Nick Goold

Dow Jones Index

Despite another volatile week for US equities, the Dow Jones index ended the week close to unchanged. The week's focus was the state of the US banking system as rumors of problems in other US banks weakened sentiment. Also, issues at Credit Suisse magnified with UBS negotiating to buy Credit Suisse over the weekend.

The US data released last week showed inflation was less than expected, but worries about US banks overshadowed the economic data. There is little US economic data to be released this week, but the US Federal Reserve meets to decide on interest rates. Following the recent banking problems, despite inflation remaining high, there is a 50% chance of no interest rate and 50% of a 0.25% interest rate rise. Either result will create significant volatility; either scenario could be considered bullish or bearish.

There is still a lot of risk to the downside in the Dow Jones Index, so looking to sell a rise is the best strategy. Volatility will remain high as it is hard to judge the magnitude of the banking problems, so rather than trying to predict the next major moves, traders will have many opportunities to follow the short-term daily trends.

Resistance: 32500, 33000, 33500, 34000, 34500, 35000

Support: 31725, 31450, 31000, 30500, 30000

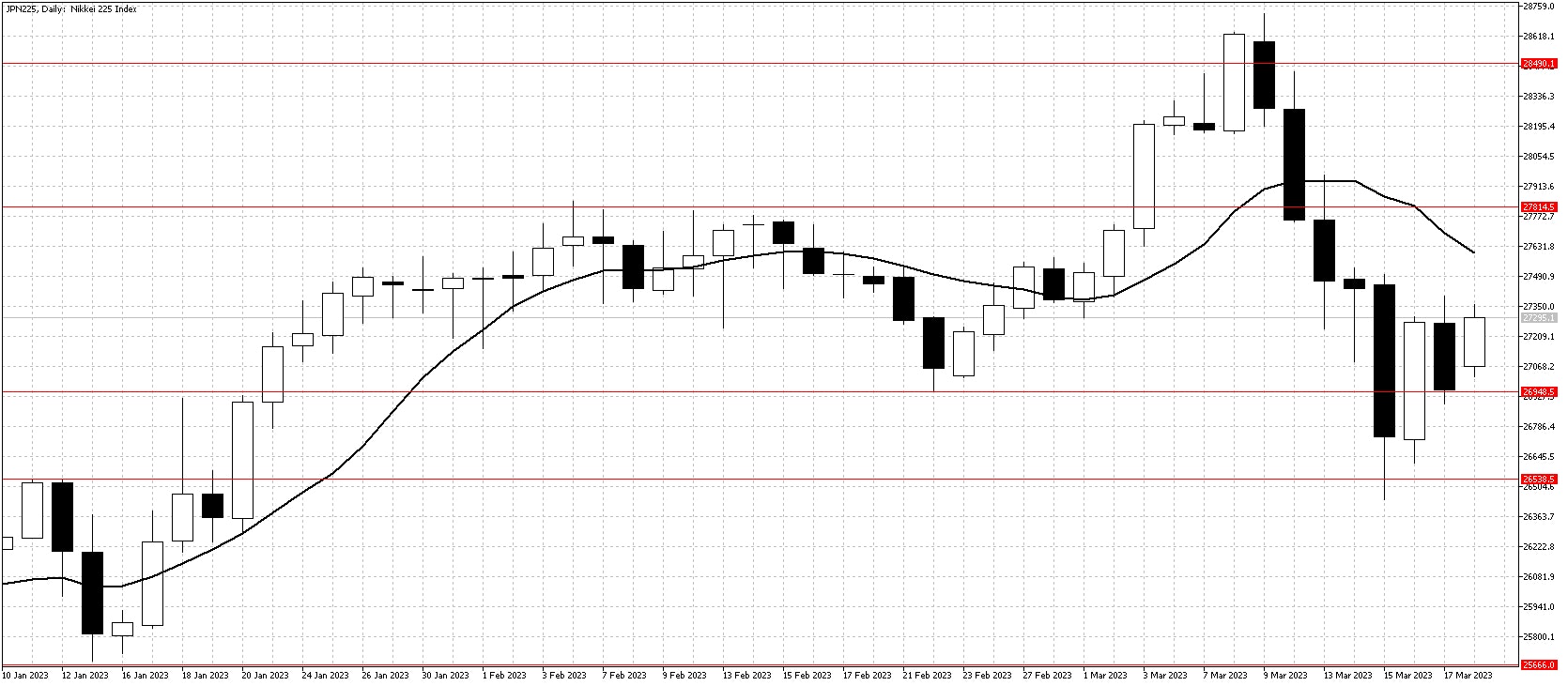

Nikkei 225 index

The Nikkei 225 index suffered again as both US equities and the lower USDJPY pushed values lower. In addition, the US 10-year interest rate again fell significantly down to 3.40%, reducing the USD's attractiveness. The Nikkei 225 index encouragingly held support from last month on Friday, but the current downtrend remains strong.

There is no talk of the banking troubles hitting Japan, which is positive, and should the USDJPY find support, the Nikkei could quickly rise in the short term. Fundamentally, the Japanese stock market is stronger than the US, so any positive news on US banks could also see the Nikkei index rise quickly.

In the short term, the market remains difficult to forecast as there are many unknowns regarding the future of the US banking system. However, this week expect the Nikkei index to move sideways to higher.

Resistance: 27500, 27815, 28500, 29000, 29250

Support: 26950, 26500, 26250, 25500, 25000, 24500