Nick Goold

Dow Jones index

Following a volatile March, US equities markets started April quietly ahead of the Easter holidays. Higher official US interest rates showed signs of slowing the US economy, with ISM figures lower than expectations. However, Friday's employment figures matched expectations, and there was little impact with the market closed for a holiday.

It will be a quiet start to the week with the Easter holiday on Monday, but volatility should increase with US CPI figures released on Wednesday. Other economic data are minutes from the latest Fed meeting on Wednesday and US retail sales data on Friday.

The technical outlook remains positive for the Dow Jones index, with the 10-day moving average pointing higher and likely to act as support this week. Should last week's high be broken, the medium-term target will be 34,000. The market is currently bullish, but should inflation figures be higher than expected, a quick fall could present a buying opportunity this week.

Resistance: 33600, 34000, 34500, 35000

Support: 33000, 32550, 31750, 31450, 31000, 30500, 30000

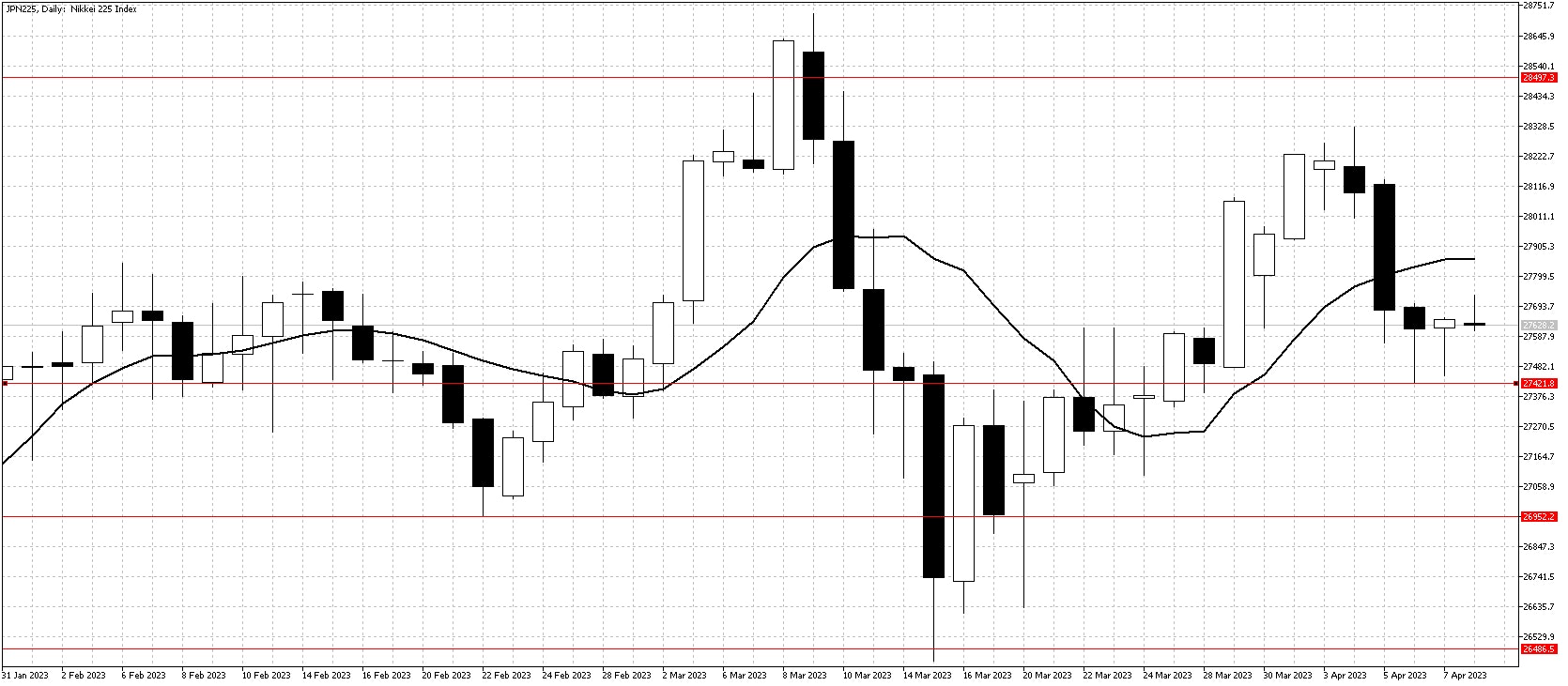

Nikkei 225 index

The Nikkei index started the last week well, continuing the recent recovery but suffered from profit-taking as the USDJPY fell towards the end of the week. In addition, Japanese household spending figures were much lower than expected, which encouraged liquidation from investors.

While there has been a significant increase in tourism this year, the Japanese consumer is still struggling to adjust to the rise in inflation, Japanese wages are slowly increasing, but the Japanese consumer is risk-averse and reducing spending as prices rise.

The Nikkei outlook remains positive in the medium term, so last week's fall presents a potential buying opportunity this week. In addition, equity traders closely watch movements in the USDJPY, and a move above 133.00 could trigger a quick rise in the Nikkei index.

Resistance: 28500, 29000, 29250

Support: 27425, 26950, 26500, 26250, 25500, 25000