Nick Goold

Gold

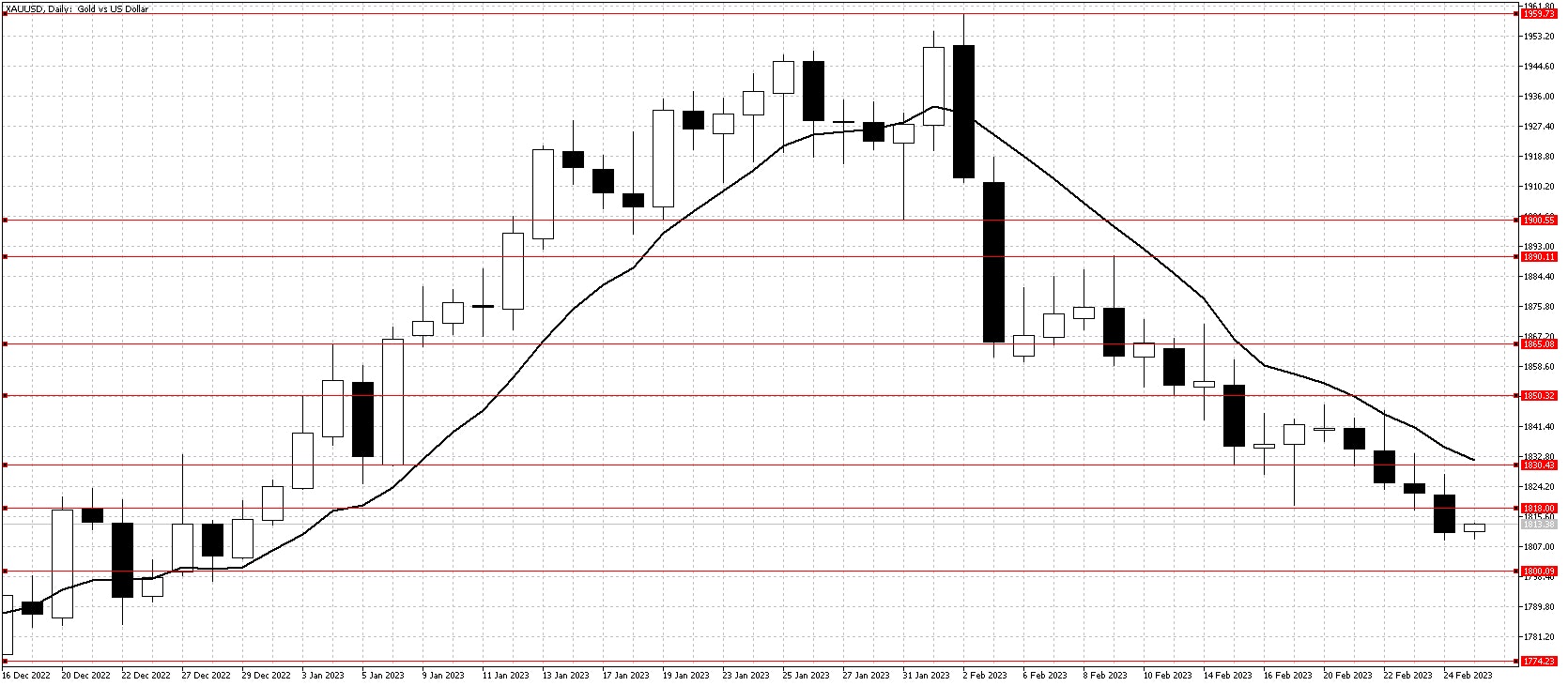

Gold prices attempted to recover last week but failed again to move back above the 10-day moving average. The market is in a perfect downtrend, with the strong USD and higher long-term US interest rates continuing to attract sellers.

Friday`s higher-than-expected US inflation figures pushed prices below support at last week`s low. As a result, gold prices have now lost all of 2023`s gains, which might trigger further selling from traders changing their forecast for 2023.

In the short term, the market is oversold, so there is a potential for a rise at the start of the week. However, this week one of the many US economic figures could change sentiment if they are weaker than expected, so be careful of getting too bearish at these levels.

Resistance: 1818, 1830, 1850, 1870, 1890, 1900

Support: 1800, 1775, 1760, 1745

WTI

WTI prices moved as expected last week, testing the lower end of the $72 to $82, only to recover at the end of the week. The Ukraine/Russia war continued into its second year and showing no signs of ending, which is providing support as Russian oil supplies are reduced. In addition, China’s demand for oil is expected to increase and lead to record imports this year, offsetting weaker US demand as interest rates rise.

WTI prices finished the week strongly despite the strong USD, so there is a potential for a rise in the coming week. While the prices remain in a range, there are still good trading opportunities in both the short and medium term.

Resistance: 77.50, 80.50, 82.70, 84.00, 90.00

Support: 73.80, 72.50, 70.00, 66.00