Nick Goold

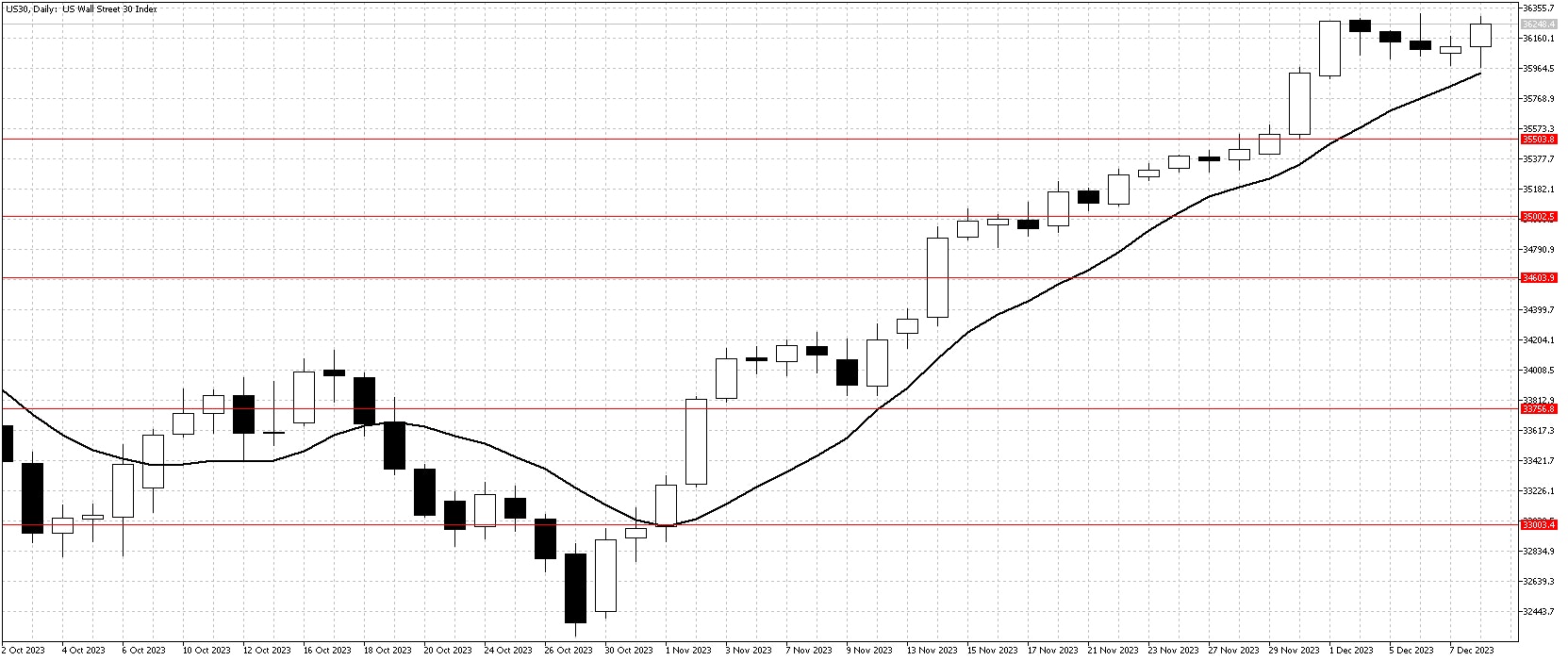

Dow Jones Index

The Dow Jones Industrial Average experienced a week of consolidation following the recent significant gains. Early in the week, the market faced some selling pressure due to overbought conditions, indicating that many traders believed stocks were valued higher than they should be. This selling phase, however, was short-lived. By the end of the week, buyer sentiment had shifted positively, bolstered by favourable economic reports. The 10-day moving average, a key indicator for traders, trended upwards, providing a support level for the market. This shift in momentum was further reinforced by the U.S. unemployment report, which exceeded expectations. November saw the addition of 199,000 new jobs, surpassing the anticipated 180,000, while the unemployment rate fell to 3.7%, signalling a robust job market.

Another factor contributing to the market's resilience was the University of Michigan's preliminary consumer sentiment index for December, which registered a significant increase, reaching its highest level since August. This rise in consumer confidence was primarily driven by easing inflation fears. Survey respondents anticipated a 3.1% price increase over the next year, a notable decrease from the 4.5% expectation in November and the lowest forecast since March 2021. This decline in inflation expectations was complemented by improvements in both consumer expectations and their assessment of current economic conditions, suggesting a more optimistic outlook on the economy's trajectory.

The market is poised for further strength, but vital economic indicators, such as the Consumer Price Index (CPI), Producer Price Index (PPI), and Retail Sales data, will be crucial in determining the market's direction. These data releases have the potential to influence market trends significantly. Nevertheless, if the market remains above the 10-day moving average, traders will likely find it easier to follow the uptrend. This technical support level guides market sentiment, indicating that as prices stay above this average, the general market trend will likely remain positive.

Resistance: 36960, 37000, 38000

Support: 35500, 35000, 34600, 33800, 33000

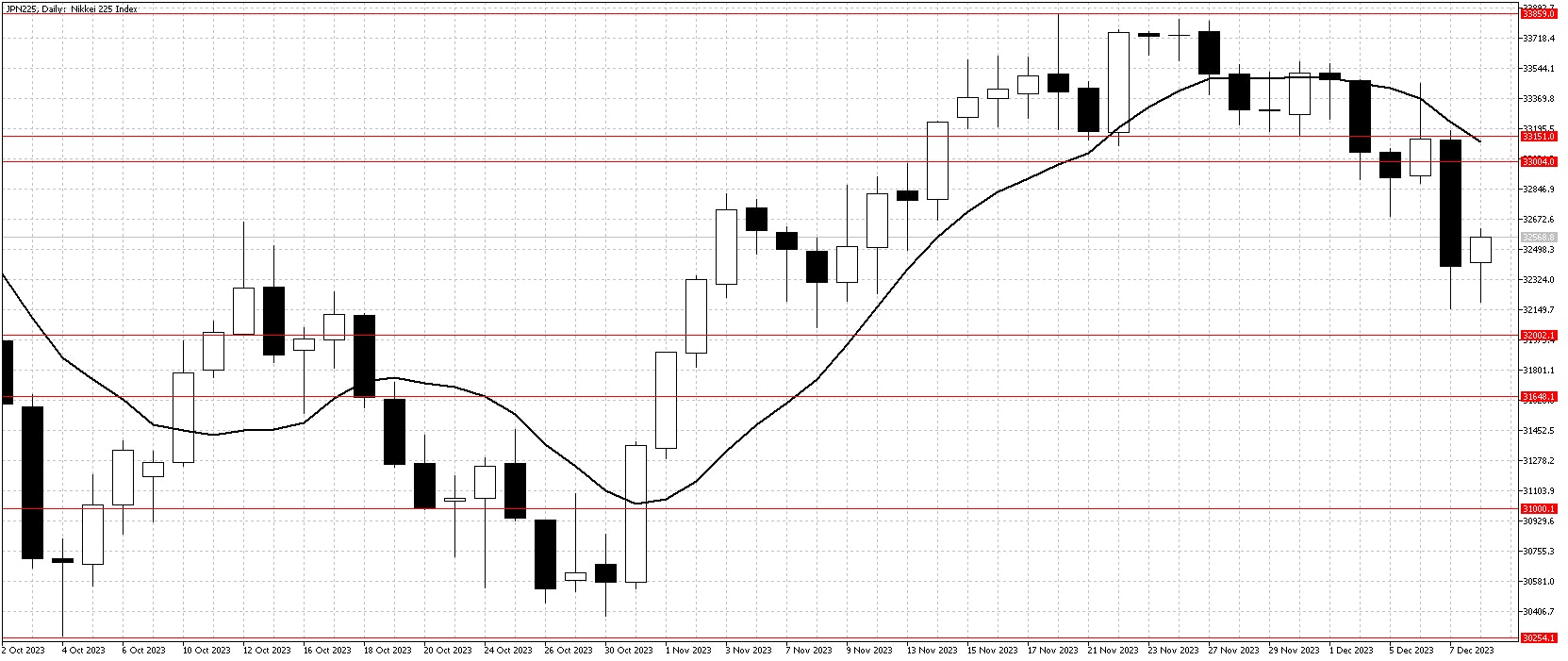

Nikkei 225 Index

Last week, the Nikkei index experienced a significant drop, primarily influenced by unexpected comments from officials at the Bank of Japan (BoJ). These comments sparked market speculation that the central bank might move away from its policy of negative interest rates sooner than previously thought. This expectation shift impacted the USDJPY pair, which had been a supporting factor for the Nikkei's rise. The currency pair saw a notable decline, dropping from 147 to 142 on Thursday, as traders rapidly exited their long positions. This sudden change in monetary policy outlook caught investors off guard, leading to a swift reaction in the market.

Additionally, the financial markets were influenced by movements in the Japanese government bond (JGB) yields. The yield on the 10-year JGB notably rose to 0.77% from 0.71% at the week's start. This increase in bond yields reflects growing concerns about Japan's fiscal health and potential shifts in the BoJ's monetary policy. Moreover, Japan's economic outlook was further dampened by its gross domestic product (GDP) data release. The report indicated a more significant contraction than initially estimated, with the economy shrinking 2.9% annually in the quarter ending September, compared to a preliminary estimate of a 2.1% contraction. This decline, coupled with ongoing inflationary pressures and stagnant wage growth, has heightened worries among Japanese consumers about their future economic prospects.

Looking ahead, the Nikkei is expected to attempt a recovery from its recent losses, with solid support identified around the 32,000 level. However, given the current economic conditions and the market's recent volatility, substantial gains appear unlikely in the short term. Traders may find range trading a more suitable strategy this week, navigating within a defined price range amid ongoing uncertainty and cautious market sentiment. This approach allows for capitalizing on smaller price movements within the range rather than betting on a significant directional move, which seems less probable under the current circumstances.

Resistance: 33000, 33150, 33860, 34000

Support: 32000, 31650, 31000