Aayush Jindal

Key Highlights

- The British Pound started a short term recoveryfrom 1.2014 against the US Dollar.

- GBP/USD is struggling to gain momentum above the1.2180 and 1.2200 resistances.

- The Euro Zone CPI in July 2019 declined 0.5%(MoM), more than the -0.4% forecast.

- EUR/USD could extend losses as long as it isbelow 1.1150.

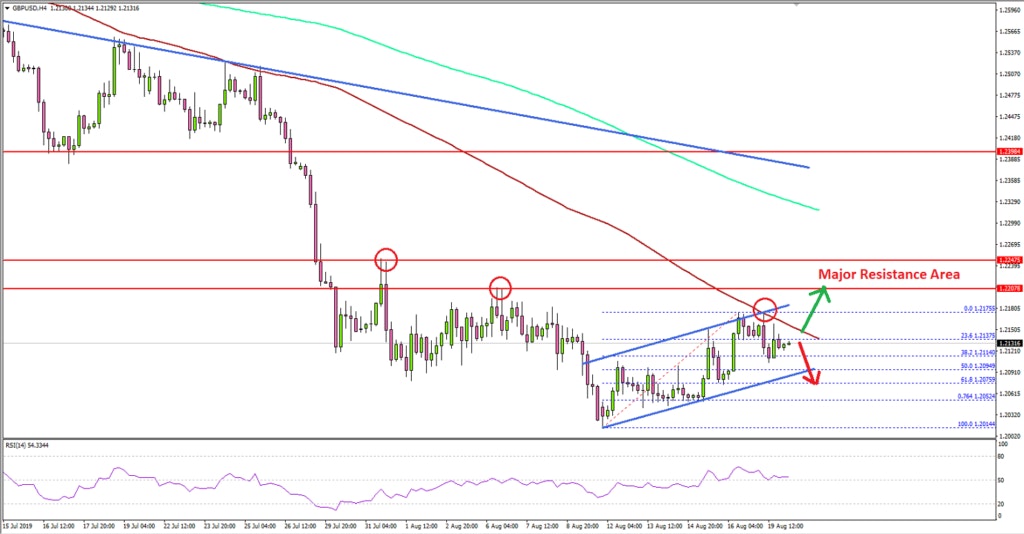

GBP/USD Technical Analysis

Earlier this month, we saw a sharp decline in the British Pound below 1.2200 against the US Dollar. The GBP/USD pair traded as low as 1.2014 and recently started an upside correction.

Looking at the 4-hours chart, the pair recovered above the1.2100 resistance to start the recent recovery. The pair even climbed above the1.2150 level, but it seems like the 100 simple moving average (red, 4-hours)capped the upside.

More importantly, the 1.2180 and 1.2200 levels seem to beacting as a strong hurdles (as discussed in the last week’s analysis). Therecent swing high was near 1.2175 before the pair corrected below the 1.2150level plus the 23.6% Fib retracement level of the upward move from the 1.2014low to 1.2175 high.

On the downside, there is a strong support forming near1.2080 and 1.2090. If there is a bearish break below the 1.2080 level, GBP/USDcould resume its slide towards the 1.2000 support.

Conversely, a clear break above the 1.2200 resistance plus aclose above the 100 simple moving average (red, 4-hours) will most likely starta strong rise towards 1.2350 in the coming days.

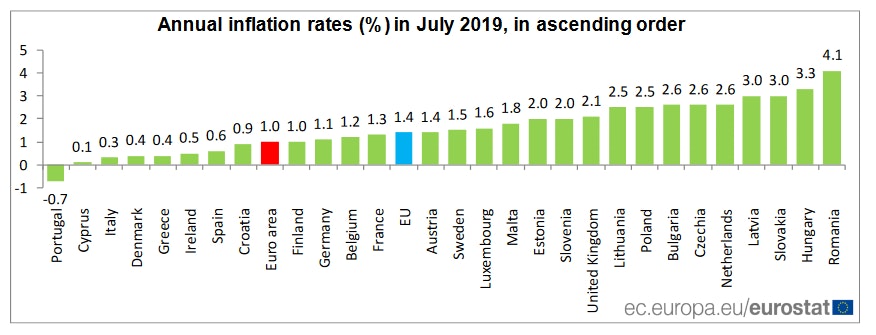

Fundamentally, the Euro Zone CPI for July 2019 was releasedby the Eurostat. The market was looking for a 0.4% decline in the CPI comparedwith the previous month.

However, the actual result was disappointing, as there was a 0.5% decline in the CPI (the last reading was +0.2%). Looking at the yearly change, the CPI declined from the last revised reading of 1.3% to 1.0%.

The report added:

In July, the highest contribution to the annual euro area inflation rate came from services (+0.53 percentage points, pp), followed by food, alcohol & tobacco (+0.37 pp), non-energy industrial goods (+0.08 pp) and energy (+0.05 pp).

EUR/USD remained in a bearish zone below the 1.1150 and 1.1160 resistance levels. Overall, the US Dollar remains in control and a strong upward move in EUR/USD and GBP/USD won’t be easy.

Economic Releases to Watch Today

- Euro Zone Construction Output June 2019 (YoY) –Forecast +2.1%, versus +2.0% previous.

- UK’s CBI Industrial Trends Survey Orders August2019 (MoM) - Forecast -25, versus -34 previous.