Aayush Jindal

Key Highlights

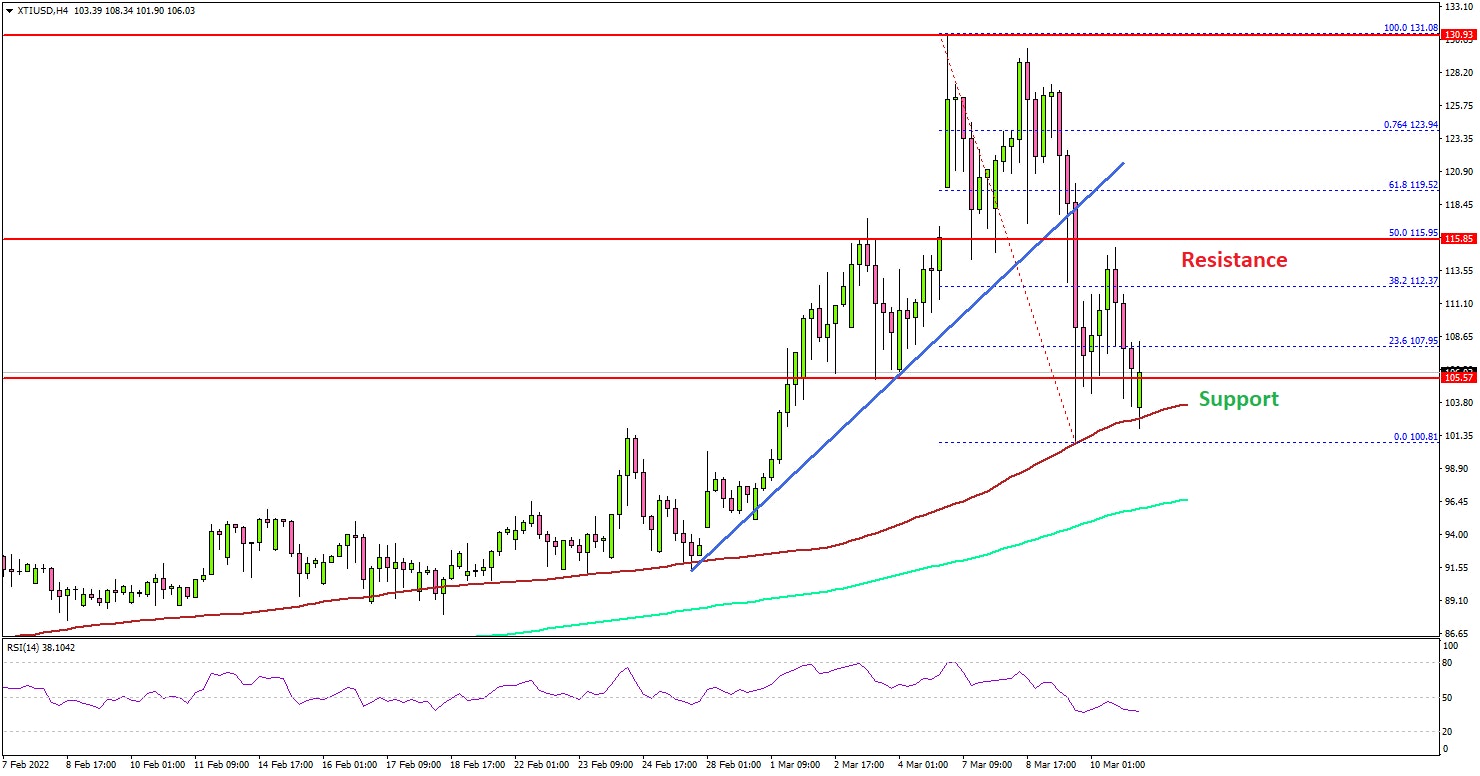

- Crude oil price surged to $131 before there was a sharp decline.

- It broke a major bullish trend line at $118.50 on the 4-hours chart.

- EUR/USD corrected losses and climbed above 1.1020.

- Gold price stayed above the $1,975 support zone.

Crude Oil Price Technical Analysis

In the past few days, crude oil price saw a major increase above $100.00 against the US Dollar. The price surpassed the $120.00 level and extended gains.

Looking at the monthly chart of XTI/USD, the price even surged towards $130.00. A multi-year high was formed near $131.08 and the price settled above the 100 simple moving average (red, 4-hours).

Recently, there was a sharp downside correction below the $120.00 level. The price even dived below $110.00. However, the bulls were active near the $100.00 level and the 100 simple moving average (red, 4-hours).

The price started a fresh increase and climbed above the $110.00 level. It is now facing resistance near the $115 zone. The next major resistance might be $120.00, above which oil price might revisit $130.00.

If not, there is a risk of a fresh move towards the $100.00 support level. Any more gains might call for a test of the $95.00 level and the 200 simple moving average (green, 4-hours).

Fundamentally, the US Consumer Price Index for Feb 2022 was released yesterday by the US Bureau of Labor Statistics. The market was looking for a 7.9% increase in the CPI compared with the same month a year ago.

The actual result was similar, as the US Consumer Price Index increased 7.9%. The monthly change was +0.8%, up from the last +0.6%.

Looking at EUR/USD, the pair started a decent recovery wave above 1.0950 and 1.1000. Besides, GBP/USD is still consolidating above 1.3100.

Economic Releases to Watch Today

- UK GDP for Jan 2022 (MoM) - Forecast +0.2%, versus -0.2% previous.

- German Consumer Price Index for Feb 2022 (YoY) – Forecast +5.1%, versus +5.1% previous.

- German Consumer Price Index for Feb 2022 (MoM) – Forecast +0.9%, versus +0.9% previous.

- Canada’s employment Change for Feb 2022 – Forecast 160K, versus -200.1K previous.

- Canada’s Unemployment Rate for Feb 2022 - Forecast 6.2%, versus 6.5% previous.