Nick Goold

Dow Jones Index

An agreement to raise the US debt limit had limited impact on US equities as a resolution was expected by investors. The Dow Jones drifted lower for most of the week testing back below 33,000 but buying returned on Thursday as the US ISM data showed inflation continues to fall.

The most anticipated news of the week was data on the US employment situation and it did not disappoint. 339,000 new jobs were added, much more than the expected 190,000 which despite the unemployment rate rising saw heavy buying from investors.

The outlook for the Dow Jones index is much improved compared to one week ago. In the medium term the market is still in a range so the market will need more positive news to move significantly higher. In the short term the index has formed a large gap from the 10 day moving average which indicates a move lower at the start of the week is likely.

Resistance: 33820, 34000, 34155, 34500, 35000

Support: 33000, 32550, 31750

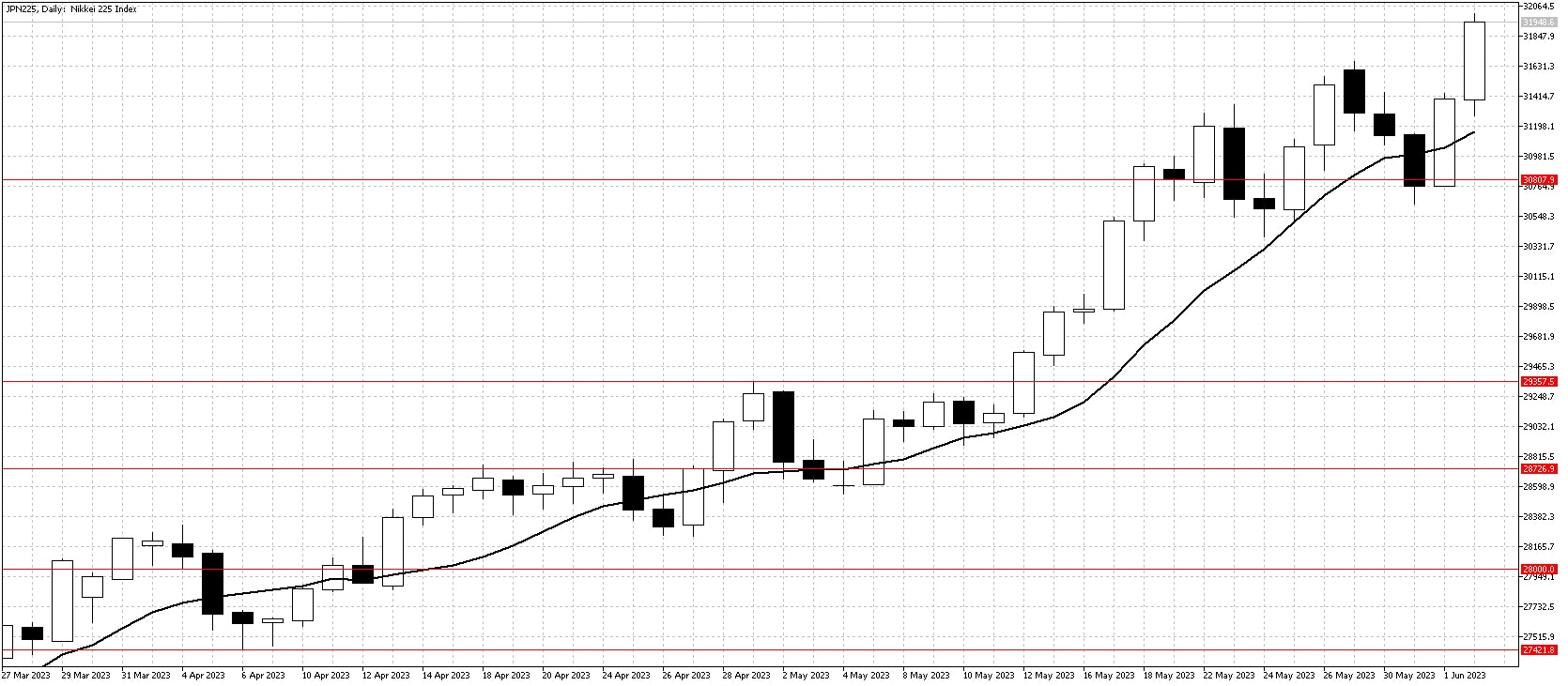

Nikkei 225 Index

Strong foreign investor interest and positivity regarding the Japanese economy continued last week seeing the Nikkei index continue higher. The Bank of Japan indicated they will maintain current monetary policy which is also sentiment.

The USDJPY hit a 6 month high on the large difference between US and Japanese interest rates which is starting to concern Japanese officials. Currently the probability of intervention seems low and the impact could be limited. Tourism to Japan continues to surge with overnight hotel stays recording 10 million which is the first time in 3 years.

The uptrend shows no signs of showing and with no resistance on the charts higher levels seem highly likely. No market moves in a straight line though so even in a strong uptrend there are short term selling opportunities and trades need to be patient for the market to fall in order to buy.

Resistance: 32000, 33000

Support: 30800, 30500, 30000, 29360