Nick Goold

Dow Jones

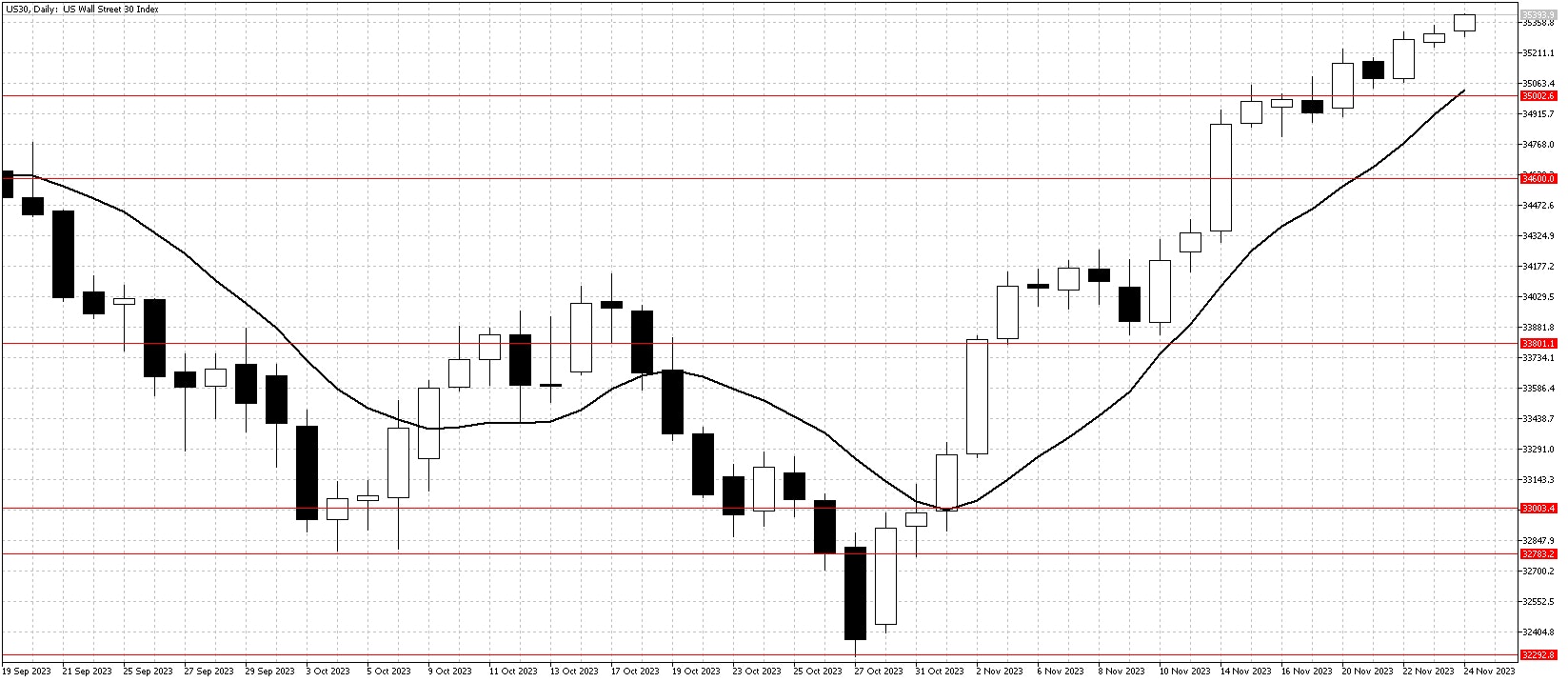

The Dow Jones witnessed another positive week, marking its fourth consecutive weekly gain. This continued upward trend occurred against a backdrop of relatively quiet market conditions. The absence of significant news and the observance of US holidays contributed to a calm trading environment, allowing the positive momentum to remain unchallenged.

Investor optimism has been fueled by recent economic data, which suggests a possible cooling of inflation. This development is significant as it raises hopes that the Federal Reserve might halt its interest rate increases, a scenario that encourages investment in stocks. Additionally, there has been a noticeable decline in the yield of 10-year US bonds, now standing at 4.5%, a decrease of 0.5% from its recent highs. This shift is a critical factor that could influence investor decisions, potentially driving more capital into the stock market as bonds become less appealing in comparison.

Looking ahead to the upcoming week, the market is expected to experience increased volatility. This forecasted change is primarily due to the impending release of crucial US economic data, including GDP and inflation figures. Additionally, a scheduled speech by FOMC member Williams will likely provide further insights into the Federal Reserve's policy outlook, which could significantly impact market movements. Currently, the Dow is nearing its yearly highs, and with solid momentum, it presents an opportune moment for short-term and medium-term traders. The prevailing market conditions favour buying strategies, as investors and traders may look to capitalize on the anticipated economic updates and the ongoing bullish trend in the market.

Resistance: 35725, 36000

Support: 35000, 34600, 33800, 33000, 32785, 32300

Nikkei index

The Nikkei index could not follow the US equity markets higher last week, encountering resistance at 30-year highs. Despite this, the Japanese stock market maintained stability, thanks in part to a combination of factors: the Yen's continued weakness, robust earnings reported in the domestic corporate sector, and an easing of supply chain constraints. These elements have collectively contributed to a steady performance of Japanese stocks, even as the market grapples with significant resistance.

October's consumer inflation report in Japan has ignited discussions regarding the future direction of monetary policy by the Bank of Japan (BoJ). The report indicated a higher-than-target inflation rate, persisting for the 19th consecutive month, leading to cautious trading. Investors are wary of driving prices above the current resistance level due to the potential for a shift towards tighter monetary policy by the BoJ. Although the Consumer Price Index (CPI) rise fell short of the expected 3.0%, the consistent overshooting of the BoJ's 2% inflation target fuels speculation about imminent policy changes.

Recent flash PMI data suggests that private sector activity in Japan has stalled, with manufacturing showing particular signs of business condition deterioration. While the medium-term outlook for the Nikkei remains robust, predicting the exact timing of a market breakout poses a challenge in the short term. This scenario presents potential range trading opportunities for short-term traders. Meanwhile, medium-term investors are best to stay prepared for buying opportunities, especially if the market exhibits any dips, as the likelihood of the Nikkei achieving new highs in the upcoming weeks appears promising.

Resistance: 33860, 34000

Support: 33000, 31650, 30250, 30000