Aayush Jindal

Key Highlights

- The Euro gained momentum and broke the 1.1350resistance against the US Dollar.

- EUR/USD is showing positive signs and it couldrise above 1.1400 in the near term.

- The US Manufacturing PMI in June 2019 (Prelim)declined from 50.5 to 50.1.

- The German IFO Business Climate Index in June2019 might slide from 97.9 to 97.3.

EURUSD Technical Analysis

After dovish signals from the Fed, the Euro stared a strong upward move above 1.1300 against the US Dollar. EUR/USD gained momentum above 1.1320 and it could continue to rise in the near term.

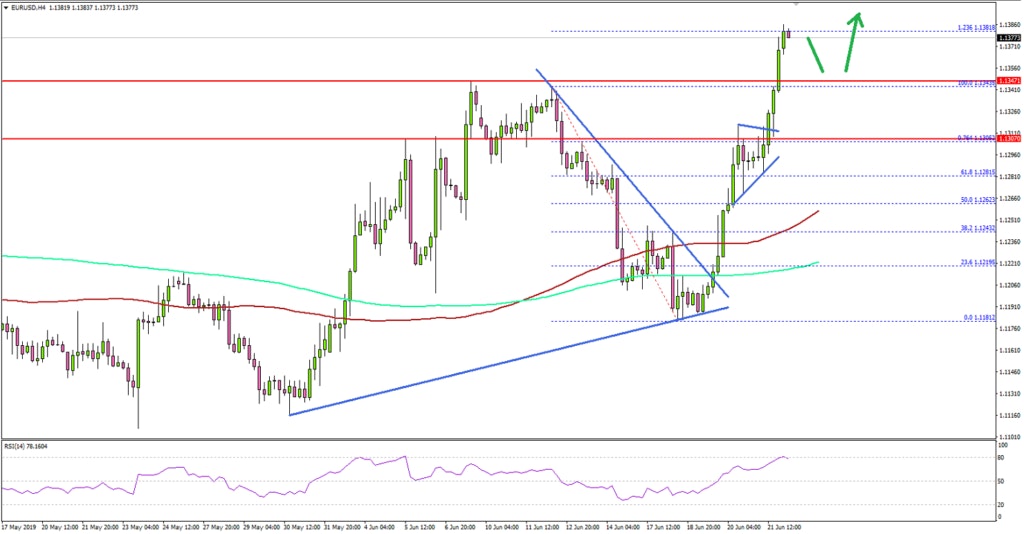

Looking at the 4-hours chart, the pair settled nicely above1.1320 and the 100 simple moving average (red, 4-hours) to move into a positivezone.

The pair even surpassed the last swing high near 1.1347 andbroke the 1.1350 resistance. It traded close to the 1.236 Fib extension levelof the last side from the 1.1343 high to 1.1181 low.

The current price action is positive, suggesting more gainsin EUR/USD above the 1.1400 and 1.1420 resistance levels. Conversely, if thereis a downside correction, the previous resistances near 1.1340 and 1.1320 arelikely to act as supports.

The main support is near the 1.1250 and the 100 simplemoving average (red, 4-hours), below which the pair could turn bearish in theshort term.

Fundamentally, the US Manufacturing PMI report for June 2019(Prelim) was released by the Markit Economics. The market was looking for a minordecline in the PMI from 50.5 to 50.4.

The actual result was lower than the market forecast, as theUS Manufacturing PMI declined from 50.5 to 50.1. Besides, the ServicesPurchasing Managers Index (PMI) also declined from 50.9 to 50.7.

The report added:

Manufacturers indicated only a fractional rise in production volumes in June, with the pace of expansion the slowest since the current phase of recovery began in mid-2016. Service providers also experienced the weakest business activity performance for around three years.

Overall, the US Dollar is clearly under a lot of pressure and pairs such as EUR/USD, GBP/USD and AUD/USD are likely to continue higher.

Economic Releases to Watch Today

- German IFO Business Climate Index June 2019 –Forecast 97.3, versus 97.9 previous.

- German IFO Current Assessment Index June 2019 -Forecast 100.0, versus 100.6 previous.

- Chicago Fed National Activity Index June 2019 –Forecast -0.37, versus -0.45 previous.