Aayush Jindal

Key Highlights

- EUR/USD started a major decline below the 1.1750 and 1.1700 support levels.

- It broke a crucial contracting triangle with support near 1.1785 on the 4-hours chart.

- The Euro Area GDP grew 12.7% in Q3 2020 (QoQ) (Prelim), more than the 9.4% market forecast.

- The US ISM Manufacturing PMI (to be released today) could increase from 55.4 to 55.6 in Oct 2020.

EUR/USD Technical Analysis

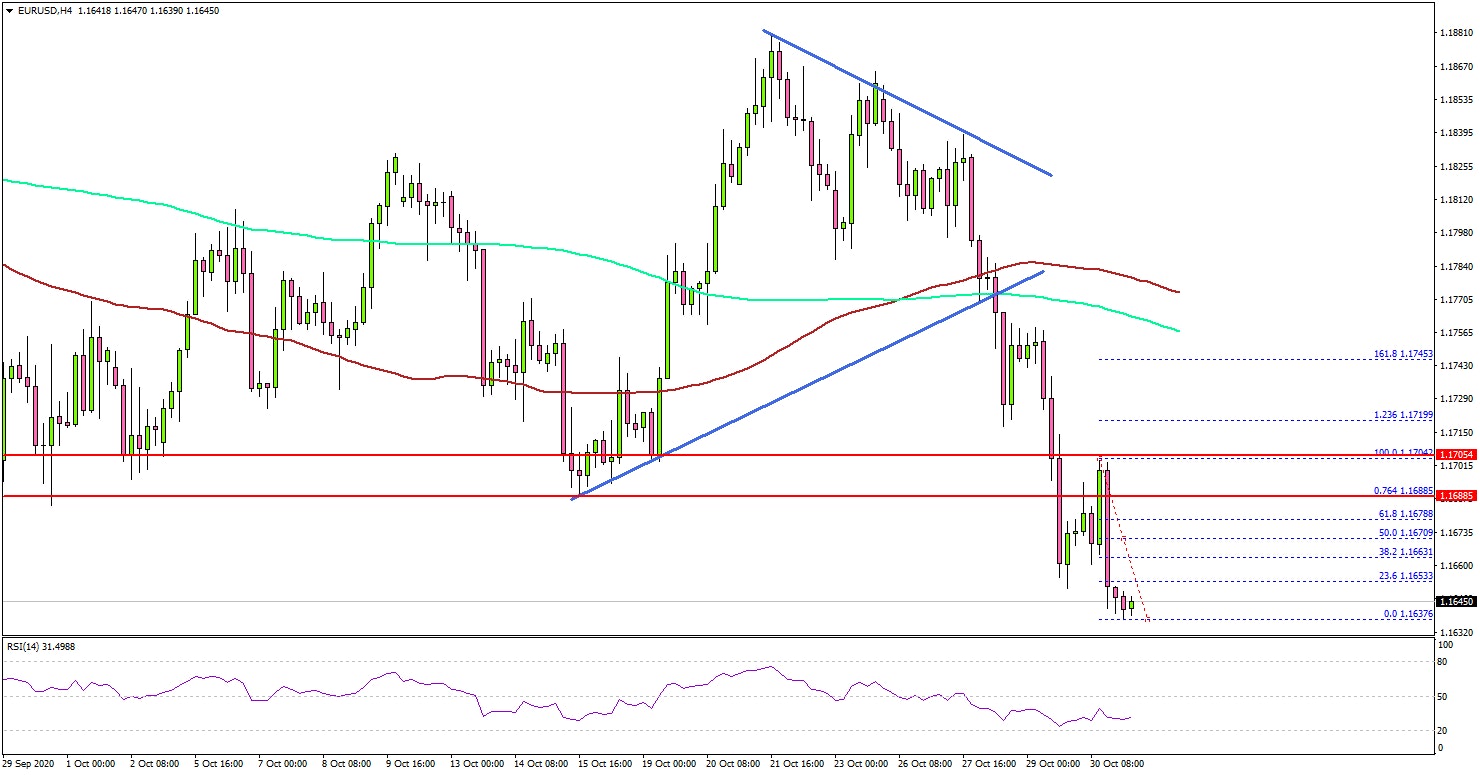

The Euro failed to stay above the 1.1850 support level and declined heavily against the US Dollar. EUR/USD broke the key 1.1750 support level to move into a bearish zone.

Looking at the 4-hours chart, the pair followed a bearish pattern from well above 1.1850. It broke a crucial contracting triangle with support near 1.1785 to start the current decline.

The pair settled well below the 1.1750 support level, the 100 simple moving average (red, 4-hours), and the 200 simple moving average (green, 4-hours). The decline was such that the pair even broke the 1.1700 support level.

It tested the 1.1640 level. If there is an upside correction, the 1.1680 and 1.1700 levels are likely to prevent gains. The next major resistance is near the 1.1750 level or the 100 simple moving average (red, 4-hours).

Conversely, the pair could continue to move down below 1.1640 and 1.1625. The next major support is near the 1.1600 level.

Fundamentally, the Euro Area Gross Domestic Product report for Q3 2020 (Prelim) was released this past Friday by the Eurostat. The market was looking for a strong rise of 9.4% in the GDP.

The actual result was above the market forecast, as the Euro Area Gross Domestic Product expanded at a solid pace of 12.7% in Q3 2020.

_afkbp.png?fm=pjpg&auto=format)

The report added that:

These were by far the sharpest increases observed since time series started in 1995, and a rebound compared to the second quarter of 2020, when GDP had decreased by 11.8% in the euro area and by 11.4% in the EU.

However, EUR/USD struggled to gain traction after the release and that’s why there is a risk of more losses below 1.1640. Looking at GBP/USD, the pair broke the 1.3000 support, but it stayed above 1.2900. Besides, USD/JPY remained strong above the 104.00 support zone.

Upcoming Economic Releases

- Germany’s Manufacturing PMI Oct 2020 - Forecast 58.0, versus 58.0 previous.

- Euro Zone Manufacturing PMI Oct 2020 – Forecast 54.4, versus 54.4 previous.

- UK Manufacturing PMI Oct 2020 – Forecast 53.3, versus 53.3 previous.

- US Manufacturing PMI Oct 2020 – Forecast 53.3, versus 53.3 previous.

- US ISM Manufacturing PMI Oct 2020 – Forecast 55.6, versus 55.4 previous.