Nick Goold

Market holidays can present unique challenges for forex traders, often resulting in reduced liquidity and limited trading activity. However, these periods can also offer valuable opportunities for those who adopt the right strategies. This article will explore effective forex trading strategies to navigate market holidays, capitalize on potential price movements, and maximize off-peak trading times.

Understanding Market Holidays

Market holidays occur when financial institutions and major trading centers close for a specific period. During market holidays, trading volumes tend to be significantly lower, resulting in reduced liquidity and potentially increased volatility in certain situations.

London holidays impact the forex market most as it is the biggest market, and there will likely be lower activity during Asian and United States trading sessions. In addition, holidays in Japan and the United States reduce activity in all forex pairs during that timezone but have a limited impact on the London market.

Forex Trading Strategies for Market Holidays

Focus on Major News Events: While trading volumes may be lower during market holidays, news events could trigger significant price movements. Keep an eye on economic releases, central bank announcements, and geopolitical news that can impact the currency markets. A news event on a market holiday will likely result in a larger-than-usual move and a reversal once more traders return to the market during or after the holiday.

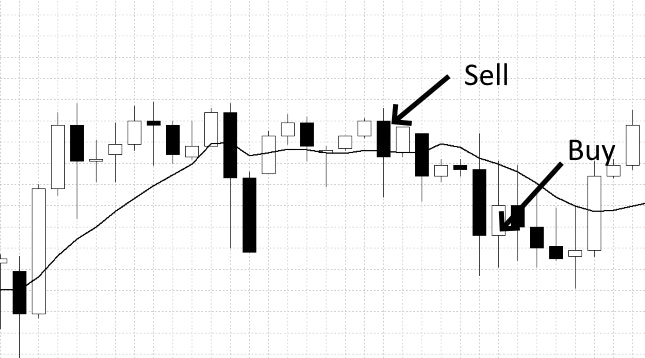

Range Trading: During market holidays, currency pairs may often trade within tight ranges due to reduced participation. Range trading strategies involve identifying support and resistance levels and entering trades when the price bounces off these levels.

One of my favorite strategies is to trade a false break of support or resistance. You wait for the market to fall below support, and if the market recovers above support again, enter a long position and wait for other traders to buy back their short position.

In addition, traders can utilize technical indicators, such as Bollinger Bands or the Average True Range (ATR), to identify periods of low volatility and execute trades accordingly.

Breakout Trading: While range-bound trading is prevalent during market holidays, breakouts can still occur. Large traders can trigger stops above resistance or below support in quiet conditions. Breakout strategies involve entering trades when the price breaks out of a defined range or consolidative pattern. Traders can set entry orders above or below key support or resistance levels and take advantage of sudden price movements.

Scalping: Scalping is a short-term trading strategy that aims to profit from small price movements. During market holidays, traders can employ scalping techniques to capitalize on price fluctuations within the reduced liquidity environment. However, it is vital to remember that large movements are still possible on a market holiday, and stop-loss orders are essential when using a scalping strategy.

Trade Lower Timeframes: During market holidays, lower timeframes, such as the 5-minute or 1-minute charts, may provide more frequent trading opportunities. Traders can utilize shorter timeframes to identify smaller price movements and execute quick trades. However, it's crucial to adapt risk management strategies accordingly, as smaller timeframes can be more susceptible to noise and false signals.

Plan for Longer-Term Positions: Market holidays can also be an opportune time to assess longer-term trading positions. Use these periods to conduct a thorough analysis, evaluate the fundamentals, and refine trading strategies for when the market returns to normal activity. Prepare a watchlist of currency pairs that may present favorable trading opportunities in the days or weeks following the holiday period. If the market moves significantly without any market news, it might be an excellent opportunity to enter a long-term trade.

Important Considerations

Reduced Liquidity and Slippage: Knowing the potential for reduced liquidity and increased slippage during market holidays is crucial. These factors can impact trade execution and order fills. Reducing your position sizes could be helpful, and consider using limit orders to mitigate the impact of slippage.

Timezone Awareness: Market holidays can vary depending on the country and timezone. While the forex market is open 24 hours a day on most holidays, major holidays like Christmas and New Year can lead to market closures. This knowledge helps traders plan their trading activities, avoid unnecessary trades during closed markets, and take advantage of overlapping trading sessions in other regions.

Risk Management: Risk management is always crucial in forex trading but becomes even more critical during market holidays. With reduced liquidity and potentially increased volatility, the risk of unexpected price movements or gaps in the market is higher. Implement strict stop-loss orders and consider widening their parameters to account for potential volatility. Additionally, avoid overexposure by limiting the number of open positions and reducing position sizes during these periods.

Stay Informed: Keep a close eye on economic calendars and stay updated on any potential market-moving events or announcements during market holidays. While trading activity may be lower, unexpected news can still significantly impact the markets. So stay informed and adjust your trading strategies accordingly.

Practice Patience: Market holidays often bring a slower pace of trading, and it's important to practice patience. Avoid the temptation to force trades or chase small price movements. Instead, wait for high-probability setups that align with your trading strategy before entering the market. Remember, quality trades are more important than quantity, especially during periods of reduced liquidity.

Conclusion

Market holidays may present challenges for forex traders due to reduced liquidity and limited trading activity. However, traders can still find profitable opportunities by employing the right strategies and adapting to the unique characteristics of these periods. Whether focusing on major news events, employing range trading or breakout strategies, or exploring cross-currency pairs, traders can make the most of off-peak times.

It's important to remain cautious, adapt risk management strategies, and stay informed about market closures and timezone differences. Additionally, utilizing lower timeframes, planning for longer-term positions, and practicing patience are vital factors to consider during market holidays.