Nick Goold

Gold

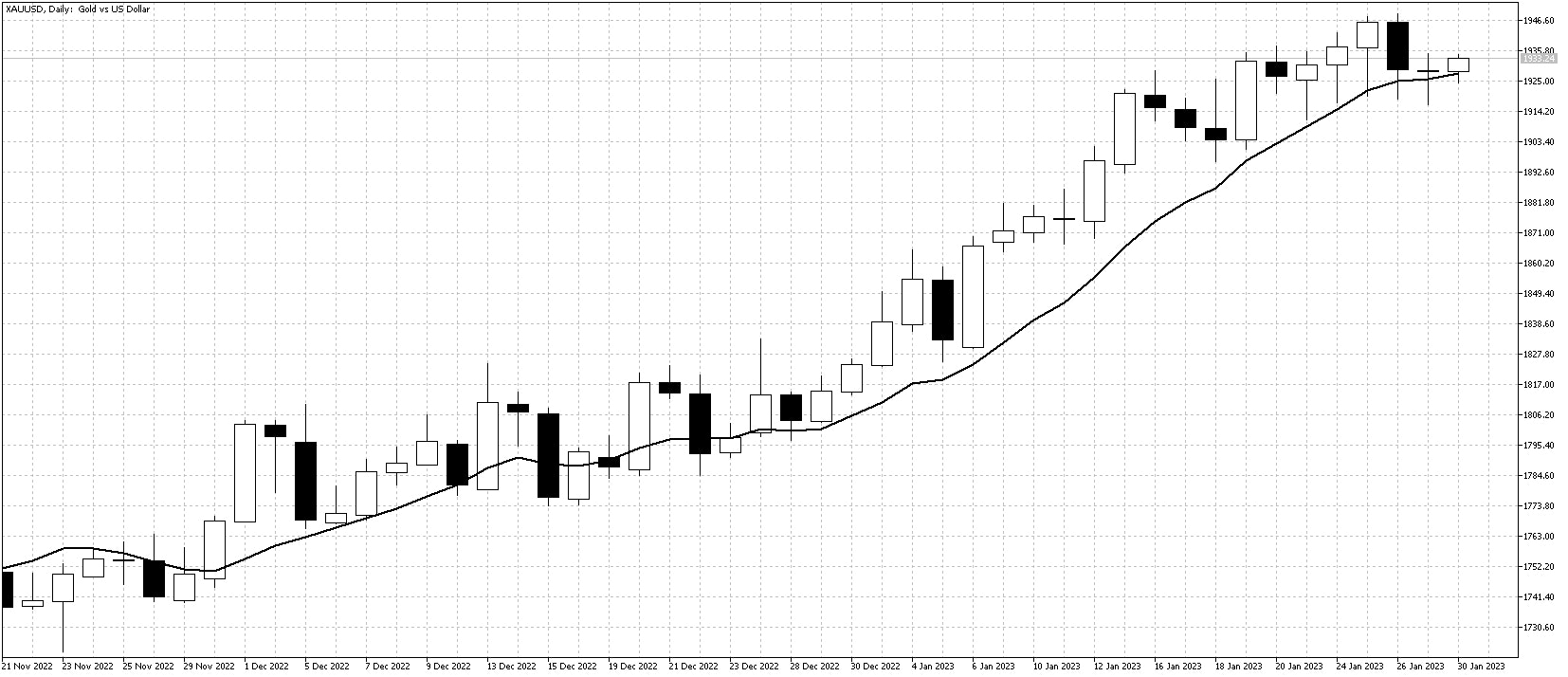

Gold's impressive price rise since October is starting to show signs of ending. While the Gold price registered a new high last week, the 10-day moving average is now pointing sideways. In addition, the better-than-expected US growth figures were negative for Gold as 10-year US interest rates are starting to push slightly higher.

This week, Gold volatility should increase as there are many important economic news events. The Federal Reserve, Bank of England, and European Central Bank are all highly likely to raise official interest rates by 0.50%, which could trigger the selling of Gold. Also, Friday's US employment figures could start a price fall if they are better than expectations.

Gold can potentially have a significant move this week, so it is one of the best markets to trade. At the moment, there is more risk to the downside, so that is the most likely way to profit this week. Should Gold move back above $1935 again, the uptrend could likely continue leading to new highs for the year.

Resistance: 1937, 1950, 1980, 2000

Support: 1910, 1900, 1875, 1864, 1845, 1820

WTI

WTI failed to break resistance at $82.50 as an increasing supply of Russian oil offset positive news on US growth. China returns from the New Year holidays this week, which is positive for WTI demand. This week's potential rises in the USD on higher interest rates could prompt selling from traders.

The medium-term chart remains in a sideways pattern, and this week could see further weakness as the short-term uptrend ended last week. However, strong support remains at $75.00, so this week could see good buying opportunities if WTI continues to fall.

Resistance: 82.70, 84.00, 90.00

Support: 79.00, 77.00, 75.00, 70.00