Aayush Jindal

Key Highlights

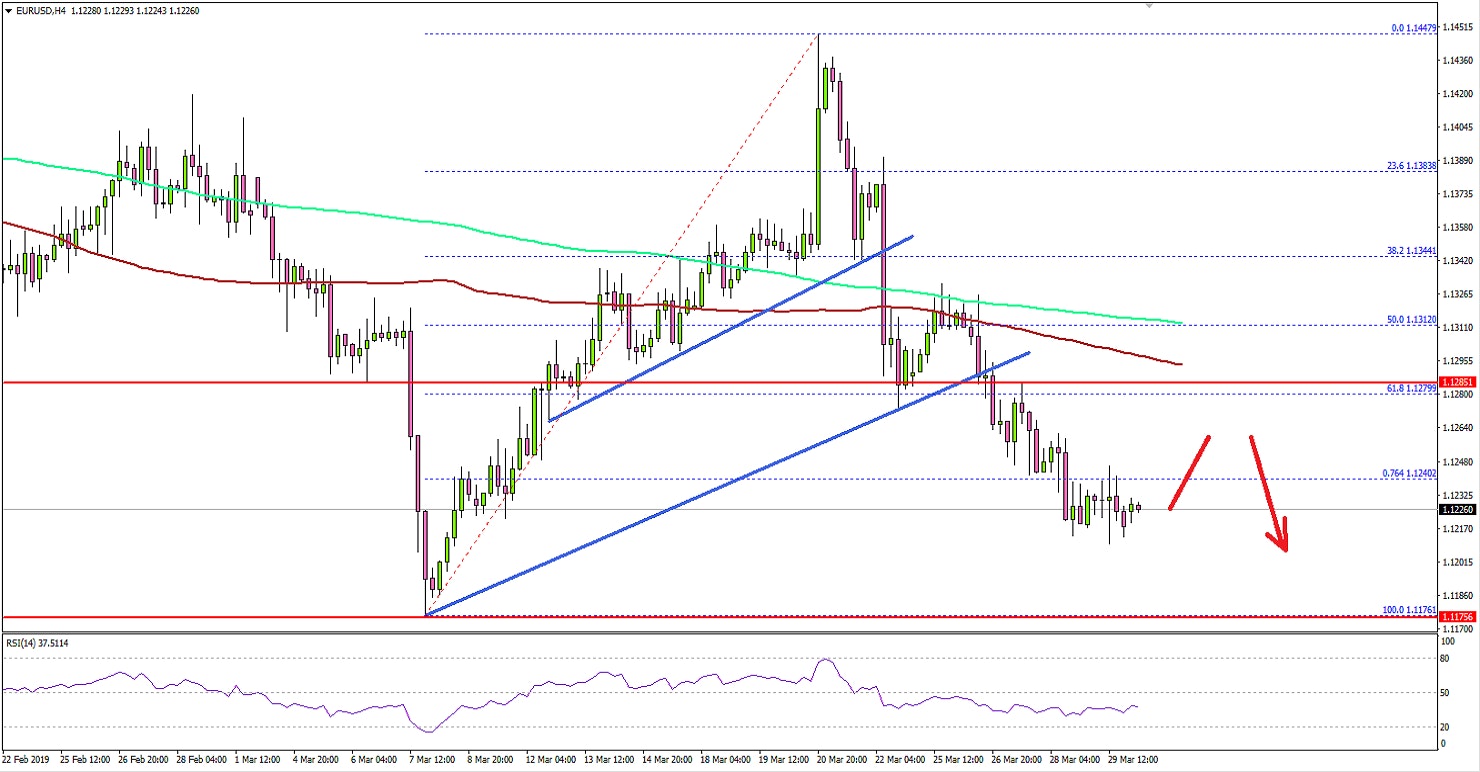

- The Euro started a major decline below the 1.1300 support against the US Dollar.

- EUR/USD traded below key bullish trend lines at 1.1340 and 1.1295 on the 4-hours chart.

- The US Personal Income increased 0.2% in Feb 2019 (MoM), less than the +0.3% forecast.

- The US ISM Manufacturing Index for March 2019 is likely to increase from 54.2 to 54.5.

EURUSD Technical Analysis

This past week, there was a strong decline in the Euro from well above the 1.1300 level against the US Dollar. The EUR/USD pair broke a crucial support near 1.1280 to enter a bearish zone.

Looking at the 4-hours chart, the pair gained bearish momentum below the 1.1280 support and the 61.8% Fib retracement level of the last wave from the 1.1176 low to 1.1447 high.The pair traded below the 1.1250 support and settled well below the 200 simple moving average (4-hours, green) and 100 simple moving average (4-hours, red). Besides, there was a close below the 76.4% Fib retracement level of the last wave from the 1.1176 low to 1.1447 high.Clearly, the pair moved into a strong downtrend and it could decline further towards the 1.1175 support area. If sellers remain in action, the pair could test the 1.1120 support and the 1.236 Fib extension level of the last wave from the 1.1176 low to 1.1447 high.On the upside, an initial resistance is near the 1.1250 level, above which the pair could test the 1.1280 pivot level and the 100 simple moving average (4-hours, red).Fundamentally, the US Personal Income report for Feb 2019 was released this past Friday by the Bureau of Economic Analysis, Department of Commerce. The market was looking for an increase of 0.3% in the personal income compared with the previous month.The actual result was lower than the forecast, as there was a 0.2% rise in the personal income. However, the outcome was positive compared to the last decline of 0.1%.The report added:

Personal income decreased $22.9 billion (-0.1 percent) in January according to estimates released today by the Bureau of Economic Analysis. Disposable personal income decreased $34.9 billion (-0.2 percent), and personal consumption expenditures increased $8.6 billion (0.1 percent).

Overall, EUR/USD might correct slightly in the short term, but it is likely to face sellers near the 1.1250 or 1.1280 resistance.

Economic Releases to Watch Today

- Germany’s Manufacturing PMI for March 2019 - Forecast 44.7, versus 44.7 previous.

- Spanish Manufacturing PMI for March 2019 – Forecast 49.5, versus 49.9 previous.

- Euro Zone Manufacturing PMI March 2019 – Forecast 47.6, versus 47.6 previous.

- UK Manufacturing PMI for March 2019 – Forecast 51.3, versus 52.0 previous.

- Euro Zone CPI for March 2019 (YoY) (Prelim) - Forecast +1.5%, versus +1.5% previous.

- Euro Zone Core CPI for March 2019 (YoY) (Prelim) - Forecast +0.9%, versus +1.0% previous.

- US ISM Manufacturing Index for March 2019 – Forecast 54.5, versus 54.2 previous.

- US Retail Sales Feb 2019 (MoM) – Forecast +0.3%, versus +0.2% previous.