Nick Goold

New York Gold

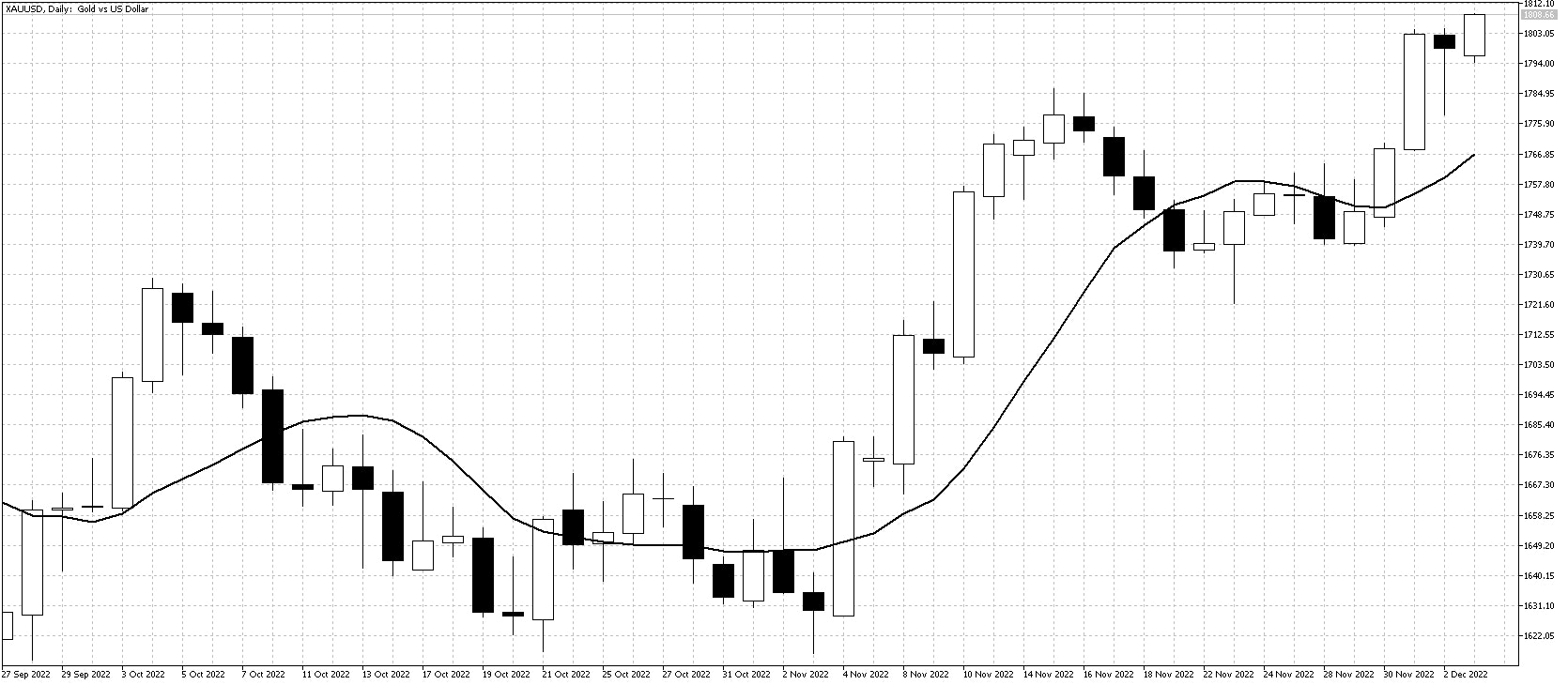

Gold continued its recent uptrend last week, surging higher as the USD continued to weaken. The most important news last week was Fed Chairman Powell indicating that the pace of official interest rate increases will slow. Following the speech, the market expects a 0.50% increase in US official interest rates in December. Prices briefly went above resistance at $1800, but better-than-expected US payroll figures saw sellers return to the market.

The coming week should be quieter as there are few economic releases. In the short term, gold looks overbought and likely to trade sideways to lower, should prices remain below $1800. A break of $1800 is possible if the USD continues to weaken and the next resistance level is $1840.

Gold can be a profitable market to trade in the current conditions as the short and medium-term charts have strong trends. The danger when gold’s volatility is high is that prices can move very quickly, so always use a stop-loss order.

Resistance: 1806, 1810, 1850

Support: 1780, 1765, 1745, 1737, 1730, 1700

WTI

WTI enjoyed a turnaround last week, moving back above the lows from September. The recovery above $76.00 is potentially a sign that the recent downtrend has ended.

The two news stories helping WTI were the weaker USD and a reduction in COVID controls in China. The oil supply organization (OPEC) is looking for ways to reduce production to support prices.

This week we are expecting sideways to higher prices as the technical indicators are no longer pointing lower. The market is looking positive, but the current trend is sideways, so it is better to wait for the market to fall to buy.

Resistance: 84.00, 90.00, 92.50, 95.00, 100.00

Support: 79.00, 77.00, 75.00, 73.00, 67.00