Aayush Jindal

If you are new to the forex market, there are a few important terms you should familiarise yourself with – pip, bid price, ask price and spread.

Pip in the forex market

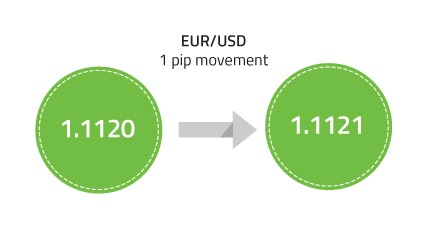

A pip in the FX market stands for point in percentage. It is the smallest unit of measurement to express the change in prices between two currencies. Most US Dollar currency pairs like EUR/USD, GBP/USD and AUD/USD are quoted to four decimal places like 1.1120. One pip equals 0.0001, and mostly the last decimal place of a forex quote (exchange rate).

For example, if the EUR/USD pair moves from 1.1120 to 1.1121 it means there was a rise of $0.0001 - one ‘Pip’. Japanese Yen pairs such as EUR/JPY are quoted to two decimal places, 112.21.

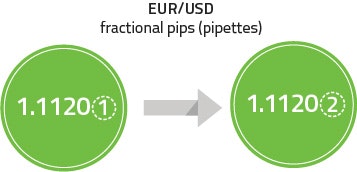

What are pipettes?

To provide accuracy, some forex brokerage and Titan FX quote rates to five decimal places. The 5th place is for fractional pip, which is 1/10th of a pip. For example, if EUR/USD moves from 1.11201 to 1.11202, the change of $0.00001 is equivalent one Pipette.

Bid and ask price

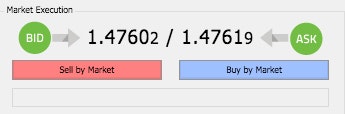

An exchange rate is quoted with a bid price and an ask price. A bid price is also known as buy price at which you buy a currency pair, and ask price is sell price at which you sell a currency pair.

<p "example-intro en-blog">For example, EUR/USD is quoted as 1.47602 / 1.47619

<p "example-intro en-blog">For example, EUR/USD is quoted as 1.47602 / 1.47619

The bid price is 1.47602 for buying EUR/USD - your broker is bidding Euros against the US Dollar and you are selling Euro for $1.47602

The ask price is 1.47619 for selling EUR/USD - your broker is offering Euros against the US Dollar, you are buying Euro for $1.47619.

Note: The bid price is always lower than the ask price.

What is spread?

To put it simply, a spread is the difference between bid price and ask price. Spreads are denominated in pips and vary from one broker to another. For example, in the above example used for ask price/ bid price (1.47602 / 1.47619) the spread is 1.7 pips.

Fixed spread is when the difference between the ask price and bid price is fixed. Fixed spreads occur irrespective of the markets conditions.

Variable spreads vary and depend on the market conditions. At times when the market is volatile you may get high spreads, and vice versa.

Most traders prefer variable spreads since the average spread is a lot lower compared with fixed spreads. Spreads can be viewed as the transaction cost to execute a trade. It's an important factor while choosing a broker for trading as it determines the cost you incur for each trade. Traders always look for tight spreads in order to maximize returns and bring down trading costs.

Titan FX provides tight spreads and quotes from as many as 50 Major Banks and other liquidity providers. Our Zero Blade ECN account offers the tightest available spreads with low commission, spreads can be as low as zero pips due to Zero Point Dynamic Liquidity Aggregation (ZP-DLA).