Aayush Jindal

Key Highlights

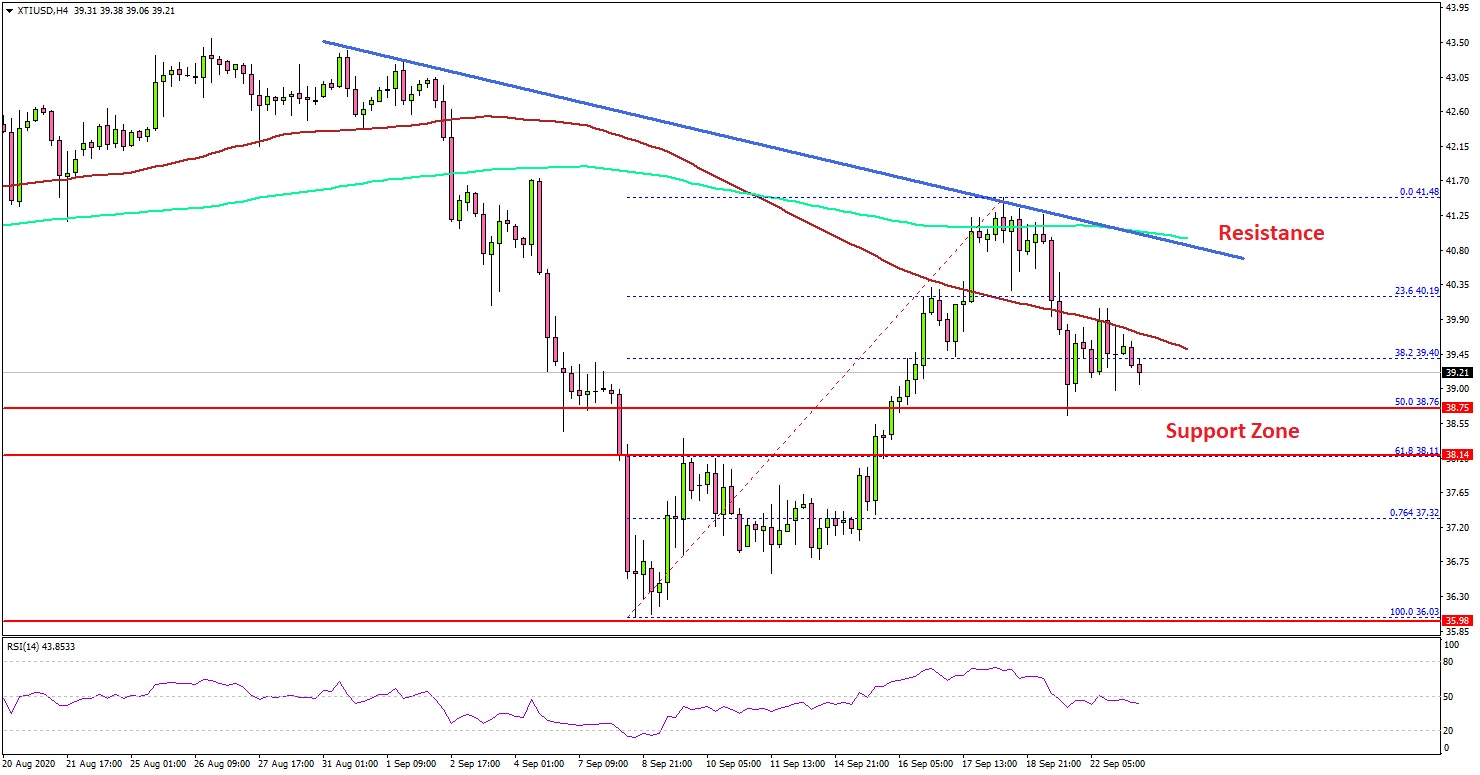

- Crude oil price faced resistance near $41.50 and declined below $40.00.

- A major bearish trend line is forming with resistance near $40.80 on the 4-hours chart of XTI/USD.

- The US Services PMI is likely to decline from 55.0 to 54.7 in Sep 2020 (Preliminary).

- The US Manufacturing PMI could rise from 53.1 to 53.2 in Sep 2020 (Preliminary).

Crude Oil Price Technical Analysis

This past week, crude oil price started a strong increase above $38.50 and $40.00 against the US Dollar. However, the price struggled to continue above $41.50 and recently corrected lower.

Looking at the daily chart of XTI/USD, the price traded as high as $41.49 and it seems like the 200 simple moving average (4-hours, green) acted as a strong resistance. There was a bearish reaction below the $40.50 and $40.00 levels.

The price even spiked below the $39.50 level and the 100 simple moving average (4-hours, red). It tested the 50% Fib retracement level of the upward move from the $36.03 low to $41.49 high.

The first key support on the downside is near the $38.10 level (a multi-touch zone). It is close to the 61.8% Fib retracement level of the upward move from the $36.03 low to $41.49 high. If there is a downside break below the $38.10 and $38.00 levels, there are chances of more losses.

Conversely, the price might attempt another increase above $40.50. There is a major bearish trend line forming with resistance near $40.80 on the same chart. A successful break above the trend line resistance, the 200 SMA, and $41.50 is must for upside continuation.

Looking at EUR/USD, the pair extended its decline below the 1.1750 support level. Similarly, GBP/USD declined further and traded to a new monthly low below 1.2750.

Economic Releases to Watch Today

- Germany’s Manufacturing PMI Sep 2020 (Preliminary) - Forecast 52.5, versus 52.2 previous.

- Germany’s Services PMI Sep 2020 (Preliminary) - Forecast 52.9, versus 52.5 previous.

- Euro Zone Manufacturing PMI Sep 2020 (Preliminary) – Forecast 51.9, versus 51.7 previous.

- Euro Zone Services PMI Sep 2020 (Preliminary) – Forecast 50.5, versus 50.5 previous.

- UK Manufacturing PMI Sep 2020 (Preliminary) – Forecast 54.3, versus 55.2 previous.

- UK Services PMI Sep 2020 (Preliminary) – Forecast 56.0, versus 58.8 previous.

- US Manufacturing PMI Sep 2020 (Preliminary) – Forecast 53.2, versus 53.1 previous.

- US Services PMI Sep 2020 (Preliminary) – Forecast 54.7, versus 55.0 previous.