Nick Goold

Gold

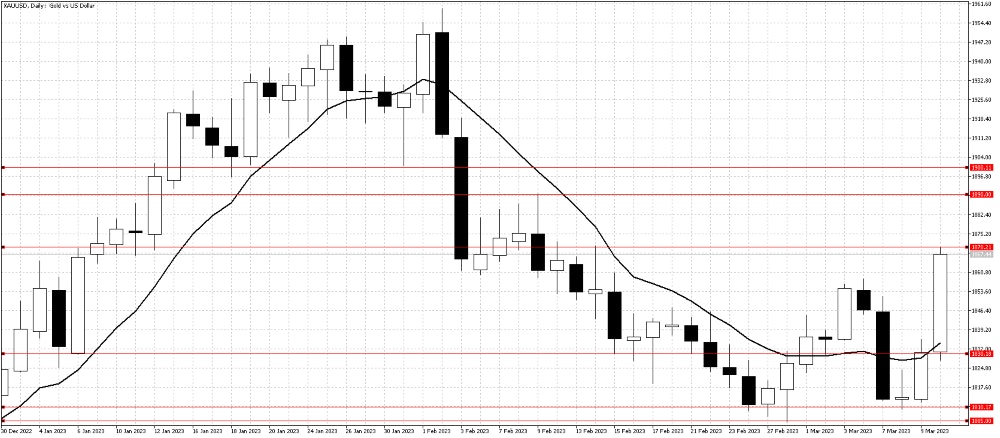

A volatile week for Gold prices as traders try to determine what will be the next trend. The Fed chairman`s speech was negative for Gold prices, sending prices quickly back to support at $1,810 as he indicated that high US interest rates would continue. With the daily 10-day moving average indicating a sideways market, traders were happy to buy ahead of support.

Range traders were rewarded at the end of the week as problems at the Silicon Valley Bank boosted prices. The current view from analysts is that the issues are contained to this bank only, but given the US equity markets closed below support last Friday, Gold could benefit from further safe-haven buying.

The USD weakened last week, helping Gold, and with many important US economic indicators ahead this week, expect further large moves. However, the gold chart still indicates a sideways market, so buying at these levels could be dangerous. Furthermore, should worries about the US banks subside and USD strengthen again, it could present a great short-term selling opportunity for Gold this week.

Resistance: 1870, 1890, 1900

Support: 1830, 1810, 1805, 1800, 1775, 1760

WTI

WTI prices failed at $80.50 resistance following weaker-than-expected economic data from China at the start of the week. In addition, Fed Chairman Powell indicated higher US interest rates are likely to continue, prompting more selling from traders worried about lower US demand.

By the end of the week, WTI prices had returned to the $75 support level, which attracted strong buying. This week expect range trading conditions to continue, so short-term trading looks to be the most attractive strategy. However, should the banking problems issue increase and US equity prices fall further, expect prices to test $72.50.

Resistance: 80.50, 82.70, 84.00, 90.00

Support: 75.00, 73.80, 72.50, 70.00, 66.00