Aayush Jindal

Key Highlights

- EUR/USD started a steady increase above the 1.1720 zone.

- A key bullish trend line is forming with support at 1.1750 on the 4-hour chart.

- GBP/USD is currently consolidating gains above 1.3450.

- Gold extended its rally and climbed to a new all-time high above $4,530.

EUR/USD Technical Analysis

The Euro found support and started a fresh increase above 1.1680 against the US Dollar. EUR/USD climbed higher above 1.1720 to enter a positive zone.

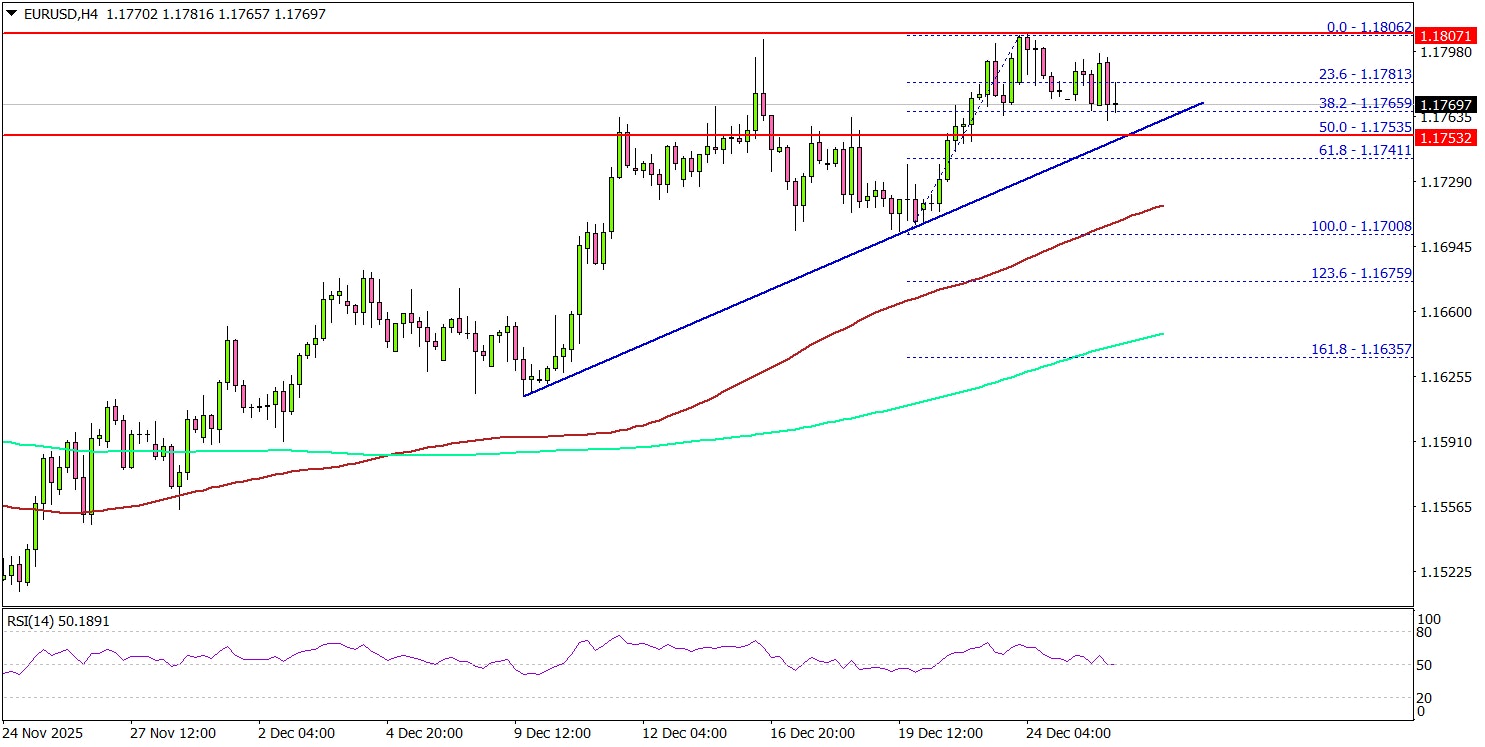

Looking at the 4-hour chart, the pair settled above 1.1750, the 200 simple moving average (green, 4-hour), and the 100 simple moving average (red, 4-hour). A high was formed at 1.1806 before there was a pullback.

The pair dipped below the 23.6% Fib retracement level of the upward move from the 1.1708 swing low to the 1.1806 high. On the downside, there is key support at 1.1750. There is also a bullish trend line forming with support at 1.1750. A downside break below the trend line might spark bearish moves.

The first major support is 1.1710 and the 100 simple moving average (red, 4-hour). The next support could be 1.1650 and the 200 simple moving average (green, 4-hour), below which the bears might aim for a move toward 1.1610.

Immediate resistance sits near 1.1800. The first key hurdle is seen near 1.1820. A close above 1.1820 could open the doors for a move toward 1.1850. Any more gains could set the pace for a steady increase toward 1.1920.

Looking at Gold, the bulls remain in action and might soon aim for a move above the $4,550 level in the near term.

Upcoming Key Economic Events:

- US Pending Home Sales for Nov 2025 (YoY) - Forecast +1%, versus +1.9% previous.