Aayush Jindal

Key Highlights

- Crude oil price gained bullish momentum above the $41.25 resistance against the US dollar.

- A crucial bullish trend line is forming with support near $40.20 on the 4-hours chart of XTI/USD.

- GBP/USD outperformed and surpassed the 1.2700 resistance.

- Canada’s CPI could increase 0.2% in June 2020 (YoY), up from the last -0.4%.

Crude Oil Price Technical Analysis

After multiple failed attempts to clear $41.25, crude oil price finally gained strength. The price surged above the $41.25 and $41.50 resistance levels.

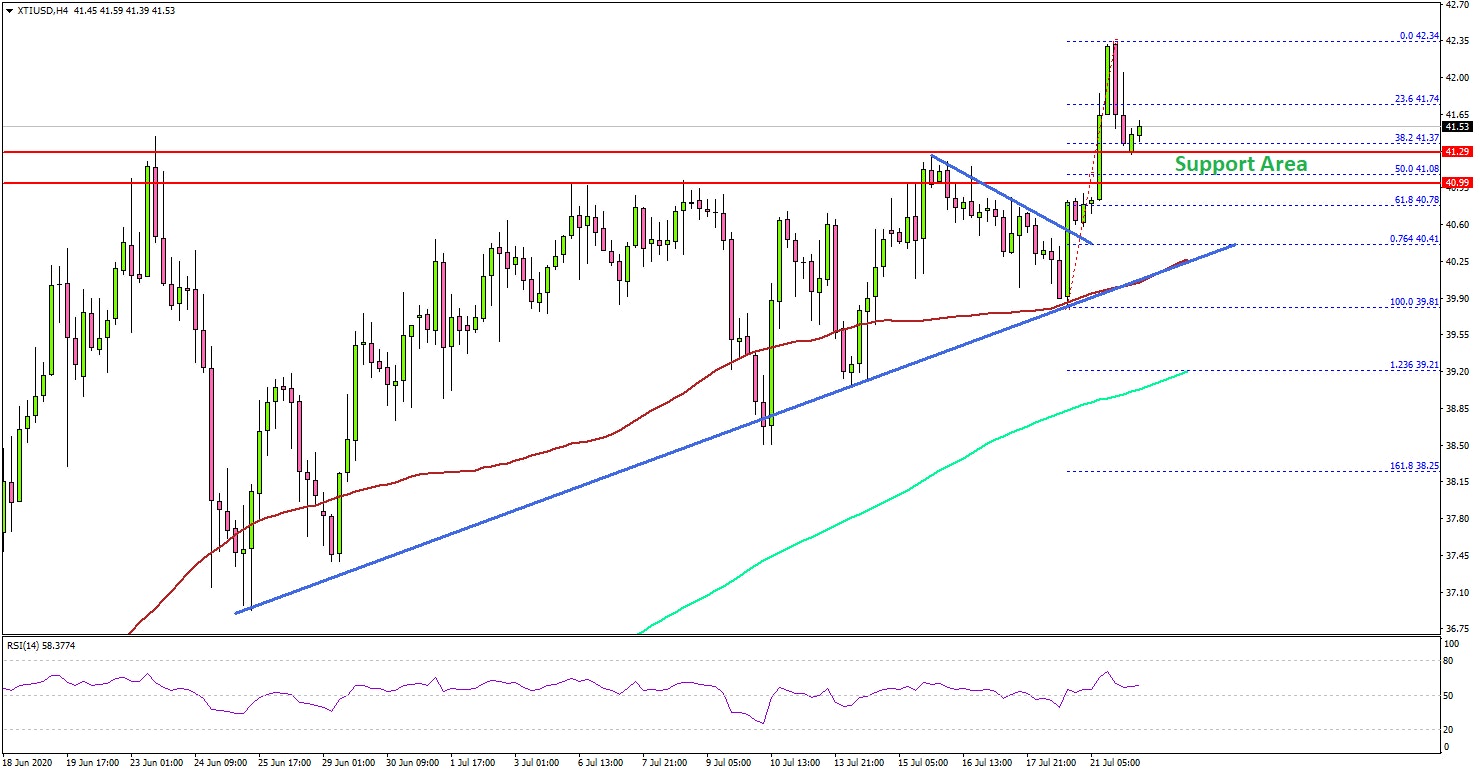

Looking at the 4-hours chart of XTI/USD, the price is following a nice bullish path above the $40.00 pivot level, the 100 simple moving average (red, 4-hours), and the 200 simple moving average (green, 4-hours).

This week, it broke a couple of important hurdles near $41.25 and a connecting bearish trend line on the same chart. As a result, the price traded to a new 4-month high above $42.00.

In the short-term, there could be a downside correction. However, the previous resistance near $41.25 and $41.00 could act as a strong support. There is also a crucial bullish trend line forming with support near $40.20 on the same chart.

Therefore, dips towards the $41.00 and $40.00 levels may perhaps find buyers. On the upside, the $42.20 and $42.50 levels are immediate hurdles. A clear break above the $42.50 resistance could open the doors for a larger rally towards the $45.00 level.

Looking at major pairs, GBP/USD remained in a positive zone and it managed to pop above the main 1.2700 resistance zone.

Economic Releases to Watch Today

- Canadian Consumer Price Index June 2020 (MoM) – Forecast +0.4%, versus +0.3% previous.

- Canadian Consumer Price Index June 2020 (YoY) – Forecast +0.2%, versus -0.4% previous.

- US Housing Price Index May 2020 (MoM) - Forecast +0.3%, versus +0.2% previous.