Nick Goold

Gold

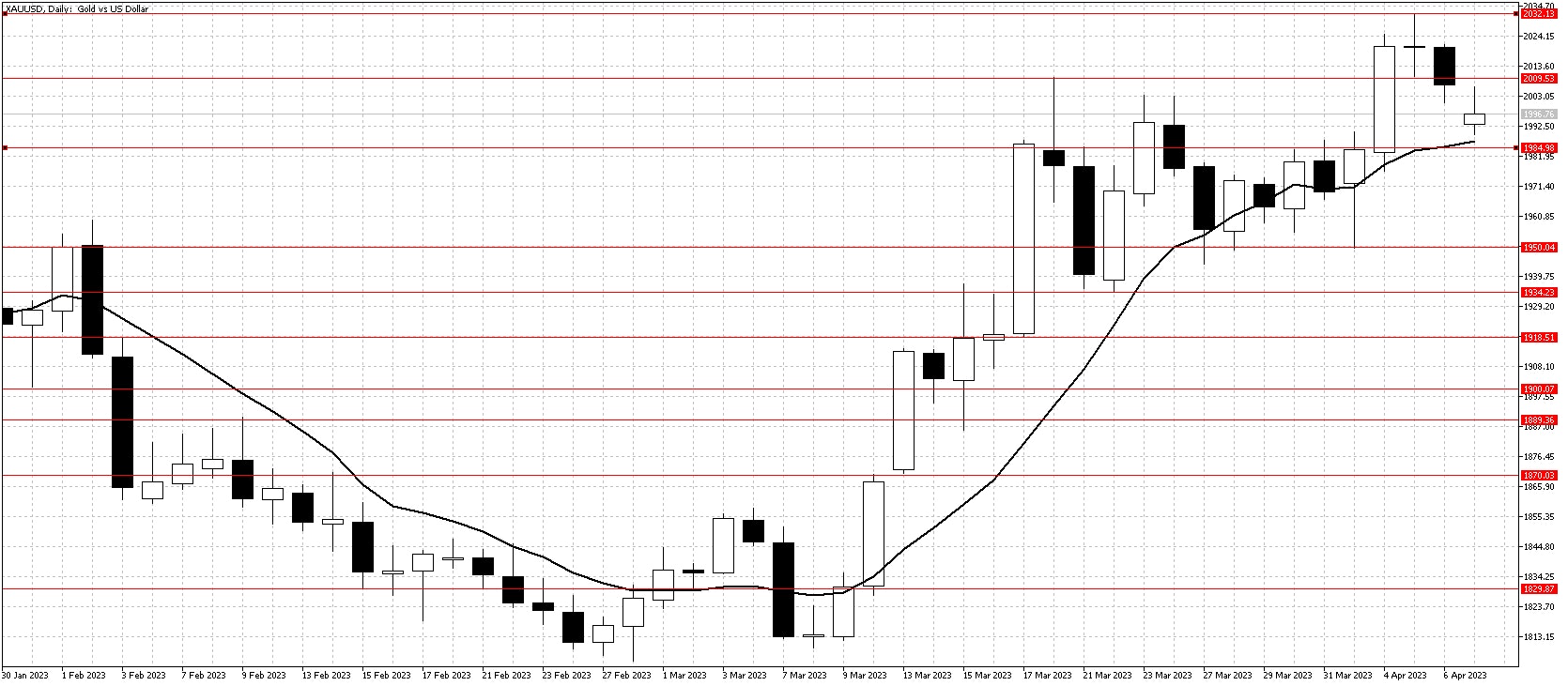

Gold prices surged again last week as weak US economic data weakened the USD and pushed long-term US interest rates lower. Investors are increasingly interested in Gold as inflation remains high and as a hedge against a weaker USD. In addition, there is increasingly positive talk regarding Gold as the recent banking failures raised questions about the strength of the financial system.

Now prices are back above $2,000 again, and bulls are targeting all-time highs hit over the pandemic at $2,075. Currently, the technical picture is positive and higher prices are more likely if Gold can stay above the 10-day moving average.

On the other hand, there is a potential for disappointment as a pushback below $2,000 could signal a false break. Gold sentiment can change quickly, and following short-term trends can present profitable trading opportunities.

Resistance: 2010, 2032, 2070

Support: 1985, 1950, 1935, 1918, 1900, 1890, 1870, 1830

WTI

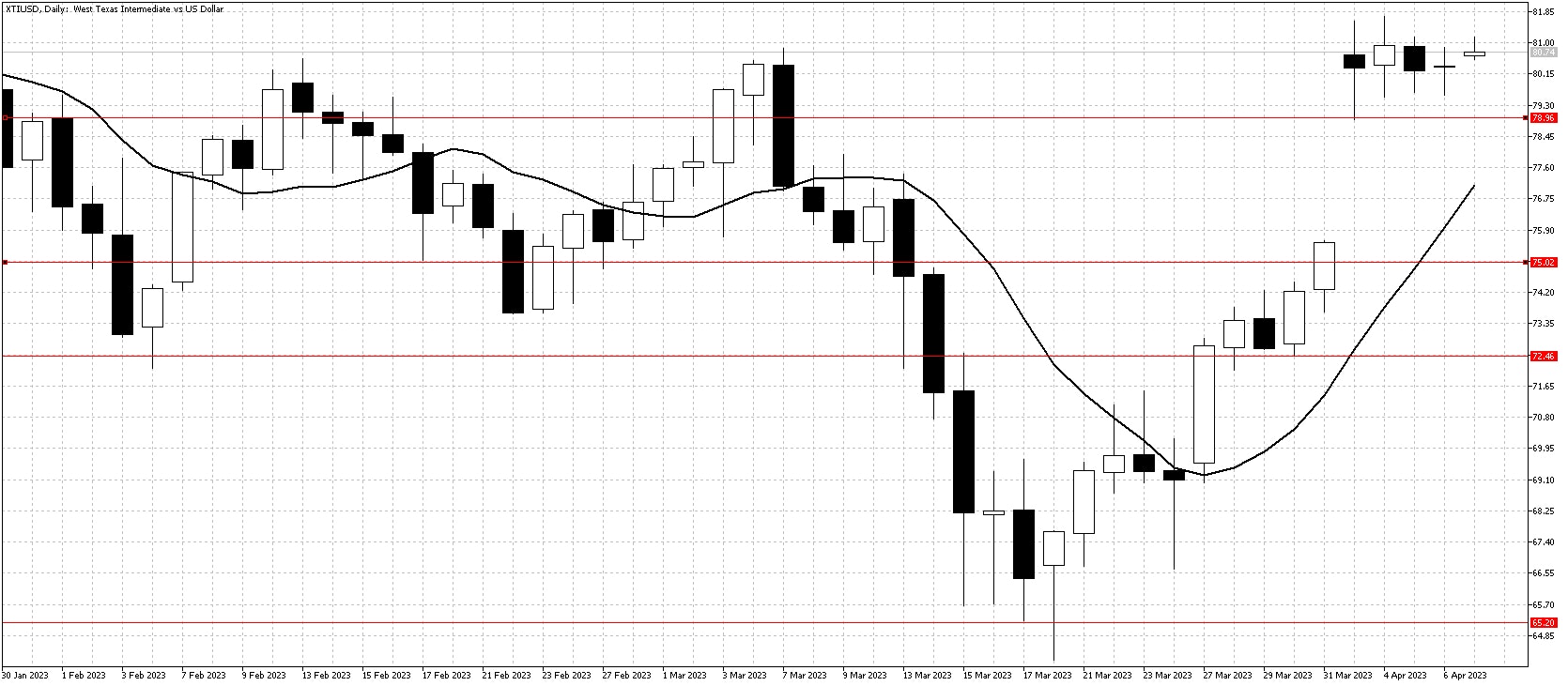

Surprise production cuts from OPEC led by Russia saw WTI remain above $80 despite weak economic figures from the US, increasing the probability of a recession in 2023. The voluntary output cut of 1.66 million barrels per day and hopes of continued recovery in Chinese demand brightens the medium-term outlook for WTI.

The weaker USD recently is also favorable for WTI, but strong resistance remains at $82.50 at the highs from 2023. WTI is a speculative market, so there is a potential for a surprise break of $82.50 this week, so looking for buying opportunities looks to be the best short-term strategy. If prices fall below $79.50, a quick fall back to $75.00 is possible.

Resistance: 82.50, 85.00, 90.00

Support: 75.00, 72.50, 70.00, 65.00, 62.00