Aayush Jindal

Key Highlights

- EUR/USD started a downside correction from the 1.1900 resistance.

- A crucial bullish trend line is forming with support near 1.1685 on the 4-hours chart.

- The Euro Zone Manufacturing PMI could remain at 51.1 in July 2020.

- The US ISM Manufacturing PMI could increase from 52.6 to 54.0 in July 2020.

EUR/USD Technical Analysis

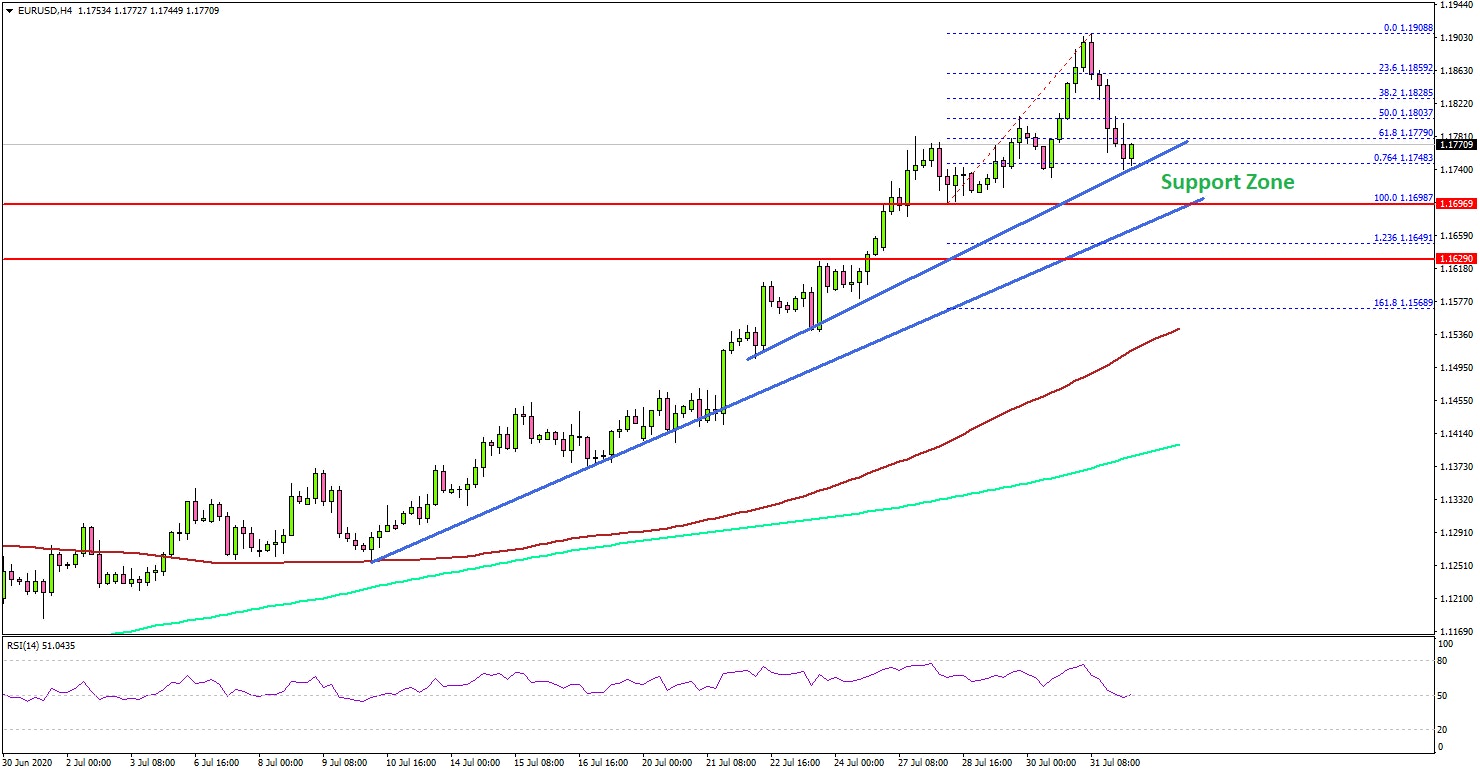

The Euro followed a strong bullish path above the 1.1800 resistance against the US Dollar. EUR/USD traded to a new multi-month high at 1.1908 and recently started a downside correction.

Looking at the 4-hours chart, the pair broke the 1.1880 and 1.1850 support levels to move into a short-term downside correction. The pair traded below the 50% Fib retracement level of the upward move from the 1.1698 low to 1.1908 high.

On the downside, there are many supports forming near 1.1700. There is also a crucial bullish trend line forming with support near 1.1685 on the same chart.

If there is a bearish break below the 1.1700 and 1.1680 support levels, the pair could correct lower towards the 1.1550 support or the 100 simple moving average (red, 4-hours). Conversely, the pair could start a fresh increase from the 1.1700 support.

On the upside, an initial resistance is near the 1.1820 level, above which the pair is likely to revisit the 1.1880 and 1.1900 resistance levels.

Fundamentally, the Euro Area Gross Domestic Product for Q2 2020 (prelim) was released this past week by the Eurostat. The market was looking the GDP to decline by 12%.

The actual result mostly in line with the forecast, as the Euro Area GDP decreased at a rate of 12.1 percent in the second quarter of 2020.

The report added:

Compared with the same quarter of the previous year, seasonally adjusted GDP decreased by 15.0% in the euro area and by 14.4%in the EU in the second quarter of 2020, after -3.1% and -2.5% respectively in the previous quarter.

Overall, EUR/USD is likely to find a strong support near 1.1700 and 1.1680. Similarly, GBP/USD could correct lower towards the 1.3000 and 1.2950 support levels.

Upcoming Economic Releases

- Germany’s Manufacturing PMI July 2020 - Forecast 50.0, versus 50.0 previous.

- Euro Zone Manufacturing PMI July 2020 – Forecast 51.1, versus 51.1 previous.

- UK Manufacturing PMI July 2020 – Forecast 53.6, versus 53.6 previous.

- US Manufacturing PMI July 2020 – Forecast 51.3, versus 51.3 previous.

- US ISM Manufacturing PMI July 2020 – Forecast 54.0, versus 52.6 previous.