Aayush Jindal

Key Highlights

- AUD/USD started an upside correction from the 0.5500 support area.

- A major bearish trend line was breached with resistance near 0.5850 on the 4-hours chart.

- The US Manufacturing PMI declined from 50.7 to 49.2 in March 2020 (Prelim).

- The US Durable Goods Orders could decline 0.8% in Feb 2020, more than the last -0.2%.

AUD/USD Technical Analysis

This month, the Aussie Dollar declined heavily from well above 0.6200 against the US Dollar. AUD/USD even broke the 0.5800 support area before it found support near 0.5500.

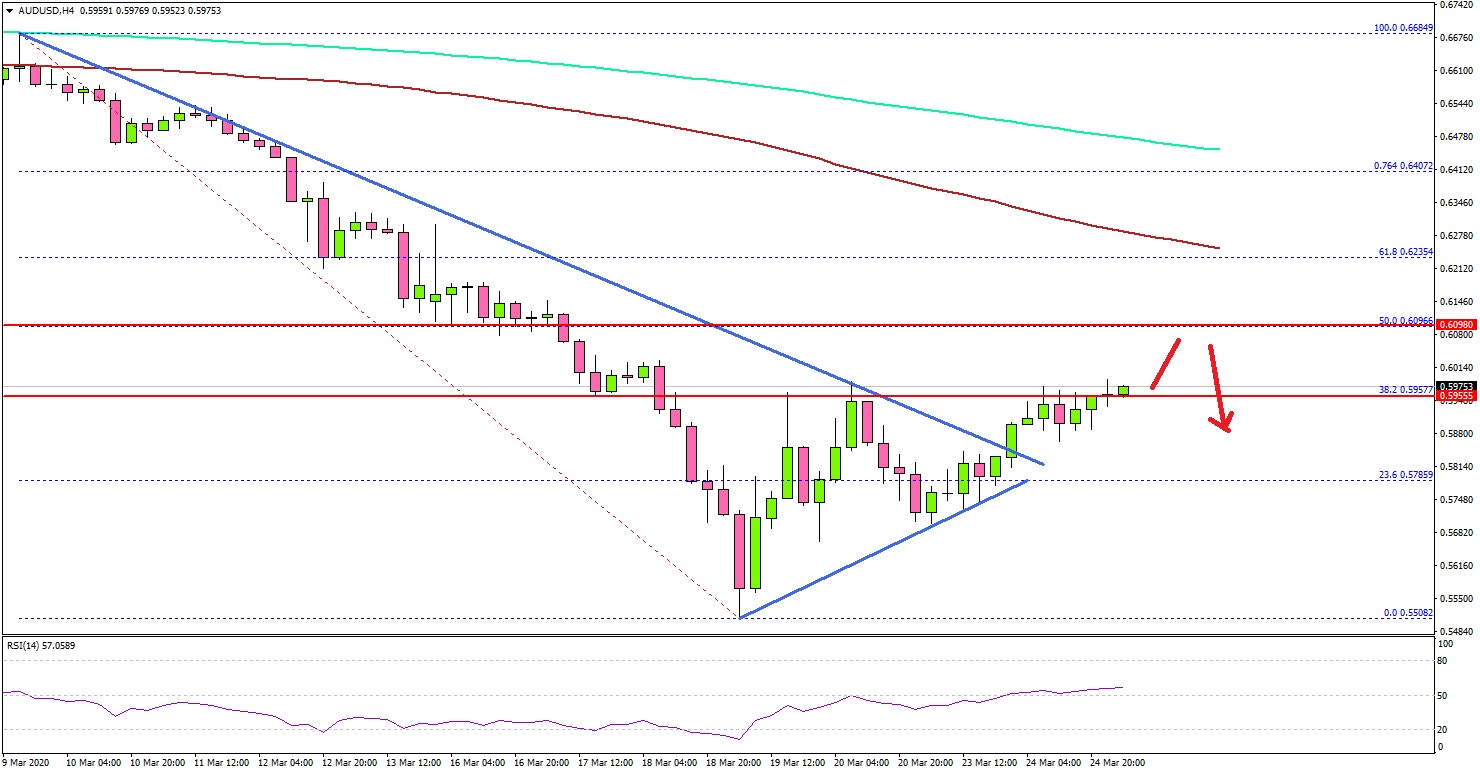

Looking at the 4-hours chart, the pair traded as low as 0.5508 and settled well below the 100 simple moving average (red, 4-hours), and the 200 simple moving average (green, 4-hours).

The pair is currently correcting higher and trading above the 0.5700 resistance. Besides, there was a break above a major bearish trend line with resistance near 0.5850.

The pair climbed above the 23.6% Fib retracement level of the key drop from the 0.6684 high to 0.5508 low. On the upside, there are many hurdles near the 0.6000 and 0.6100 levels.

The 50% Fib retracement level of the key drop from the 0.6684 high to 0.5508 low is also near the 0.6096 to act as a hurdle. A clear break above the 0.6100 resistance could set the pace for more upsides in the near term.

If AUD/USD fails to continue high above 0.6000 or 0.6100, there is a risk of a fresh decline. An initial support is near the 0.5800 level. If the bears take control, the pair could revisit the 0.6500 support area.

Fundamentally, the US Manufacturing Purchasing Managers Index (PMI) for March 2020 (prelim) was released by the Markit Economics. The market was looking for a sharp decline from 50.7 to 42.8.

The actual result was better, as the US Manufacturing PMI came in at 49.2. However, the US Services PMI declined sharply from 49.4 to 39.1.

The report added:

U.S. private sector firms indicated a marked contraction in overall business activity in March following the escalation of the coronavirus disease 2019 (COVID-19) outbreak.

Looking at EUR/USD, the pair is facing a strong resistance near 1.0865 and GBP/USD is likely to face hurdles near 1.1850 in the near term.

Upcoming Economic Releases

- UK Consumer Price Index Feb 2020 (YoY) – Forecast +1.7%, versus +1.8% previous.

- UK Core Consumer Price Index Feb 2020 (YoY) – Forecast +1.5%, versus +1.6% previous.

- German IFO Business Climate Index for March 2020 – Forecast 87.7, versus 87.7 previous.

- US Durable Goods Orders for Feb 2020 – Forecast -0.8% versus -0.2% previous.