Aayush Jindal

Key Highlights

- Crude oil price is following a bullish path above the $35.00 support against the US dollar.

- A major bullish trend line is forming with support near $35.40 on the 4-hours chart of XTI/USD.

- The US Retail Sales increased 17.7% in May 2020 (MoM), whereas the forecast was +8.0%.

- The UK Claimant count changed 528.9K in May 2020, much more than the forecast of 370K.

Crude Oil Price Technical Analysis

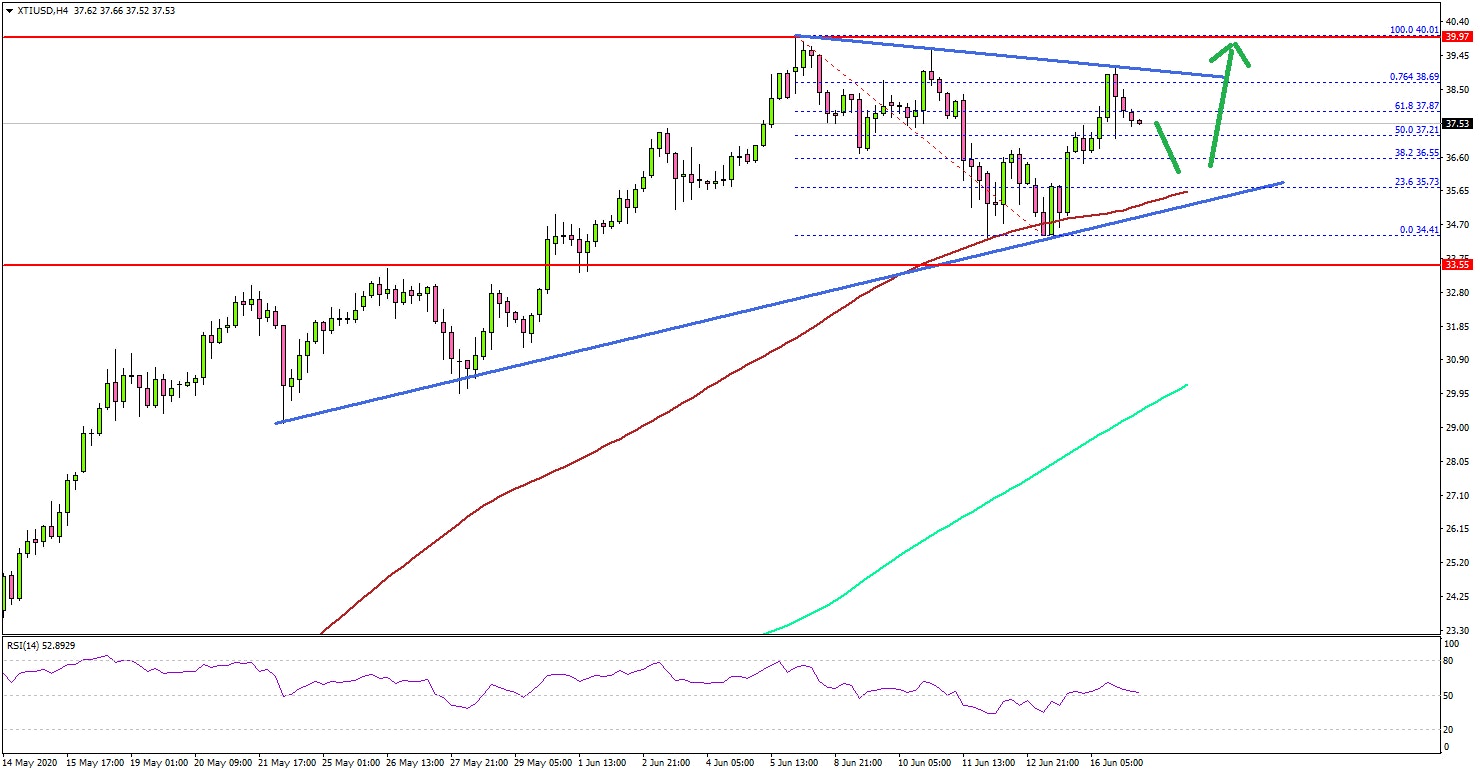

After trading to a new monthly high at $40.01, crude oil price started a downside correction. However, the decline was limited and the price resumed its rise from the $34.40 zone.

Looking at the 4-hours chart of XTI/USD, the price traded as low as $34.41 and started a steady rise. There was a break above the $35.50 and $36.50 resistance levels.

The price even surpassed the 61.8% Fib retracement level of the main decline from the $40.01 high to $34.41 low (spot price). It seems like the bulls are now eyeing more upsides above the crucial $40.00 resistance zone. If they succeed, the price could test the $42.00 level or $42.50 resistance.

On the downside, there are key supports forming near $35.00 and the 100 simple moving average (red, 4-hours). There is also a major bullish trend line forming with support near $35.40 on the same chart.

If there is a daily close below the $35.00 support, the price could decline towards the $30.00 support or the 200 simple moving average (green, 4-hours).

Fundamentally, the US Retail Sales report for May 2020 was released by the US Census Bureau. The market was looking for an 8% rise in sales compared with the previous month.

The actual result was much better, as there was a sharp increase of 17.7% in sales. Looking at the Retail Sales ex Autos, there was a 12.4% increase.

The report added:

Retail trade sales were up 16.8 percent (± 0.5 percent) from April 2020, but 1.4 percent (± 0.7 percent) below last year.

Looking at major pairs, both EUR/USD and GBP/USD are trading above important supports and likely to continue higher.

Economic Releases to Watch Today

- UK Consumer Price Index May 2020 (YoY) – Forecast +0.5%, versus +0.8% previous.

- UK Core Consumer Price Index May 2020 (YoY) – Forecast +1.3%, versus +1.4% previous.

- Euro Zone CPI for May 2020 (YoY) - Forecast +0.1%, versus +0.1% previous.

- Euro Zone CPI for May 2020 (MoM) - Forecast -0.1%, versus +0.3% previous.

- Canadian Consumer Price Index May 2020 (MoM) – Forecast +0.7%, versus -0.7% previous.

- Canadian Consumer Price Index May 2020 (YoY) – Forecast 0%, versus -0.2% previous.