Nick Goold

Technical analysis

The recent uptrend continued for the Nikkei last week and now important resistance at 28400 looks likely to be tested. Looking for buy opportunities seems best this week.

The key drivers for the Nikkei remain the Dow and USDJPY. The USDJPY has been very volatile recently breaking the long term uptrend but the negative impact on the Nikkei has been limited.

The Nikkei is now focusing on positive news and following the recent rise in the Dow. While many stock markets are down over 10% since the start of the year, the Nikkei is only down 3% this year.

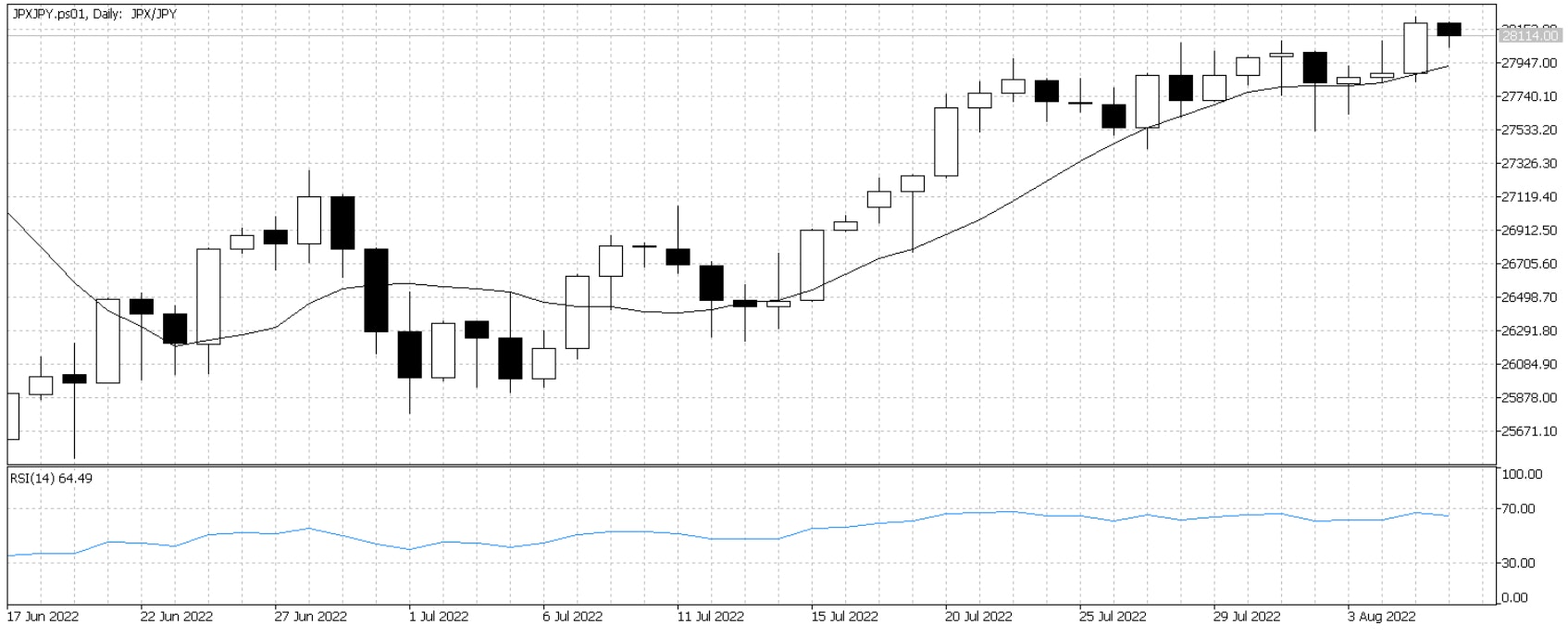

A popular indicator for many longer term swing Nikkei traders is the RSI (Relative Strength Indicator). RSI measures the speed and magnitude of a market`s price changes to determine if the market is overvalued or undervalued. A value over 70 indicates an overbought situation and below 30 is oversold.

Currently the RSI on the Nikkei daily chart is still below 70 which indicates the uptrend is still in place and likely to continue. Should the market quickly rise and the RSI rise above 70 it might be a good opportunity to take profits on long positions.

Resistance:28250, 28400, 28700, 29000, 30000

Support:28000, 27500, 27000, 26000, 25500, 25000

Nikkei 225 CFDs vs Nikkei futures

FX brokers like Titan offer the opportunity to trade the Nikkei 225 CFD market. The advantage of trading CFDs is that traders can start with a smaller position than futures markets and use higher leverage. CFDs markets closely track movements of futures markets so the trading experience is very similar.

The reason why large traders use futures to trade is they can trade in one place and all other traders can see their order. This allows large traders to trade a large position with less costs. For retail traders CFDs are usually the best market to trade. There are three markets which offer the ability to trade Nikkei futures. There are Nikkei futures contracts listed in Japan (JPX), Singapore (SGX) and the US (CME).