Nick Goold

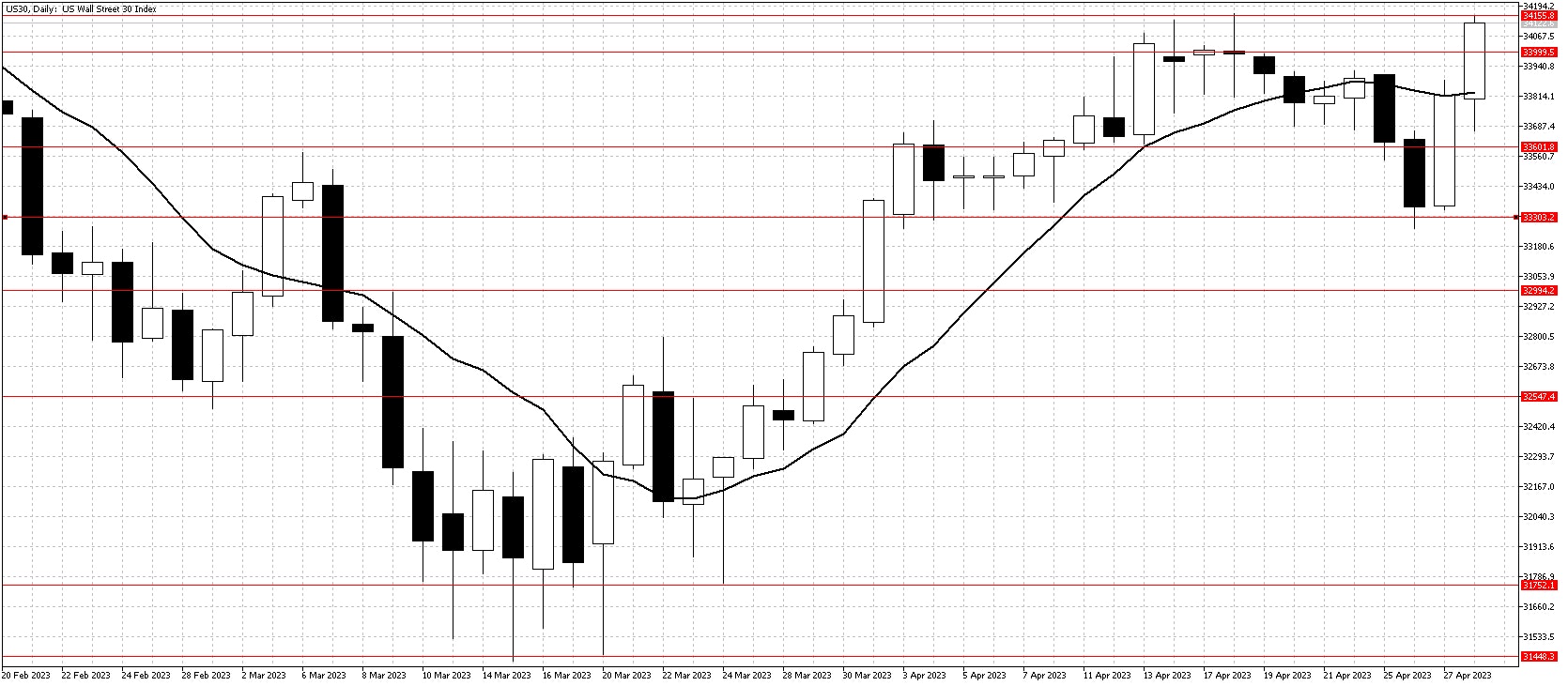

Dow Jones index

Problems at another US bank saw the Dow Jones index fall back to April lows at the start of the week. However, support held at 33,300 as strong earnings releases from US technology stocks encouraged buyers to look for cheap stocks. In addition, Thursday's weak US GDP number showed that the US Federal Reserve's policy is helping to cool the economy, which was seen as positive.

Hopes that the problems at First Republic Bank are isolated saw the Dow close April for the largest monthly gain since January. Next week the focus will be the FOMC meeting, where markets are pricing in a roughly 80% or higher probability of a 25bp Fed Funds rate hike to 5.25%.

In addition, Friday's US employment numbers are the other major economic news.

The Dow stopped at 34150 resistance from the April highs on Friday, but the upward momentum is strong, so higher levels are expected. However, the overall market is still range bound, so it might be better to wait for a slight fall or a significant break of resistance to buy the Dow Jones index.

Resistance: 34155, 34500, 35000

Support: 34000, 33600, 33300, 33000, 32550, 31750

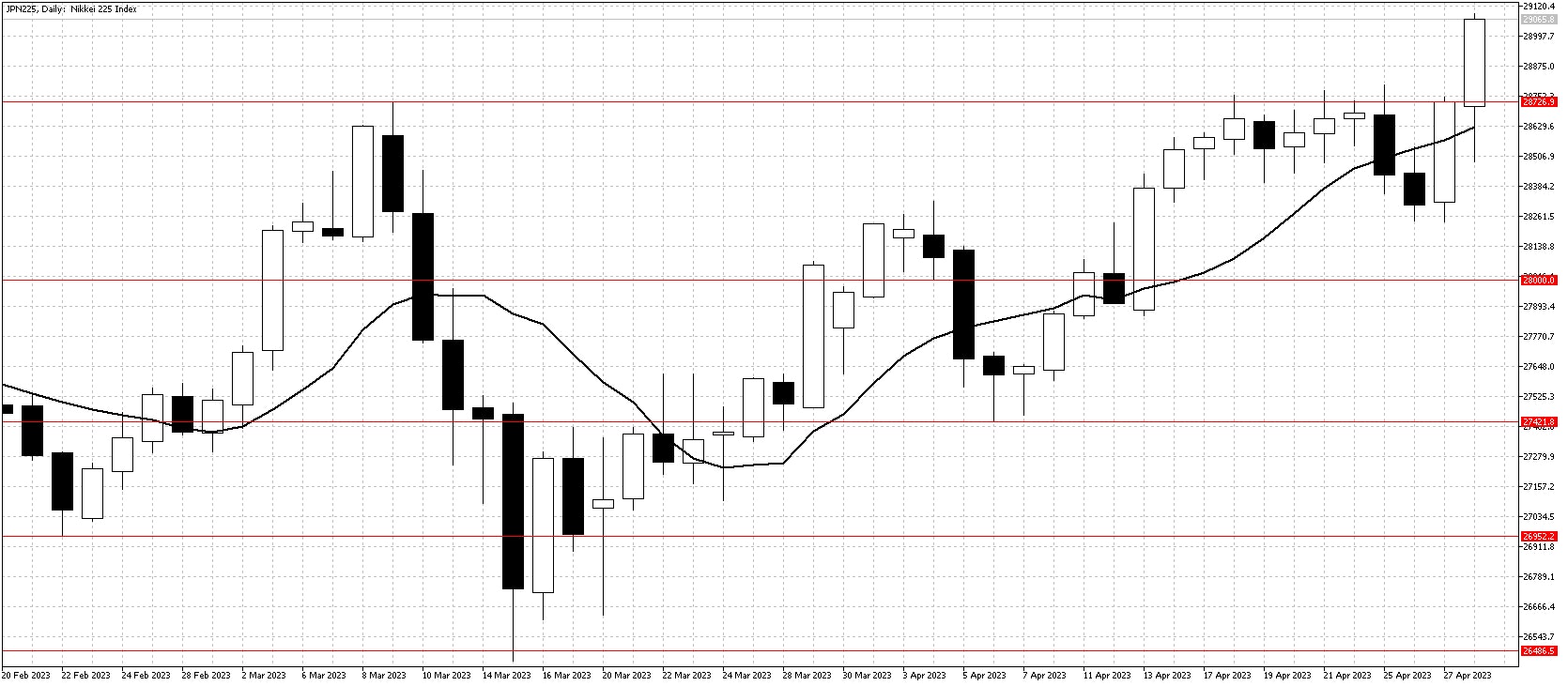

Nikkei 225 index

The Nikkei 225 index followed the Dow Jones lower as the market waited for the first Bank of Japan monetary policy meeting by new governor Ueda. As expected, the BOJ maintained its short-term interest rate target intact at -0.1% and for the 10-year bond yield around 0%, and will continue to "patiently" continue with stimulus.

The BOJ announcement saw the Nikkei surge higher to make new highs for 2023 as the USDJPY also rose significantly. In addition, Japan lifted most of the coronavirus border controls, which is positive for the economy as tourists surge back to Japan.

Continued gains look likely in the coming week as the strong USDJPY will continue to help sentiment. The next resistance level from the 2022 highs at 29233 is the next target, and then 30,000.

Resistance: 29233, 30000

Support: 28725, 28000, 27425, 26950, 26500, 26250, 25500, 25000