Aayush Jindal

Key Highlights

- EUR/USD remains in a bearish zone below the 1.0630 level.

- It is facing a major resistance near 1.0630 and 1.0650 on the 4-hours chart.

- GBP/USD declined sharply below the 1.2500 support zone.

- The US nonfarm payrolls increased 428K in April 2022.

EUR/USD Technical Analysis

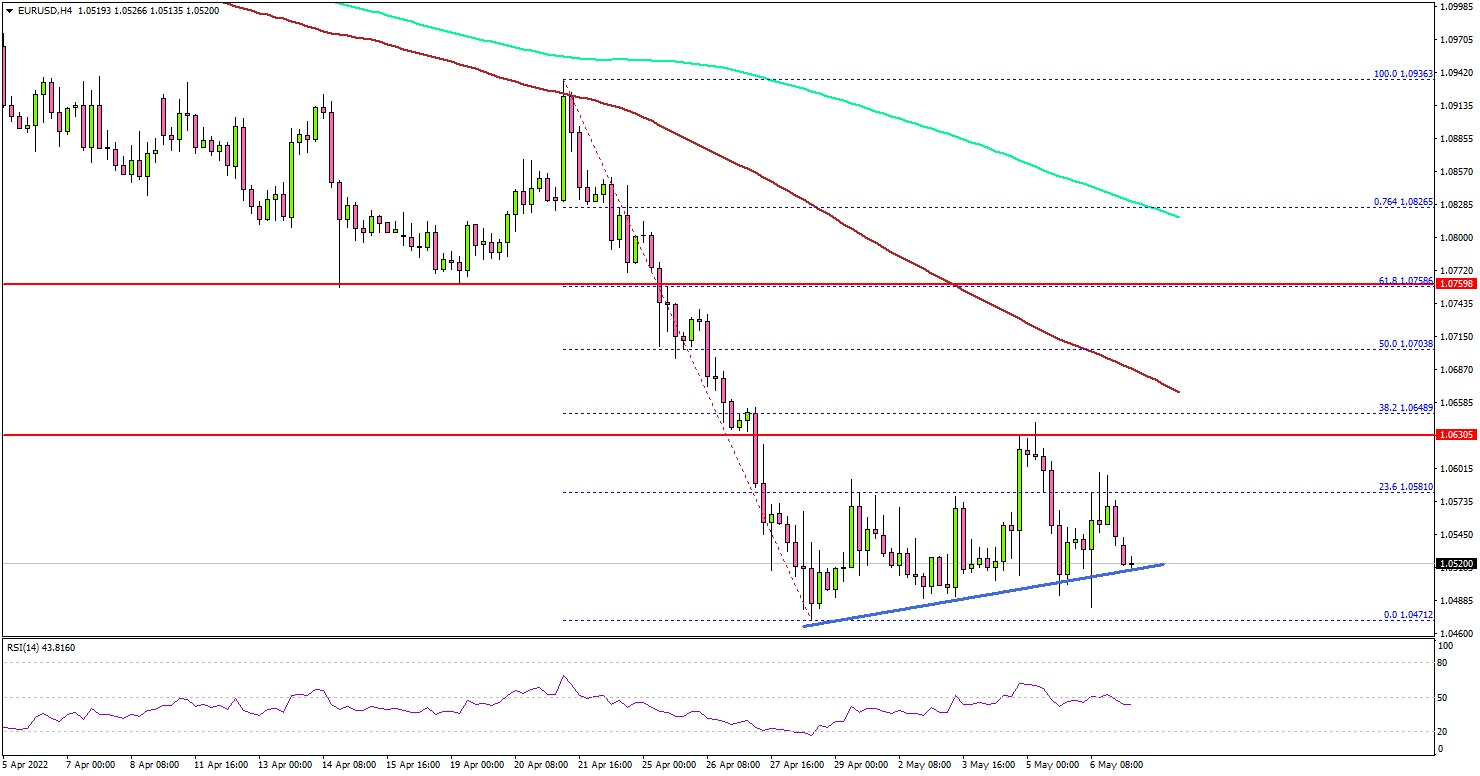

The Euro started a major decline from the 1.0930 resistance against the US Dollar. EUR/USD tested the 1.0475 zone and recently started a consolidation phase.

Looking at the 4-hours chart, the pair traded as low as 1.0471 and remained well below the 200 simple moving average (green, 4-hours), and the 100 simple moving average (red, 4-hours).

There was a minor upside correction above the 1.0550 resistance level. There a clear move above the 23.6% Fib retracement level of the key decline from the 1.0936 swing high to 1.0471 low.

On the upside, an initial resistance is forming near the 1.0630 level. The next major resistance is near the 1.0700 high. It is near the 50% Fib retracement level of the key decline from the 1.0936 swing high to 1.0471 low.

If there is an upside break above 1.0700, the pair could accelerate higher towards 1.0850. If not, there is a risk of more downsides below the 1.0500 level. The next major support is near the 1.0475 level. Any more losses may perhaps push EUR/USD towards the 1.0420 support.

Fundamentally, the US nonfarm payrolls report for April 2022 was this past Friday by the US Bureau of Labor Statistics. The market was looking for an increase of 391K.

The actual result was above the market forecast, as the US nonfarm payrolls increased 428K, similar to the last reading (revised from 431K to 428K).

Looking at GBP/USD, there was a sharp decline below 1.2550 and 1.2500. Besides, gold price is struggling to clear the $1,900 resistance.

Economic Releases

- US Wholesale Inventories for March 2022 – Forecast +2.3%, versus +2.3% previous.