Nick Goold

Channel trading is a Forex trading strategy using lines on a chart to find trend and range trading opportunities. This guide will delve into the depths of channel trading in Forex, exploring its various aspects and implications for Forex trading.

Introduction to Channel Trading

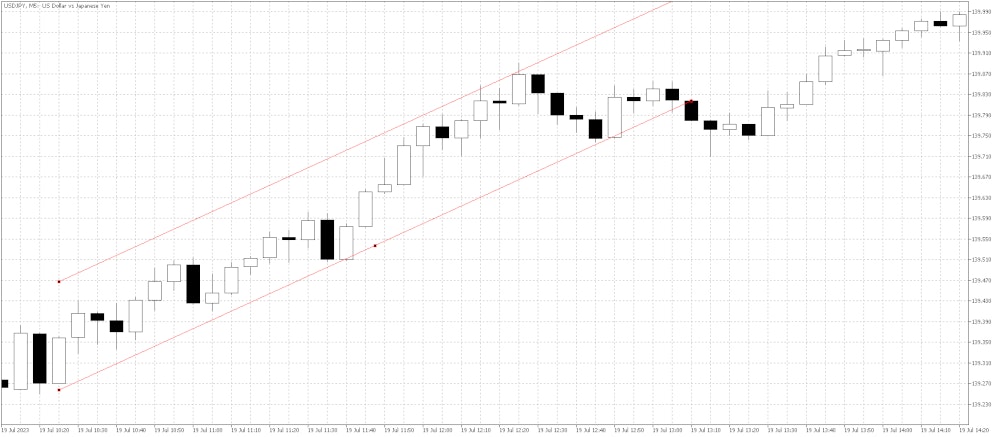

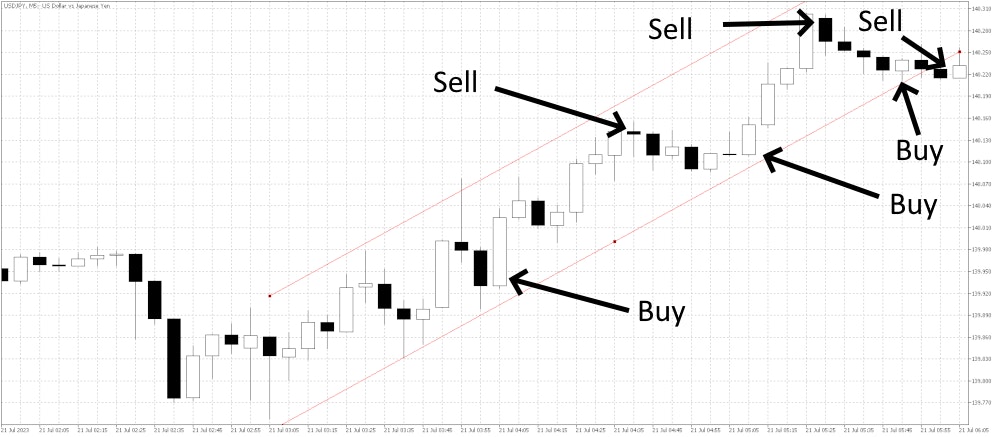

A price channel is formed by two parallel trend lines on a price chart, creating a corridor for the price action. The upper trend line is drawn by connecting the swing highs (peaks) in price, while the lower trend line is formed by connecting the swing lows (troughs). These channels can have an upward (bullish), downward (bearish), or sideways (ranging) trend, effectively encapsulating the fluctuations of the asset price within the bounds of these trend lines.

The Different Types of Price Channels

The varying trends of price channels lead to the formation of three primary types of channels:

Ascending Channels

These are formed by connecting two or more upward trend lows, followed by drawing a parallel line at the same angle that touches the trend peak. The price increases within this channel until a breakout occurs where the price falls below the lower line.

Descending Channels

The inverse of ascending channels, descending channels are created by connecting two or more downward trend highs, followed by a parallel line at the same angle touching the trend low. The price decreases within this channel until a breakout occurs where the price breaks above the upper line.

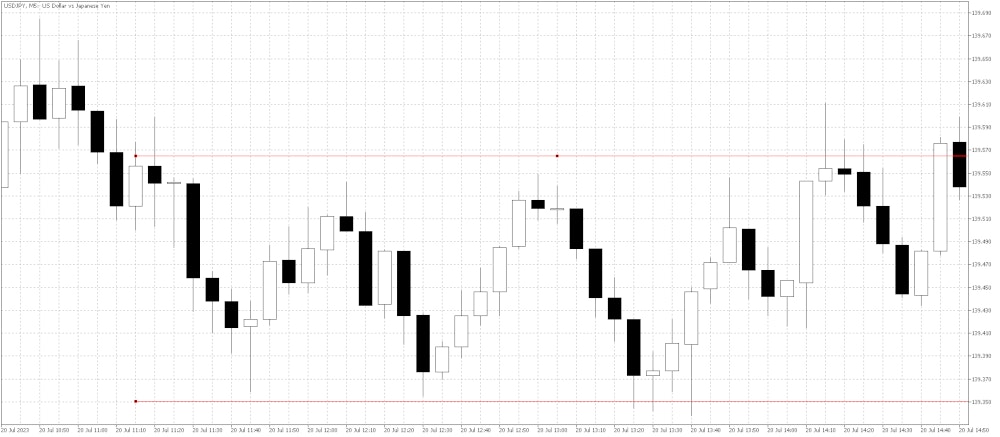

Horizontal Channels (Range)

Horizontal upper and lower trend lines characterize these channels. The price fluctuates between these parallel lines, creating a 'range' that the market trades within. Horizontal channels often indicate that the market is consolidating and not trending upwards or downwards.

Trading Strategies Using Price Channels

Channel trading requires a strategic approach that generally involves the following steps:

Channel Identification

The initial step is to identify the existence of a price channel on the chart. A minimum of two points are needed for both the upper and lower trend lines to establish a valid channel. The more points used to draw the channel, the more validity and strength it possesses.

Entry Points

Once a channel has been identified, traders seek buying opportunities when the price touches the lower trend line (support) and selling opportunities when it touches the upper trend line (resistance). This strategy operates on the premise that the price will continue to oscillate within the confines of the channel.

Stop-Loss Orders

Setting a stop-loss order is crucial to mitigate potential losses if the price unexpectedly breaks out of the channel. A common approach is to place the stop-loss order just outside the channel boundaries.

Profit Targets

Traders should also determine a take-profit level for when the price reaches the opposite side of the channel. This allows traders to secure profits before the market potentially reverses.

Trading Breakouts

A breakout refers to a situation where the price moves outside the channel. This is often interpreted as a potential end to the current trend and the initiation of a new one. Breakouts can result in substantial price moves, thus providing lucrative trading opportunities.

The Crucial Role of Confirmation

Despite the potential profitability of channel trading, it is crucial to obtain confirmation before initiating a trade. Confirmation can be achieved through various methods, such as witnessing a bounce off the trend line accompanied by increased trading volume or observing a candlestick pattern indicating a potential reversal. Additionally, traders can use technical indicators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) to corroborate potential reversals within the channel.

The Art of Combining Channel Trading with Other Strategies

While effective, channel trading can be enhanced when combined with other trading strategies and technical analysis tools. For instance, traders can merge channel trading with fundamental analysis, identifying potential price channels in anticipation of major economic data releases. Furthermore, additional technical analysis tools such as Fibonacci retracements or pivot points can be employed by traders to identify potential support and resistance levels within the channel, thus enhancing the precision of trading decisions.

Risks and Limitations of Channel Trading

Like all trading strategies, channel trading comes with risks and limitations. The possibility of price breaking out of the channel always exists, which could lead to potential losses. Also, during periods of low volatility, the price may consolidate within a tight range, leading to fewer trading opportunities. Moreover, the identification and drawing of channels require subjective judgment, which means different traders might interpret the same price chart differently, leading to a divergence in trading decisions.

Channel Trading and Forex Market Psychology

Understanding market psychology is an integral part of channel trading. The repeating patterns of support and resistance within a channel reflect the psychological dynamics of fear and greed among market participants. Recognizing these patterns and understanding the market sentiment that creates them can provide traders deeper insight into potential price movements.

Conclusion

When used effectively, channel trading can be a potent tool in a Forex trader's arsenal. By providing a systematic approach to identifying trading opportunities based on price patterns, it offers a structured framework for trading decisions. However, it's vital to remember that it should not be used in isolation. Combining it with other technical analysis tools and risk management techniques can enhance its effectiveness significantly. As with any trading strategy, the key to successful channel trading lies in understanding how to implement it, recognizing its limitations, and managing risk effectively.