Aayush Jindal

Key Highlights

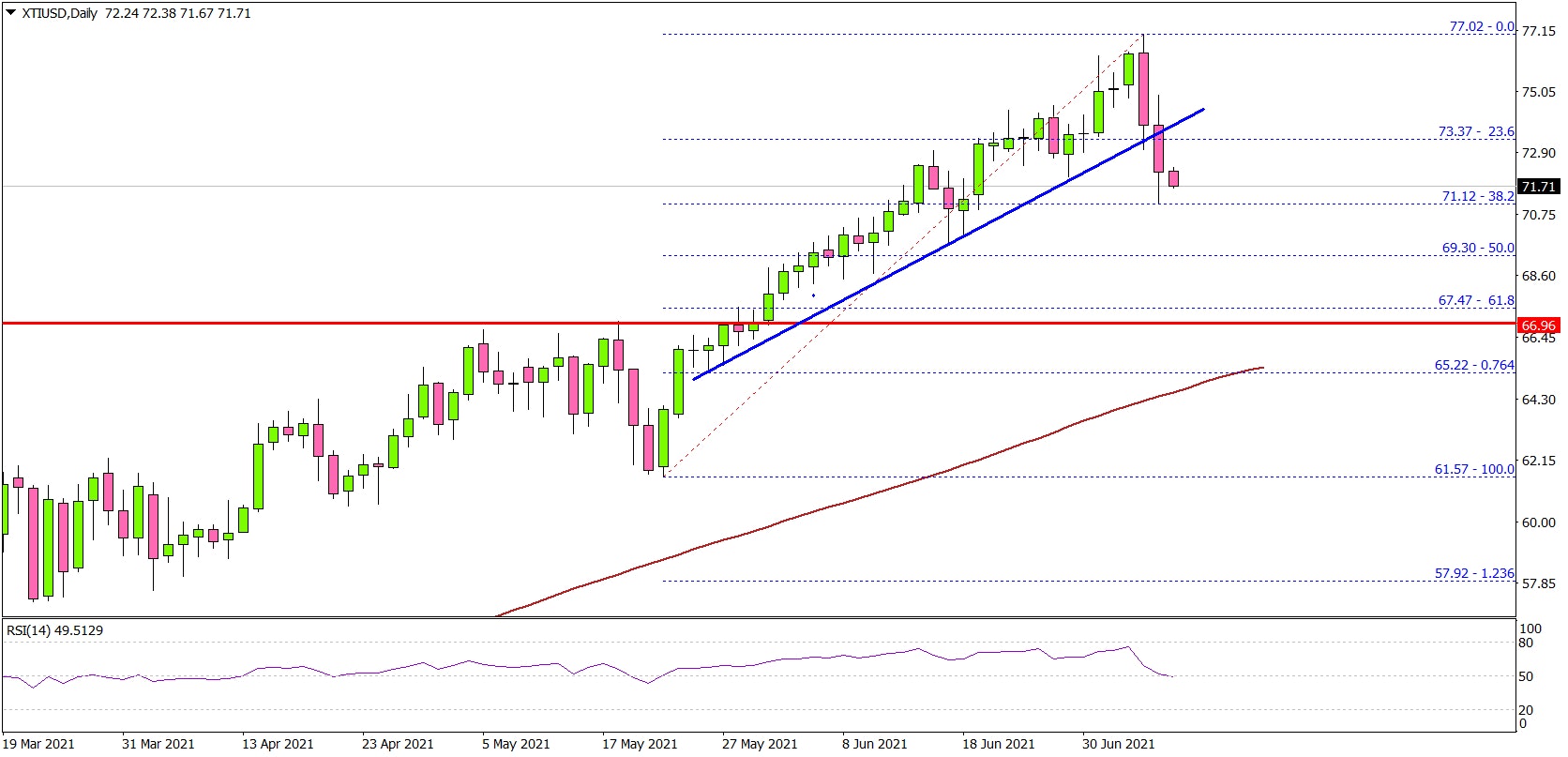

- Crude oil price started a downside correction from the $77.02 high.

- There was a break below a major bullish trend line with support near $73.35 on the daily chart of XTI/USD.

- EUR/USD extended its decline below 1.1800, GBP/USD is trading well below 1.3850.

- The US Initial Jobless Claims could decline to 350K from 364K in the week ending July 03, 2021.

Crude Oil Price Technical Analysis

In the past few weeks, crude oil price gained bullish momentum above $70.00 against the US Dollar. The price extended its rise above the $72.00 and $73.50 resistance levels to move further into a positive zone.

Looking at the daily chart of XTI/USD, the price even settled nicely above the $70.00 zone, the 100-day simple moving average (4-hours), and the 200-day simple moving average (green).

There was also a break above the $75.00 resistance zone. It traded to a new multi-month high near $77.02 before it started a downside correction. There was a break below a major bullish trend line with support near $73.35.

The price traded below the 23.5% Fib retracement level of the upward move from the $61.57 swing low to $77.02 high. The next major support is near the $70.00 level.

The 50% Fib retracement level of the upward move from the $61.57 swing low to $77.02 high is also near the $69.30 level. On the upside, the first major resistance is near the $73.50 level. The next major resistance is near the $75.00 level.

A clear break above the $75.00 level could open the doors for a move towards the $78.00 level. Looking at EUR/USD, the pair extended its decline below the 1.1820 and 1.1800 levels. Besides, GBP/USD remains at a risk of more downsides below 1.3740.

Economic Releases to Watch Today

- Germany’s Trade Balance for May 2021 - Forecast €15.4B, versus €15.9B previous.

- US Initial Jobless Claims - Forecast 350K, versus 364K previous.