Nick Goold

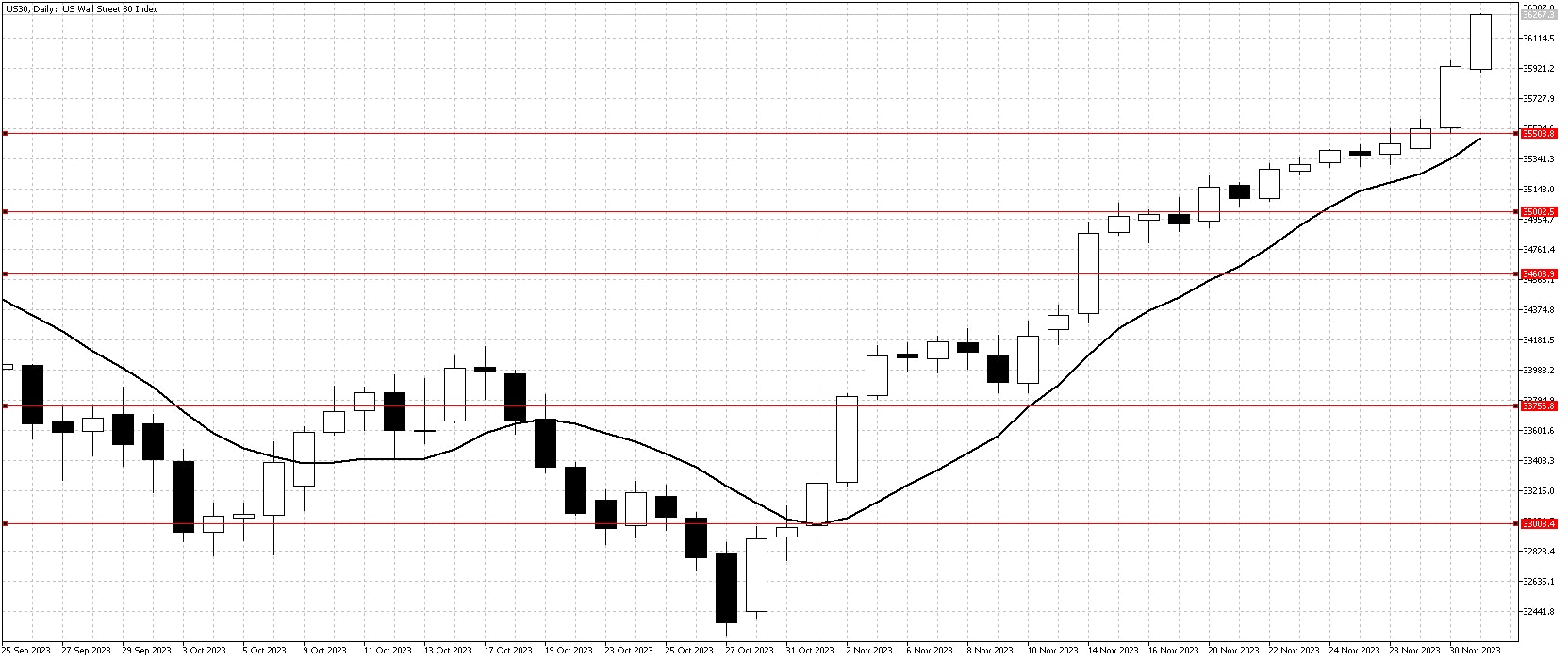

Dow Jones Index

November was remarkable for the Dow Jones Industrial Average, with the index recording a substantial 7% gain. This impressive performance was further bolstered by a more than 2% rise in the month's final week, showcasing a robust momentum in the stock market. A key driver of this surge in stock prices was the significant drop in 10-year U.S. bond yields, which fell by 0.20% to 4.2%.

The decrease in bond yields was influenced by several factors, notably the Federal Reserve's preferred inflation gauge and the personal consumption expenditures (PCE) price index. The PCE price index only rose by 0.2% in October, indicating a slowdown from its September figures. This deceleration in inflation growth is a positive sign for the stock market, as it suggests a less aggressive stance on interest rate hikes by the Federal Reserve, thus fostering a more investor-friendly climate.

Additionally, a significant contribution to the lowering of interest rates and the consequent rise in stock prices was a speech by Federal Reserve Chairman Powell. In his address, Powell acknowledged that the interest rates were now "well into restrictive territory", hinting at a potential slowdown in rate hikes. However, he also cautioned that the Federal Reserve would not hesitate to raise rates again if the economic data warranted such a move. Powell's speech was crucial in shaping investor expectations and market sentiments.

Looking ahead, the Dow has not only surpassed its highs for 2023 but is now edging towards challenging record highs around the 37,000 mark. However, the market is currently slightly overbought, leading up to Friday's U.S. unemployment data release. This scenario presents a potential opportunity for short-term traders to capitalize on by selling. Conversely, the advisable strategy for medium-term traders seems to be maintaining long positions or waiting to buy if the market retracts closer to the 10-day moving average.

Resistance: 36960, 37000, 38000

Support: 35500, 35000, 34600, 33800, 33000

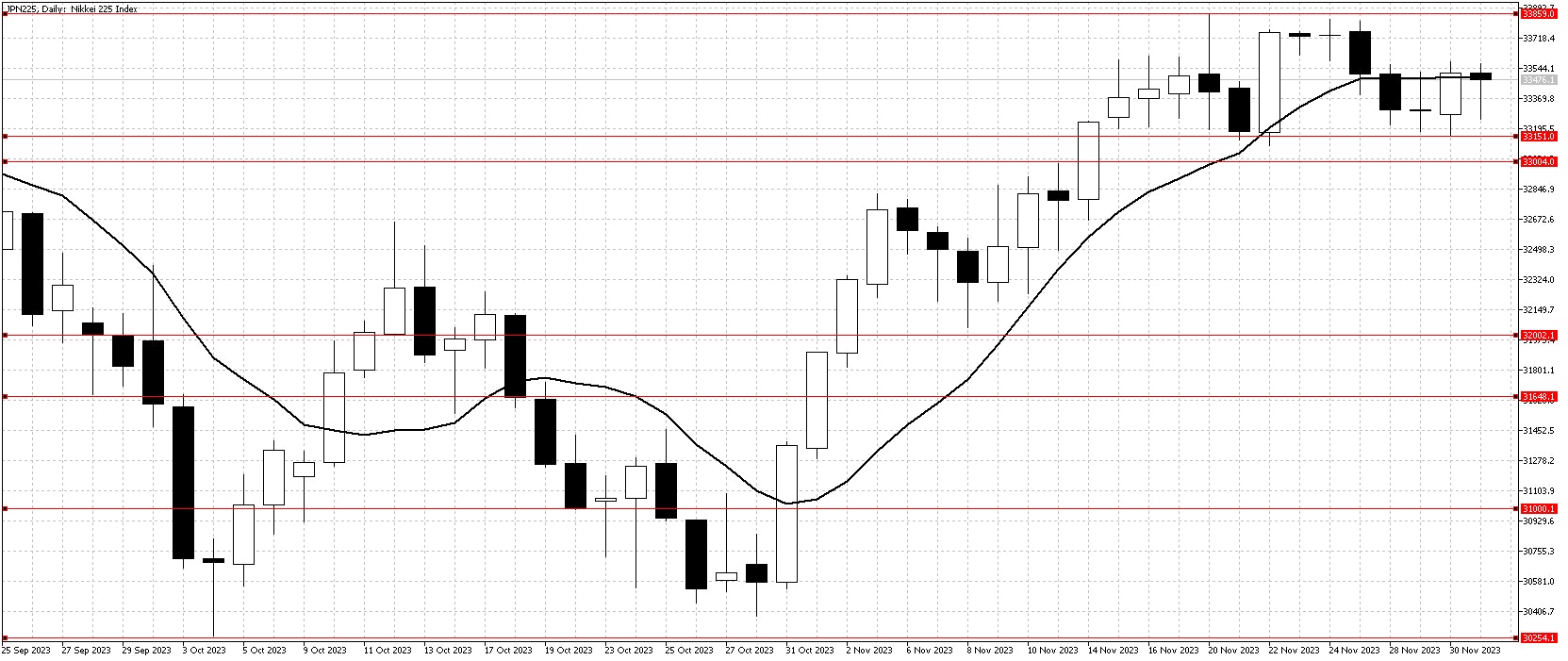

Nikkei Index

This week, the Nikkei experienced a downturn, primarily influenced by the strengthening of the Japanese Yen, despite the substantial gains seen in the Dow Jones. A key factor contributing to the Yen's strength is the growing anticipation that the U.S. Federal Reserve might start reducing interest rates next year. This potential shift could weaken the U.S. dollar, making Japanese products more expensive in overseas markets and affecting the profitability of companies that rely heavily on exports.

Japan's parliament is enacting an extra budget for the current business year, which extends until March 2024. This budget is aimed at supporting the fiscal stimulus, demonstrating the government's ongoing efforts to bolster the economy. The Bank of Japan (BoJ) board members indicated a commitment to continue their current accommodating monetary policy. This stance is designed to stimulate economic growth by keeping interest rates low and encouraging borrowing and spending. However, this announcement did not prevent the Nikkei from falling, suggesting that investor concerns may extend beyond domestic monetary policy.

This week, with the Dow currently overbought and likely to see a retracement and the USD/JPY exchange rate potentially poised for further decline, the Nikkei is exposed to additional risks of loss. This situation might present opportunities for selling in the coming week for traders.

Resistance: 33860, 34000

Support: 33150, 33000, 32000, 31650, 31000