Aayush Jindal

Key Highlights

- Crude oil price started a steady increase above the $105.00 resistance.

- A key bullish trend line is forming with support near $113.70 on the 4-hours chart.

- Gold price is consolidating above the $1,900 support zone.

- The US Manufacturing PMI could decline from 57.5 to 56.3 in March 2022 (Prelim).

Crude Oil Price Technical Analysis

After a sharp decline, crude oil price found support near $95.00 against the US Dollar. The price formed a base and started a fresh increase above the $100.00 resistance.

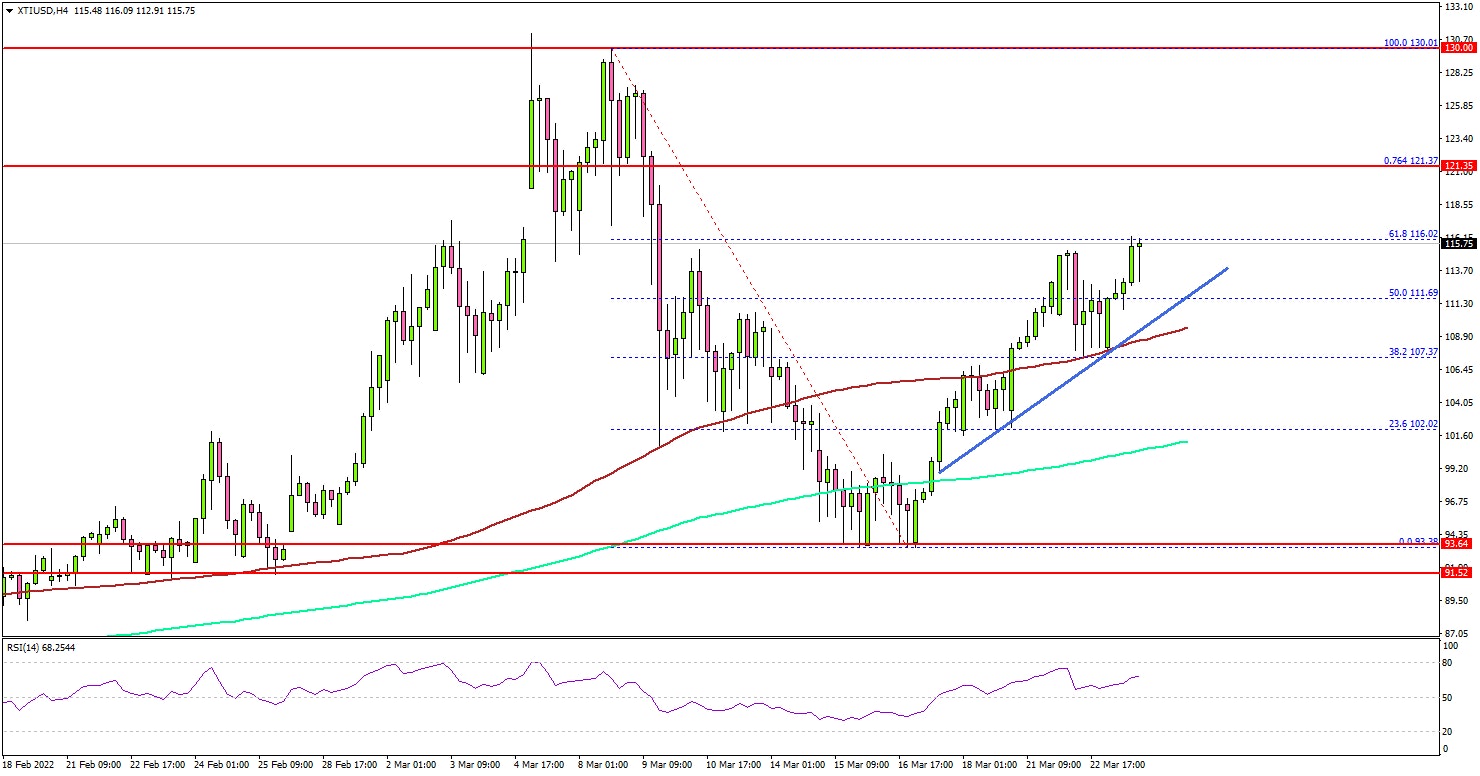

Looking at the monthly chart of XTI/USD, the price cleared the $105.00 resistance zone and the 200 simple moving average (green, 4-hours). The price climbed above the 50% Fib retracement level of the downward move from the $130 swing high to $94 swing low.

It even moved above the $110 level and the 100 simple moving average (red, 4-hours). Besides, there is a key bullish trend line forming with support near $113.70 on the same chart.

It is now facing resistance near the $118 zone. The next major resistance might be $121.50 or the 76.4% Fib retracement level of the downward move from the $130 swing high to $94 swing low.

Any more gains might send the price towards the $130 level. If not, the price might correct lower below the $110 level. The next major support is near $105, below which there is a risk of a move towards the $100 level.

Looking at the gold price, there were mostly range moves above the $1,900 and $1,905 levels. To start a fresh increase, the price must surpass the $1,950 resistance.

Economic Releases to Watch Today

- Germany’s Manufacturing PMI for March 2022 (Preliminary) - Forecast 55.8, versus 58.4 previous.

- Germany’s Services PMI for March 2022 (Preliminary) - Forecast 53.8, versus 55.8 previous.

- Euro Zone Manufacturing PMI for March 2022 (Preliminary) – Forecast 56.0, versus 58.2 previous.

- Euro Zone Services PMI for March 2022 (Preliminary) – Forecast 54.2, versus 55.5 previous.

- US Manufacturing PMI for March 2022 (Preliminary) – Forecast 56.3, versus 57.5 previous.

- US Services PMI for March 2022 (Preliminary) – Forecast 56.0, versus 56.5 previous.

- US Initial Jobless Claims - Forecast 212K, versus 214K previous.