Aayush Jindal

Key Highlights

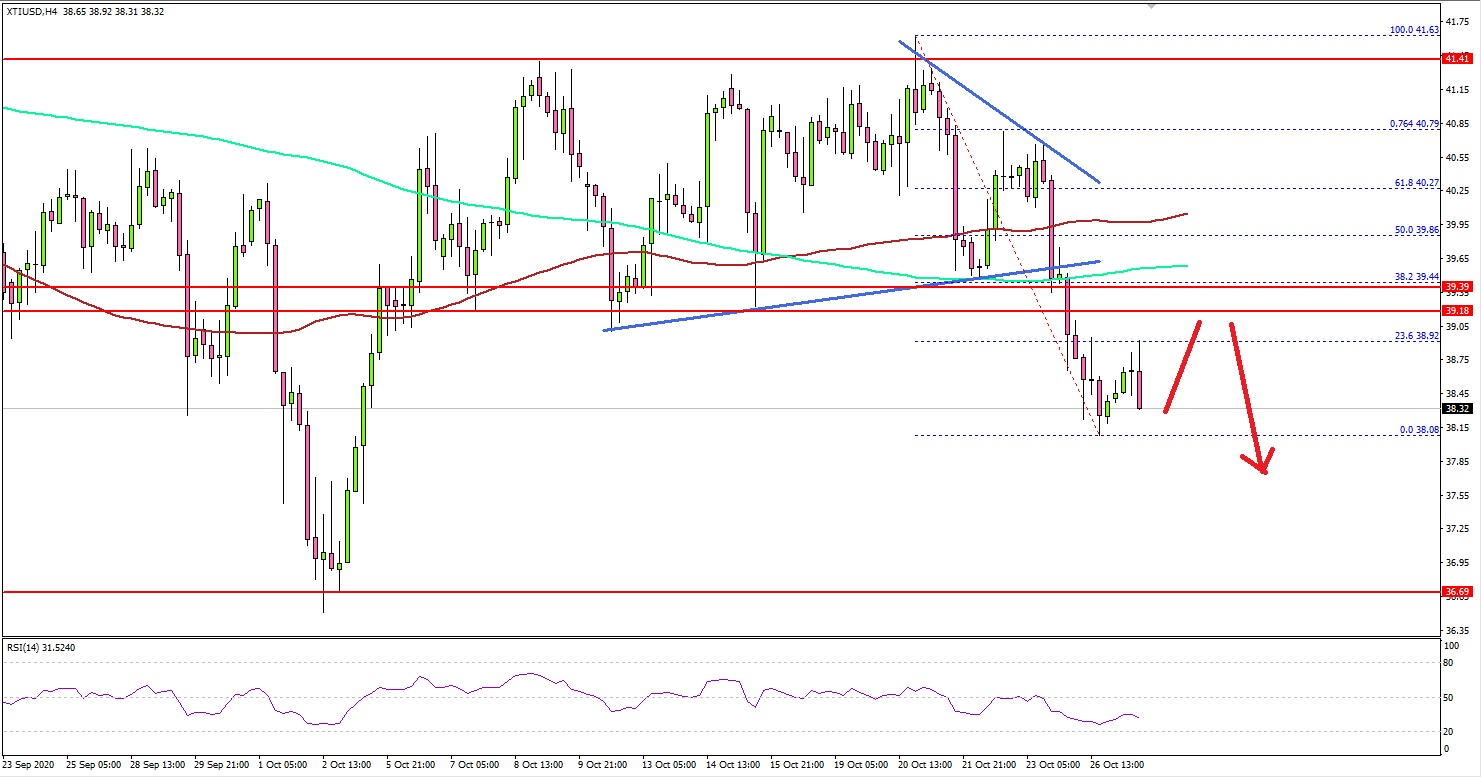

- Crude oil price started a sharp decline after it failed to clear the $41.40 resistance area.

- There was a break below a key contracting triangle at $39.65 on the 4-hours chart of XTI/USD.

- The US Durable Goods Orders increased 1.9% in Sep 2020, up from the last 0.4%.

- The EIA Crude Oil Stocks (to be released today) could change 1.11M, up from the last -1.001M.

Crude Oil Price Technical Analysis

In the last analysis, we discussed a potential double top pattern for crude oil price near $41.40 against the US Dollar. The price did fail to break the $41.40 resistance, resulting in a sharp decline.

Looking at the 4-hours chart of XTI/USD, the price spiked above the $41.50 level, but it failed to settle above $41.40. As a result, there was a strong bearish reaction below $41.00 and $40.00.

The price broke many important supports near $39.00, the 100 simple moving average (4-hours, red) and the 200 simple moving average (4-hours, green). It settled well below the $39.00 level (a crucial support and a multi-touch zone).

If there is a downside break below the $38.00 level, the price could continue to move down. The next major support is near the $36.80 level.

If there is an upside correction, the $39.00 level might act as a strong resistance. The next key resistance is near the $40.00 level and the 100 simple moving average (4-hours, red).

Fundamentally, the US Durable Goods Orders for Sep 2020 was released yesterday the US Census Bureau. The market was looking for a rise of 0.5% in orders.

The actual result was well above the market forecast, as the US Durable Goods Orders increased 1.9% in Sep 2020. Looking at the Nondefense Capital Goods Orders Excluding Aircraft, there was a 1% increase, down from the last 2.1%.

Overall, crude oil price remains at a risk of more losses as long as it is below $39.00. Looking at EUR/USD, there are chances of a fresh break below 1.1780, and GBP/USD might climb above 1.3100 in the coming sessions.

Economic Releases to Watch Today

- EIA Crude Oil Stocks Change – Forecast 1.11M, versus -1.001M previous.

- BoC Interest Rate Decision - Forecast 0.25%, versus 0.25% previous.