Nick Goold

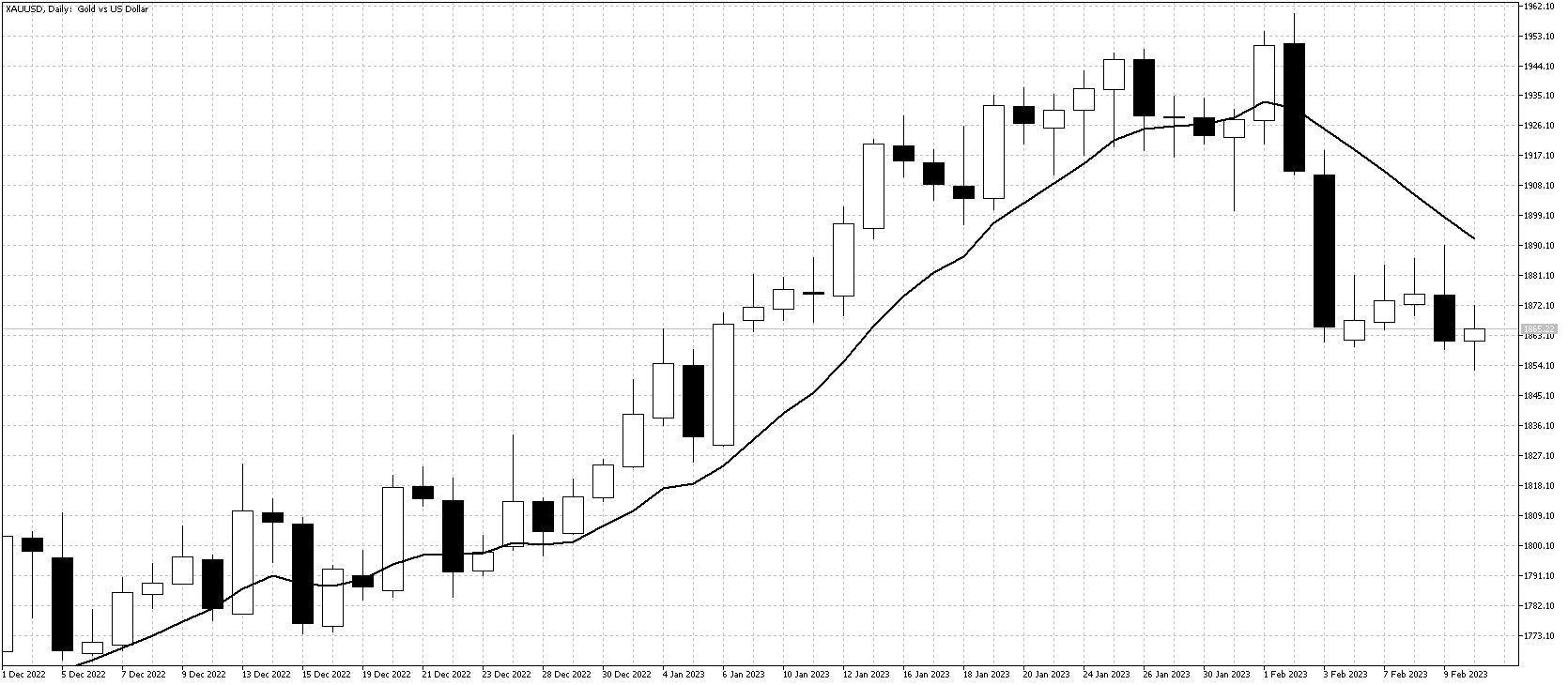

Gold

Following the price collapse, following US employment figures, buyers returned, taking advantage of the oversold market. However, as the week progressed, the 10-day moving average fell, acting as resistance and putting prices under pressure again. In addition, the USD and 10-year US interest rates started to rise towards the end week giving sellers the confidence to enter the market.

This week the market will turn its attention back to US economic releases, with inflation and retail sales figures keenly awaited. Stronger growth or inflation figures could change traders' expectations for 2023 and negatively impact gold prices.

There is some positive news, as Asian consumers have taken advantage of the fall in prices to buy physical gold in the past week. Prices are still holding on to support, so range trading is the most likely scenario this week if economic releases are close to expectations.

Resistance: 1881.50, 1890, 1900, 1916, 1937, 1950, 1960

Support: 1852, 1845, 1820, 1800

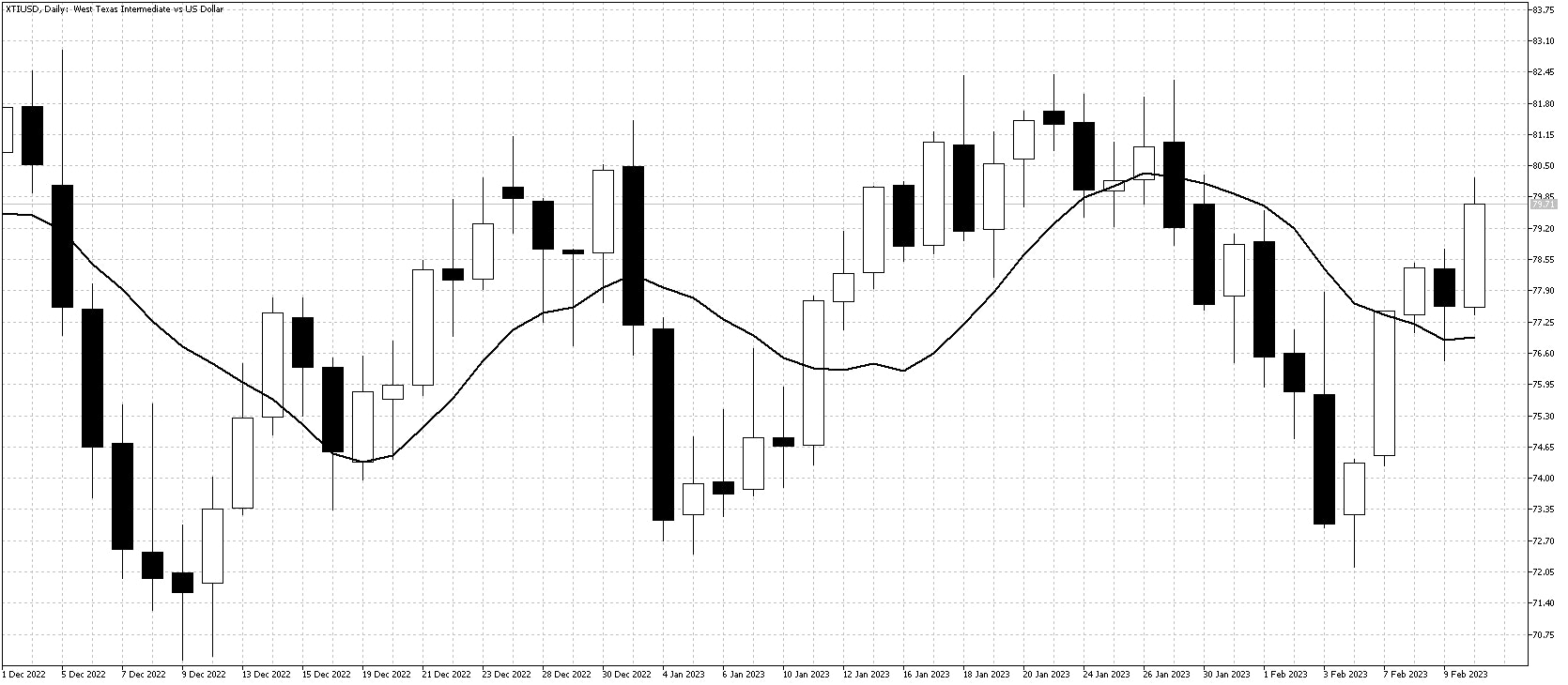

WTI

WTI prices tested the 2023 low at the start of last week, attracting strong buying and changing market sentiment. Traders also focused on the potential increased demand should the US economic growth in 2023 beat forecasts. In addition, Russia will cut oil output by 500,000 barrels per day on export restrictions, helping prices higher.

Technically the market remains range bound in 2023, so while prices might test a little higher focusing on selling opportunities this week seems best. The risk of higher US interest rates and a stronger USD remain negative points for WTI prices in the medium term.

Resistance: 80.50, 82.70, 84.00, 90.00

Support: 77.00, 75.00, 72.50, 70.00, 66.00