Nick Goold

Dow Jones index

Another positive week for the Dow Jones index as equity traders continue to push for a positive end to a tough year for equities. At the start of the week sellers were in control selling at resistance from the highs in August. The main news event of last week was the speech by Fed Chairman Powell on Wednesday, creating volatility as expected. Powell indicated that the size of official interest rate rises will slow which resulted in a surge higher for US equity prices.

The coming week has few expected market moving news events so a quiet week is most likely. As the market is close to resistance, sideways to higher price action is most likely as traders fight for control of the market. Equity traders are hoping for a more positive 2023 so there is a push to buy ahead of the end of the year.

The 10-day moving average continues to point higher and act as support, so traders should focus on buying opportunities now. The next major resistance level is 35500 so there is a potential for further gains. Market sentiment can change very quickly in current conditions so traders need to be aware of any potential news events.

Resistance:35000, 35500, 36000, 36500, 37000

Support:34000, 33560, 33000, 32000, 31725, 31000

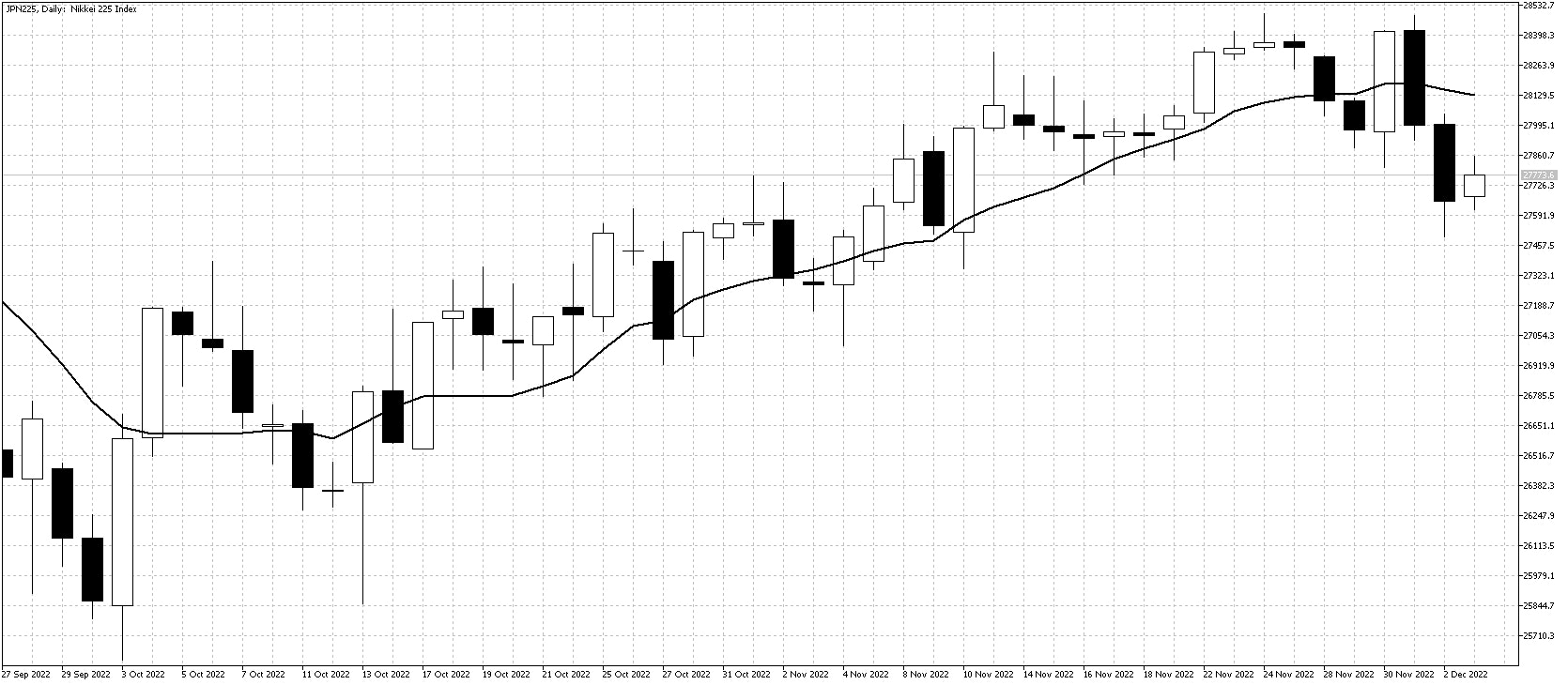

Nikkei 225 index

The Nikkei moved in the opposite direction to US equities last week due to the strong Yen hurting market sentiment. There is a fear that the stronger yen will hurt the profits of Japanese companies operating overseas.

The Nikkei has now formed a double top pattern at 25500 which signifies that the recent uptrend has come to an end for now. US equities remain positive and will prevent large falls in the Nikkei so rather than selling, range trading this week looks to be the better strategy.

Resistance:28500, 28750, 29000, 29250

Support:27500, 27000, 26500, 26000