Aayush Jindal

Key Highlights

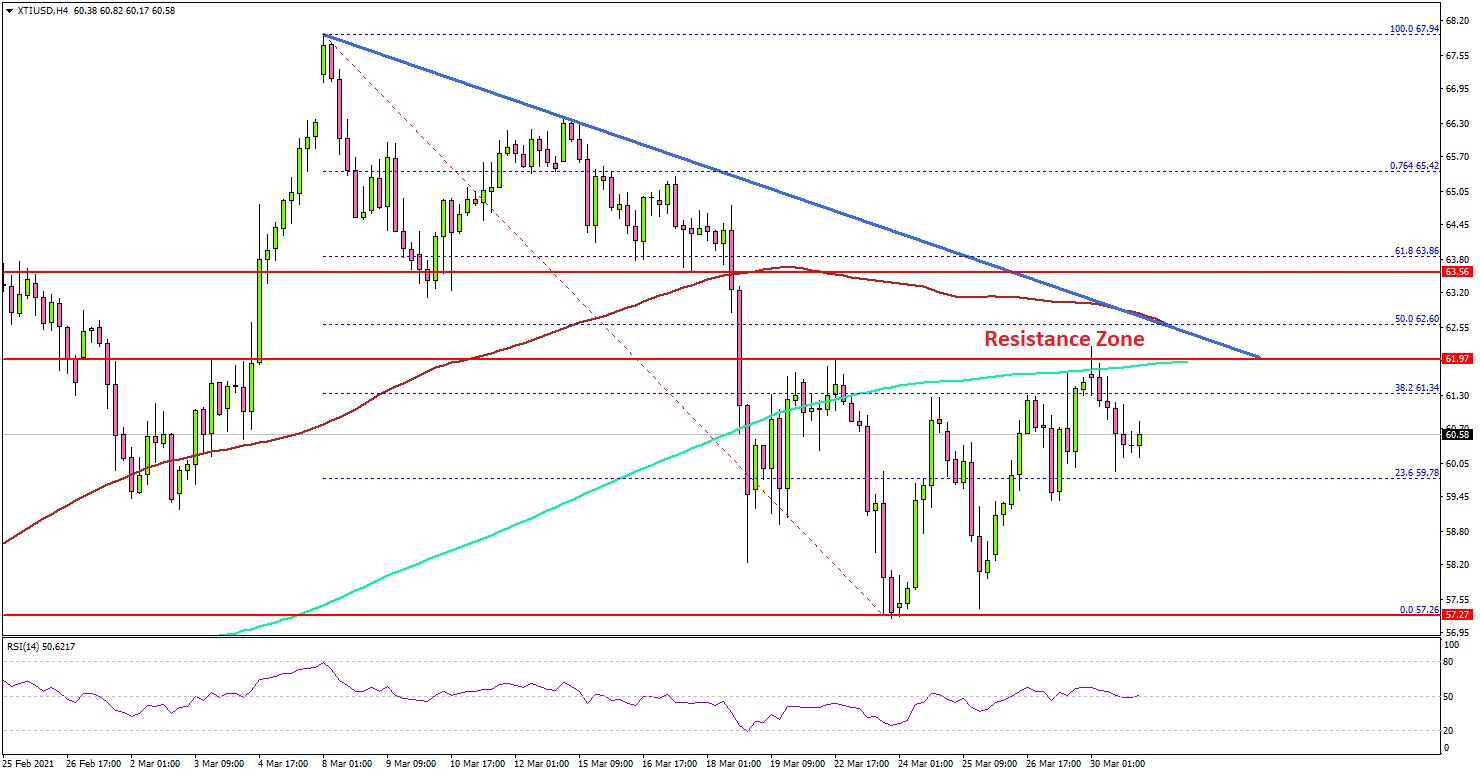

- Crude oil price corrected higher, but it is now facing hurdles near $62.20 and $62.50.

- A crucial bearish trend line is forming with resistance near $62.60 on the 4-hours chart of XTI/USD.

- Gold price failed above $1,730 and started a fresh decline.

- The US ADP employment could change 550K in March 2021, up from the last 117K.

Crude Oil Price Technical Analysis

After trading close to $68.00, crude oil price started a downside correction against the US Dollar. The price traded below the $62.50 and $60.00 support levels before it found support near $57.20.

Looking at the 4-hours chart of XTI/USD, the price traded as low as $57.20. It even settled below $62.50 pivot level, the 100 simple moving average (red, 4-hours) and the 200 simple moving average (green, 4-hours).

Recently, there was an upside correction from $57.20 and the price climbed above $58.50. The price even spiked above the 38.2% Fib retracement level of the downward move from the $67.94 high to $57.20 low.

However, the price struggled to gain momentum above $62.20 and the 200 simple moving average (green, 4-hours). There is also a crucial bearish trend line forming with resistance near $62.60 on the same chart.

The 50% Fib retracement level of the downward move from the $67.94 high to $57.20 low is also near $62.57. A clear break above the $62.50 resistance and a follow up move above the 100 simple moving average (red, 4-hours) is must for a strong increase towards $65.00 and $66.00.

If there is no upside break, the price could start a fresh decline below $59.50. The main support is now near $57.20, below which the price might dive towards the $55.00 level.

Looking at EUR/USD, there were additional losses below the 1.1800 support. Besides, GBP/USD is trading in a bearish zone below 1.3850.

Economic Releases to Watch Today

- Euro Zone CPI for March 2021 (YoY) (Prelim) - Forecast +1.3%, versus +0.9% previous.

- Euro Zone Core CPI for March 2021 (YoY) (Prelim) - Forecast +1.2%, versus +1.1% previous.

- UK GDP for Q4 2020 (QoQ) - Forecast +1.0%, versus +1.0% previous.

- US ADP Employment Change for March 2021 - Forecast 550K, versus 117K previous.