Aayush Jindal

Key Highlights

- The Euro failed to clear a crucial resistancenear 1.1260 against the US Dollar.

- EUR/USD traded below two bullish trend linesnear 1.1200 on the 4-hours chart.

- The Euro Area CPI increased 1.7% in April 2019(YoY), similar to the forecast and last reading.

- The German PPI in April 2019 (MoM) mightincrease 0.2%, whereas the last was -0.1%.

EURUSD Technical Analysis

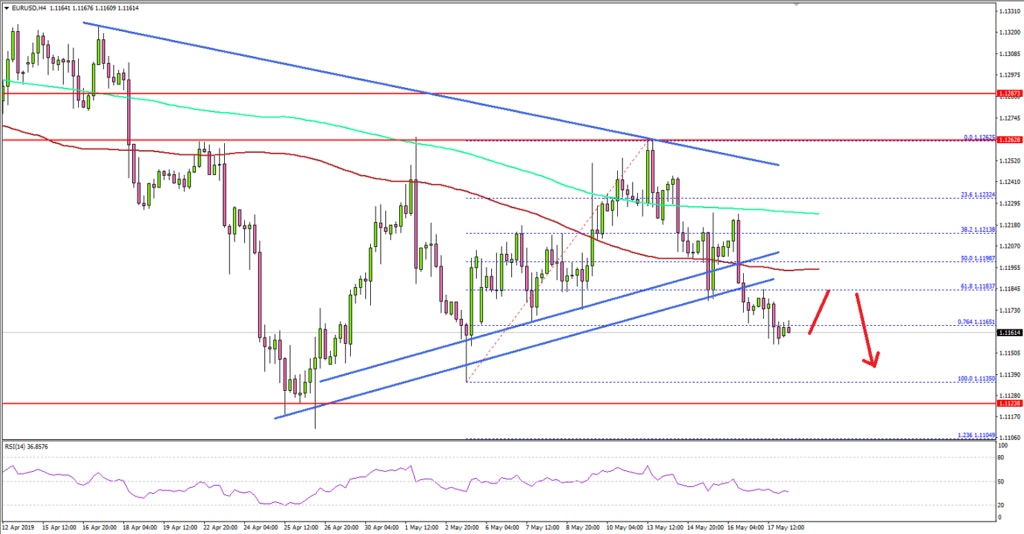

This past week, the Euro recovered above the 1.1220 and 1.1240 levels against the US Dollar. However, the EUR/USD pair struggled to clear a significant resistance area near 1.1260, and later trimmed most gains.

Looking at the 4-hours chart, the pair failed on threeoccasions near the 1.1260 and 1.1265 resistance levels. Recently, it traded ashigh as 1.1262 and declined below 1.1240 and 1.1220.

The recent decline was strong, considering a close below1.1200, 100 simple moving average (4-hours, red), and the 200 simple movingaverage (4-hours, green). More importantly, the pair traded below two bullishtrend lines near 1.1200 on the same chart.

The pair even traded below the 61.8% Fib retracement levelof the upward move from the 1.1135 low to 1.1262 high. It opened the doors formore losses below the 1.1165 and 1.1150 support levels.

If the pair continues to move down, it could retest the1.1135 swing low. Below 1.1135, the pair is likely to test 1.1100 or the 1.236Fib extension level of the upward move from the 1.1135 low to 1.1262 high.

Conversely, if there is an upside correction, the previoussupport near 1.1200 and the 100 simple moving average (4-hours, red) are likelyto act as resistance. The next key resistances are 1.1225, 1.1240 and 1.1260.

Fundamentally, the Euro Area CPI report for April 2019 was releasedby the Eurostat. The market was looking for a 1.7% rise in the CPI comparedwith the same month a year ago.

The actual result was similar to the forecast, as the Euro AreaCPI increased 1.7%. Besides, the monthly change was +0.7%, similar to theforecast, but below the last +1.0%.

The report added:

In April 2019, the highest contribution to the annual euro area inflation rate came from services (+0.86 percentage points, pp), followed by energy (+0.51 pp), food, alcohol & tobacco (+0.29 pp) and non-energy industrial goods (+0.06 pp).

Overall, EUR/USD remains at a risk of more losses towards 1.1100 in the near term. Besides, there were heavy downsides in GBP/USD below 1.2900 and 1.2800, and AUD/USD broke the key 0.6900 support area.

Economic Releases to Watch Today

- German Producer Price Index April 2019 (MoM) –Forecast +0.2%, versus -0.1% previous.

- Chicago Fed National Activity Index April 2019 –Forecast -0.33, versus -0.15 previous.