Aayush Jindal

Key Highlights

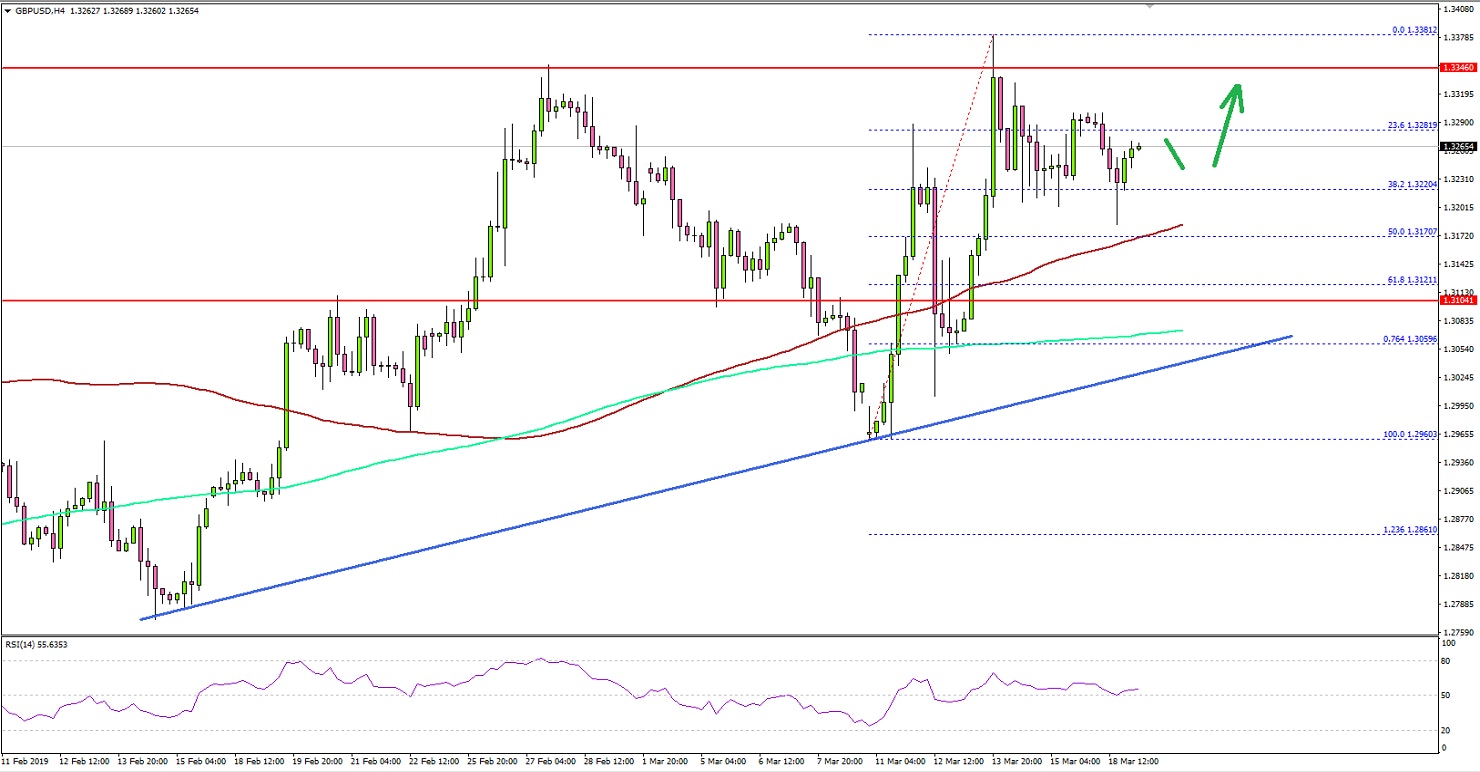

- The British Pound climbed to 1.3380 before correcting lower against the US Dollar.

- A major bullish trend line is formed with support at 1.3060 on the 4-hours chart of GBP/USD.

- The UK Rightmove House Price Index increased 0.4% in Feb 2019 (MoM), less than the last +0.7%.

- The UK Claimant Count for Feb 2019 will be released today, which could change by 2.7K.

GBPUSD Technical Analysis

After correcting lower, the British Pound found a strong support at 1.2960 against the US Dollar. The GBP/USD pair climbed above the 1.3160 and 1.3240 resistance levels to move into a positive zone. Looking at the 4-hours chart, the pair even gained traction above the 1.3300 resistance level. Besides, there was a close above the 200 simple moving average (green, 4-hours) and 100 simple moving average (red, 4-hours).The pair traded as high as 1.3381 before starting a downside correction. It traded below the 23.6% Fib retracement level of the last wave from the 1.2960 low to 1.3381 high.However, there are many supports on the downside near the 1.3170 level and the 50% Fib retracement level of the last wave from the 1.2960 low to 1.3381 high. The main support is near the 1.3120 level (the previous resistance area).Moreover, there is a major bullish trend line is formed with support at 1.3060, placed along with the 200 simple moving average (green, 4-hours). Therefore, dips in GBP/USD towards the 1.3170 or 1.3120 levels are likely to find a strong buying interest.On the upside, an initial resistance is near the 1.3300 level, followed by 1.3320. A break above the 1.3320 level could push the pair towards the 1.3380 swing high in the near term.Overall, there could be an extended decline in GBP/USD, but the pair is likely to find support on the downside near 1.3170 or 1.3120.

Looking at the 4-hours chart, the pair even gained traction above the 1.3300 resistance level. Besides, there was a close above the 200 simple moving average (green, 4-hours) and 100 simple moving average (red, 4-hours).The pair traded as high as 1.3381 before starting a downside correction. It traded below the 23.6% Fib retracement level of the last wave from the 1.2960 low to 1.3381 high.However, there are many supports on the downside near the 1.3170 level and the 50% Fib retracement level of the last wave from the 1.2960 low to 1.3381 high. The main support is near the 1.3120 level (the previous resistance area).Moreover, there is a major bullish trend line is formed with support at 1.3060, placed along with the 200 simple moving average (green, 4-hours). Therefore, dips in GBP/USD towards the 1.3170 or 1.3120 levels are likely to find a strong buying interest.On the upside, an initial resistance is near the 1.3300 level, followed by 1.3320. A break above the 1.3320 level could push the pair towards the 1.3380 swing high in the near term.Overall, there could be an extended decline in GBP/USD, but the pair is likely to find support on the downside near 1.3170 or 1.3120.Economic Releases to Watch Today

- UK Claimant Count Change Feb 2019 – Forecast 2.7K, versus 14.2K previous.

- UK ILO Unemployment Rate Jan 2019 (3M) – Forecast 4.0%, versus 4.0% previous.

- German ZEW Economic Sentiment Index March 2019 – Forecast -11.3, versus -13.4 previous.

- US Factory Orders Jan 2019 (MoM) - Forecast +0.3%, versus +0.1% previous.