Nick Goold

Dow Jones Index

After another week of high volatility, the Dow Jones index ended close to unchanged. UBS buying Credit Suisse at the start of the week was greeted positively by investors seeing the year's lows hold. However, rumors continued swirling regarding other banks' financial situation, so investors remained cautious.

The US Federal Reserve raised interest rates by 0.25% as the fight against inflation remained the focus. The interest rate was seen as unfavorable, seeing the Dow Jones index come back under pressure at the end of the week.

This week the focus will remain on the banks, with Deutsche Bank now under pressure to prove its strength. The market will likely remain worried in the short term, so it is hard to see a significant rise. Nevertheless, the current situation presents great range trading opportunities for short-term traders. Medium to long-term trading is more difficult as the risk of further negative banking news is high.

Resistance: 32550, 33000, 33500, 34000, 34500, 35000

Support: 31750, 31450, 31000, 30500, 30000

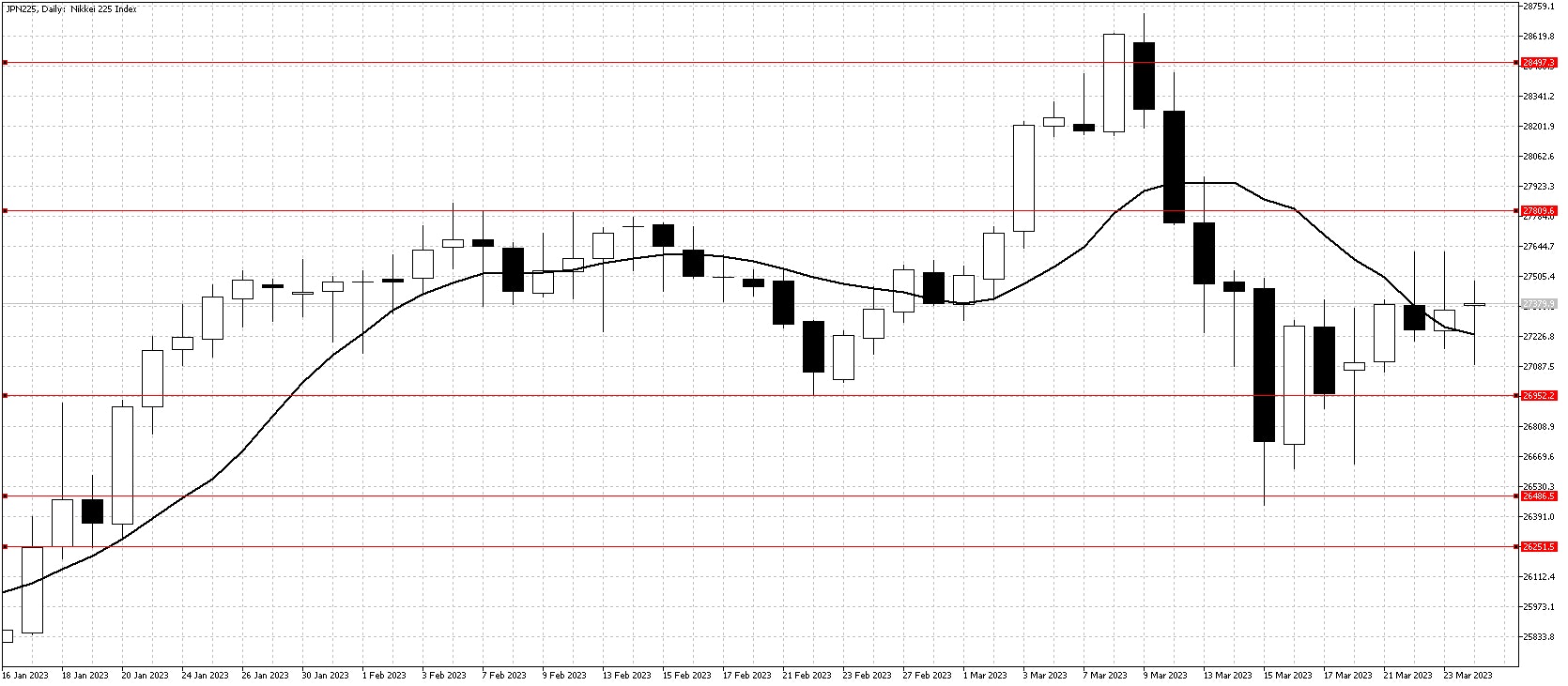

Nikkei 225 index

The Nikkei 225 plunged lower Monday but successfully held support ahead of the previous week's lows. Despite the USDJPY falling all week, Japanese stocks slowly moved higher for the rest of the week, which is a positive sign. Inflation figures for February were the highest in 41 years, but at 3.1%, it is much lower than most other parts of the world.

The close above the 10-day moving average is positive for the short to medium-term outlook for the Nikkei index. Expect strong support ahead of 27,000 and a potential test to 28,000 in the coming weeks should banking worries subside.

Resistance: 27815, 28500, 29000, 29250

Support: 26950, 26500, 26250, 25500, 25000, 24500