Aayush Jindal

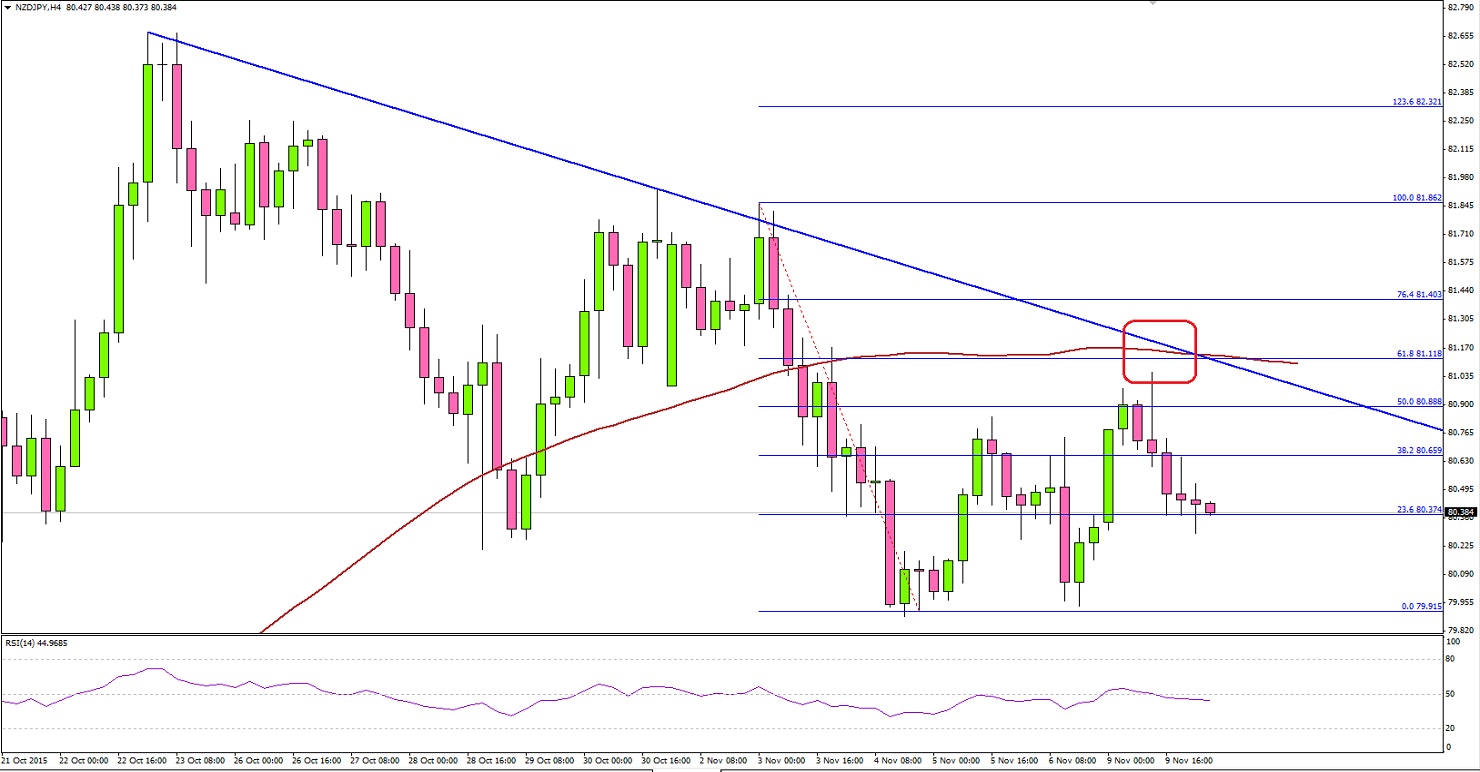

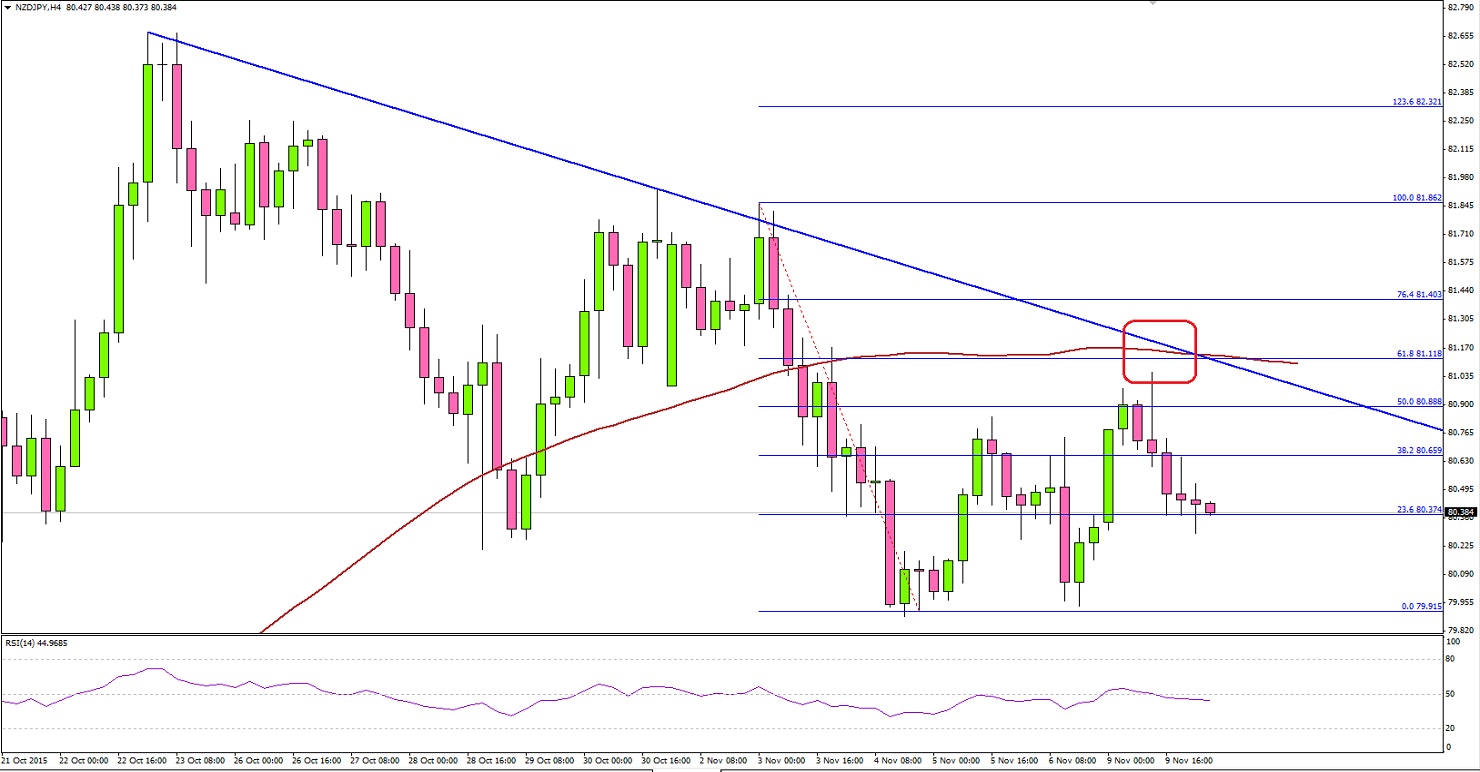

Key Highlights Moreover, there are a couple of things aligned around the trend line like the 100 moving average and the 61.8% Fib retracement level of the last drop from the 81.86 high to 79.91 low. One key bearish point to note is the fact that the RSI (4H) moved below the 50 level, suggesting the fact that sellers are in control.On the downside, the last swing low of 79.90-80.00 holds the key for the NZDJPY pair. A break below it may encourage sellers more and ignite a solid downside ride. Let us see how the pair trades moving ahead as there are barriers on the both side for NZDJPY traders.New Zealand Electronic Card Retail SalesDuring the Asian session, the Electronic Card Retail Sales, which measures the purchases made in New Zealand on debit, credit and store cards was reported by Statistics New Zealand. The market was expecting a minor gain in sales in October 2015, compared with the preceding month.However, the result was a bit lower compared with the forecast, as there was no change in the Electronic Card Retail Sales for October. The yearly change sales were up by 5.6% in October, but less than the last increase of 6.1%.Overall, there was nothing great to cheer for the New Zealand Dollar buyers, which resulted in a minor downside reaction in NZDUSD and NZDJPY.

Moreover, there are a couple of things aligned around the trend line like the 100 moving average and the 61.8% Fib retracement level of the last drop from the 81.86 high to 79.91 low. One key bearish point to note is the fact that the RSI (4H) moved below the 50 level, suggesting the fact that sellers are in control.On the downside, the last swing low of 79.90-80.00 holds the key for the NZDJPY pair. A break below it may encourage sellers more and ignite a solid downside ride. Let us see how the pair trades moving ahead as there are barriers on the both side for NZDJPY traders.New Zealand Electronic Card Retail SalesDuring the Asian session, the Electronic Card Retail Sales, which measures the purchases made in New Zealand on debit, credit and store cards was reported by Statistics New Zealand. The market was expecting a minor gain in sales in October 2015, compared with the preceding month.However, the result was a bit lower compared with the forecast, as there was no change in the Electronic Card Retail Sales for October. The yearly change sales were up by 5.6% in October, but less than the last increase of 6.1%.Overall, there was nothing great to cheer for the New Zealand Dollar buyers, which resulted in a minor downside reaction in NZDUSD and NZDJPY.

- New Zealand Dollar corrected higher against the Japanese Yen after trading as low as 79.90.

- The NZDJPY pair is currently facing a tough resistance near the 81.00 area as the 100 moving average (4-hours) is sitting around it along with a bearish trend line.

- New Zealand Electronic Card Retail Sales as reported by Statistics New Zealand posted no change in October 2015, compared with the preceding month.

- Chinese Consumer Price Index is released by the National Bureau of Statistics of China posted a decrease of 0.3%, more than the market forecast for October 2015.

Moreover, there are a couple of things aligned around the trend line like the 100 moving average and the 61.8% Fib retracement level of the last drop from the 81.86 high to 79.91 low. One key bearish point to note is the fact that the RSI (4H) moved below the 50 level, suggesting the fact that sellers are in control.On the downside, the last swing low of 79.90-80.00 holds the key for the NZDJPY pair. A break below it may encourage sellers more and ignite a solid downside ride. Let us see how the pair trades moving ahead as there are barriers on the both side for NZDJPY traders.New Zealand Electronic Card Retail SalesDuring the Asian session, the Electronic Card Retail Sales, which measures the purchases made in New Zealand on debit, credit and store cards was reported by Statistics New Zealand. The market was expecting a minor gain in sales in October 2015, compared with the preceding month.However, the result was a bit lower compared with the forecast, as there was no change in the Electronic Card Retail Sales for October. The yearly change sales were up by 5.6% in October, but less than the last increase of 6.1%.Overall, there was nothing great to cheer for the New Zealand Dollar buyers, which resulted in a minor downside reaction in NZDUSD and NZDJPY.

Moreover, there are a couple of things aligned around the trend line like the 100 moving average and the 61.8% Fib retracement level of the last drop from the 81.86 high to 79.91 low. One key bearish point to note is the fact that the RSI (4H) moved below the 50 level, suggesting the fact that sellers are in control.On the downside, the last swing low of 79.90-80.00 holds the key for the NZDJPY pair. A break below it may encourage sellers more and ignite a solid downside ride. Let us see how the pair trades moving ahead as there are barriers on the both side for NZDJPY traders.New Zealand Electronic Card Retail SalesDuring the Asian session, the Electronic Card Retail Sales, which measures the purchases made in New Zealand on debit, credit and store cards was reported by Statistics New Zealand. The market was expecting a minor gain in sales in October 2015, compared with the preceding month.However, the result was a bit lower compared with the forecast, as there was no change in the Electronic Card Retail Sales for October. The yearly change sales were up by 5.6% in October, but less than the last increase of 6.1%.Overall, there was nothing great to cheer for the New Zealand Dollar buyers, which resulted in a minor downside reaction in NZDUSD and NZDJPY.