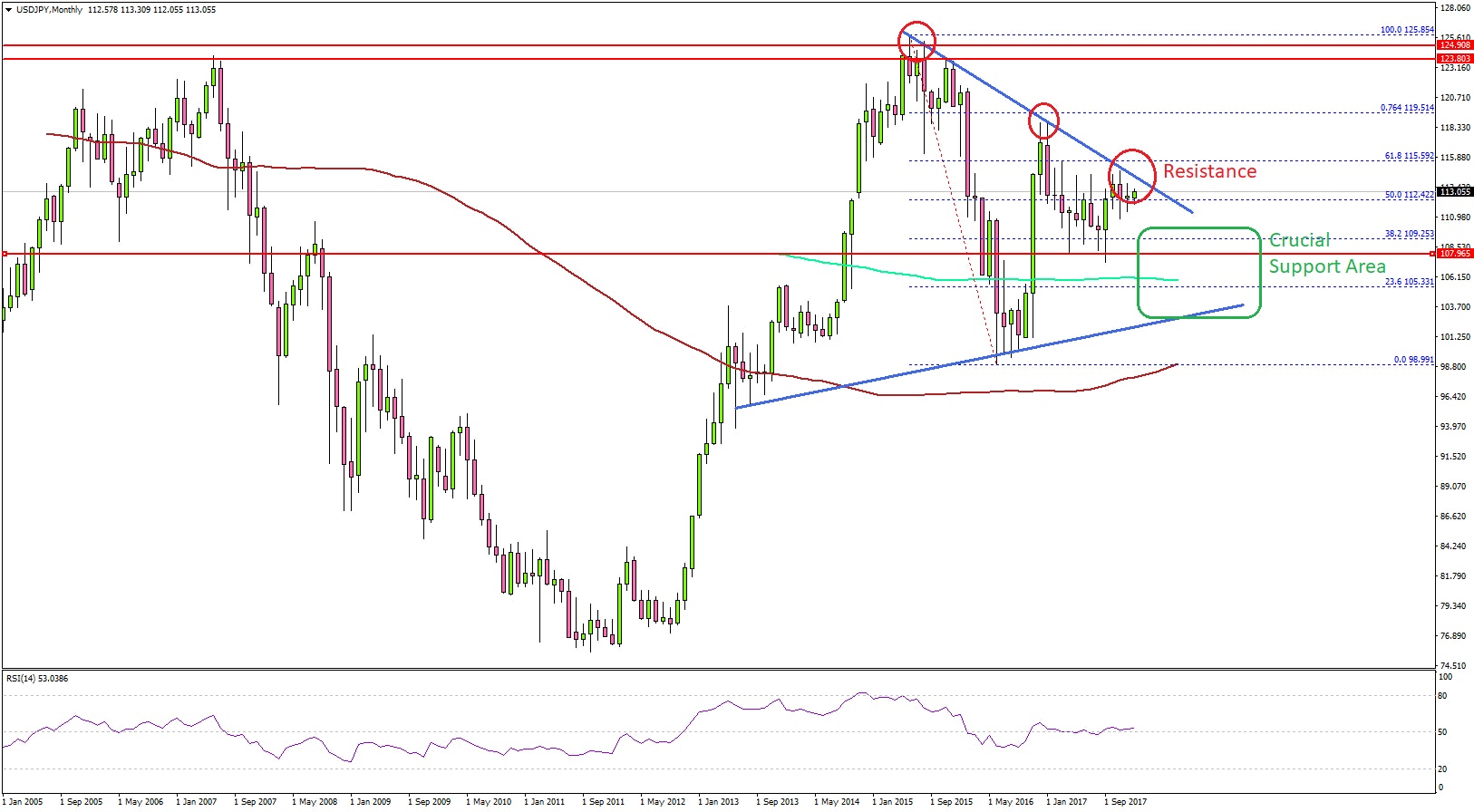

USD/JPY outlook for 2018

Let’s look at the technical aspect for USD/JPY to evaluate possible moves in 2018 and how it performed in 2017.

The monthly chart of USD/JPY suggests an upside break risk. There is a crucial bearish trend line with current resistance at 114.00-114.50. A successful monthly close above 114.50 could give power to the US Dollar bulls for further upsides. In the mentioned case, the pair will most likely accelerate toward 120.00. Above the stated 120.00, the next major resistance is at 124.00-125.00.

On the downside, there is a decent support forming at 110.00. Should there be any strength in the Japanese Yen and USD/JPY corrects lower, it could find strong buying interest near 110.00 and it may be seen as a buying opportunity.

Overall, there are many supports on the downside such as 110.00 and 108.00, which is why a substantial correction from the current levels remain supported in 2018.

Oil price gaining upside momentum

There was a slow and steady upside momentum formed for both gold and oil from crucial lows. Gold price was able to close 2017 above the $1300 level and oil price settled above $60.00.

There are many positive signs emerging for crude oil since there is an improvement in the demand cycle. Plus, an increase in geopolitical tensions in the Middle East coupled with decreasing crude stockpiles could bring bullish traction.

Should the current recovery in oil price remains intact, there could be more upsides in 2018 toward $70.00 and $75.00. On the downside, there are supports formed at $50.00 and $44.00.

Gold price rising trend

Gold price also recovered heavily in 2017 and is currently trading above both 100 and 200 weekly simple moving averages. It seems like a solid support base is forming at $1250. On the upside, a break above $1350 and $1375 is required for a run toward $1500. The outlook for 2018 looks stable as long as the price is above $1250.

Fundamentally, the Chinese economy, one of the main drivers of gold prices is showing a few signs of a slowdown. Additionally, if the Chinese government decides to do bold reforms, keeping growth aside, then there is a risk of bearish pressures on the overall market sentiment for commodities.

Rise of Cryptocurrency markets

The cryptocurrency markets stole the show in 2017. It saw a solid increase in the market share from $50B to well above $750B. Bitcoin price saw a monstrous upside move as it traded above the $10,000 mark and headed close to $20,000.

Other major cryptocurrencies such as Ether (Ethereum Blockchain), Ripple and Litecoin also saw a solid rise in terms of price and market share. The aforementioned rise attracted many investors around the world, which ignited a surge in trading volumes and volatility in the crypto market.

However, many regulatory issues, warnings and threats from many governments, central banks and regulatory firms were also the main focus. None had any major impact and it seems like the current uptrend in the crypto market is here to stay and it could also impact the Forex market in the medium term.

2018 Forecast

To sum up, 2018 could be the year of safe havens, dollar and crypto currencies. Upsides in EUR/USD and GBP/USD should be limited considering barriers on the topside. USD/JPY may follow a dip and rip scenario. Commodities arena may gain traction, but traders should be careful about considering a major upside run.