Aayush Jindal

Key Highlights

- Crude oil prices started a downside correction below the $80 support.

- A key bearish trend line is forming with resistance near $78.60 on the 4-hour chart.

- EUR/USD and GBP/USD corrected lower from local highs.

- The US Durable Goods Orders could increase by 0.8% in March 2023.

Crude Oil Price Technical Analysis

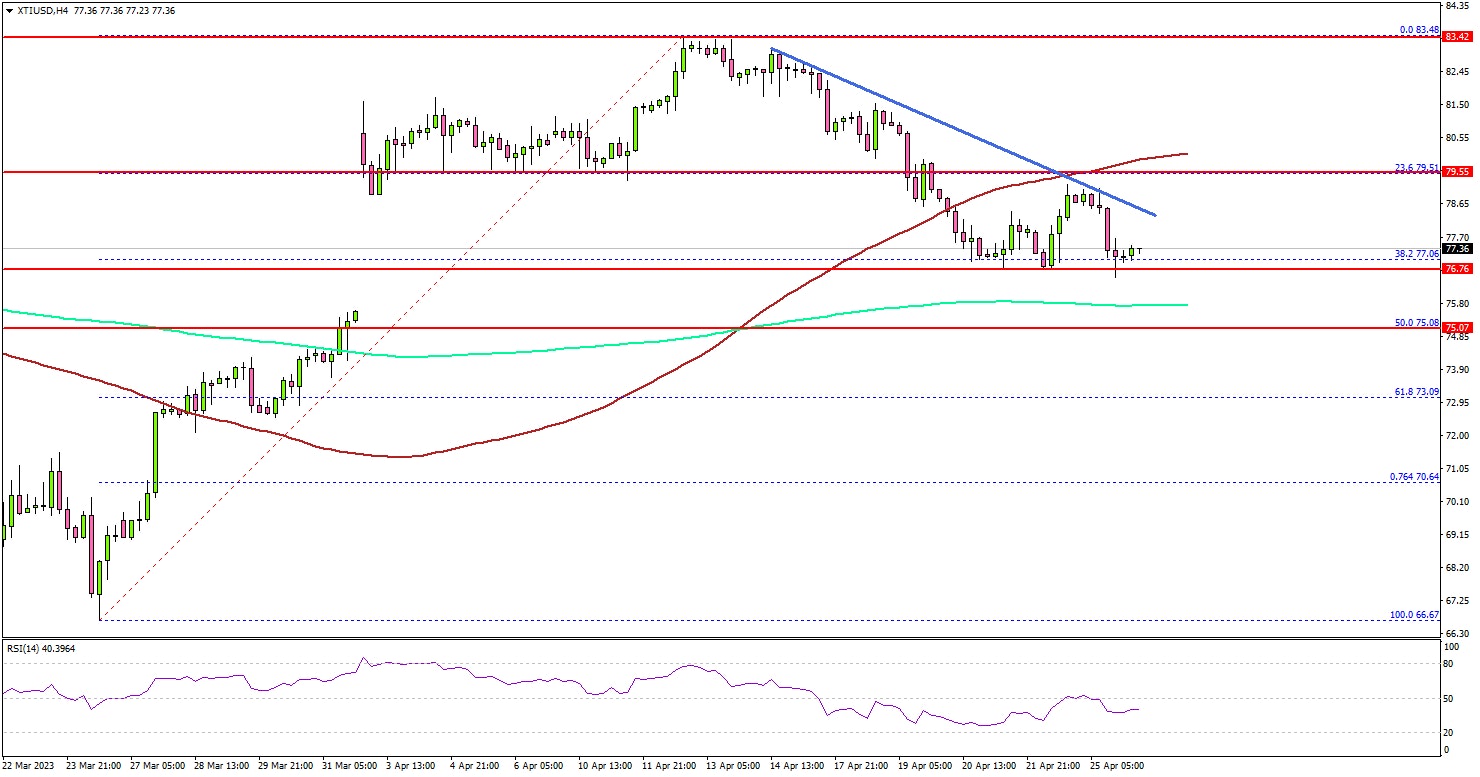

Crude oil prices struggled to clear the $83.50 resistance against the US Dollar. The price declined below the $80.00 support to move into a short-term bearish zone.

Looking at the 4-hour chart of XTI/USD, the price even declined below $78.80 and the 100 simple moving average (red, 4-hour). It tested the 38.2% Fib retracement level of the upward move from the $66.67 swing low to the $83.48 high.

The next major support sits near the $75.80 level or the 200 simple moving average (green, 4-hour). Any more losses might call for a test of 61.8% Fib retracement level of the upward move from the $66.67 swing low to the $83.48 high at $73.00.

On the upside, the price is facing resistance near the $78.65 level. The next major resistance is near the $79.50 zone and the 100 simple moving average (red, 4-hour).

A clear move above the $79.50 resistance could open the doors for another steady increase toward $80.50 or even $81.20.

Looking at EUR/USD, the pair struggled to gain strength and reacted to the downside from the 1.1050 zone.

Economic Releases to Watch Today

- US Durable Goods Orders for March 2023 – Forecast +0.8% versus -1% previous.

- US Durable Goods Orders Ex Defense for March 2023 – Forecast 0% versus -0.5% previous.