Aayush Jindal

Recap and outlook

The US Dollar performed well in October 2017 as it outpaced other major currencies such as the Euro, British Pound, and the Japanese Yen. Going forward, the EUR/USD pair might continue to decline, GBP/USD is likely to test an important support at 1.3000 and USD/JPY could attempt a major upside break above 115.00.- ECB’s dovish stance weighed a lot on the Euro and pushed the EUR/USD pair below 1.1700

- Problems and delays in Brexit negotiations continue to weigh on the GBP/USD pair as it approaches a major support at 1.3000

- USD/JPY remains elevated and looks poised to break an important swing area near 115.00

US Dollar

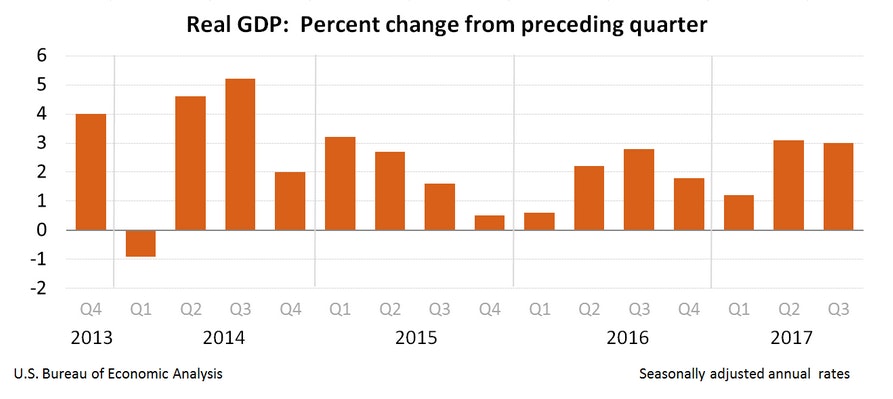

The US Dollar gained heavily this past month and might continue to move higher. A few disappointing economic releases in the US failed to ignite any major downside reaction. The main positive outcome was the US GDP, which posted a rise of 3% in Q3 2017 (Prelim).Looking back at fundamentals

- September 2017 nonfarm payrolls, released by the US Department of Labor posted a

decline of 33K whereas the market was looking for a rise of 90K. The last reading was revised up from 156K to 169K

decline of 33K whereas the market was looking for a rise of 90K. The last reading was revised up from 156K to 169K - The US unemployment rate posted a

decline from 4.4% to 4.2% in September 2017

decline from 4.4% to 4.2% in September 2017 - The US Consumer Price Index in September 2017 posted an

increase of 2.2%, which was more than the last 1.9% (YoY)

increase of 2.2%, which was more than the last 1.9% (YoY) - The Gross Domestic Product Annualized reading for Q3 2017, released by the US Bureau of Economic Analysis posted a

growth of 3%, which was more than the forecast of 2.5%

growth of 3%, which was more than the forecast of 2.5%

Looking at the upcoming releases in the US during November, the first major event would be Oct 2017 nonfarm payrolls figure. The forecast is slated for a solid rise of 300K in jobs, compared with the last decline of 33K. If the outcome is more than 200K, it would benefit the US Dollar and likely to keep it on track for more gains in the near term. The next event would be the CPI (Oct 2017) on November 15, 2017. If the CPI reading stays above the 2%, it would mean a stable bias.

Looking at the upcoming releases in the US during November, the first major event would be Oct 2017 nonfarm payrolls figure. The forecast is slated for a solid rise of 300K in jobs, compared with the last decline of 33K. If the outcome is more than 200K, it would benefit the US Dollar and likely to keep it on track for more gains in the near term. The next event would be the CPI (Oct 2017) on November 15, 2017. If the CPI reading stays above the 2%, it would mean a stable bias.Gold price back in bearish zone?

Gold traded towards $1300-1310 during mid-October but failed to remain in the bullish zone. It declined and tested the 61.8% fib retracement level of the last wave from the $1204 low to $1357 high. It seems like there is a contracting triangle forming with support near $1260 and resistance at $1295. A break on the either side would open the doors for more the next move.On the downside, the next important support below $1260 sits near the 200-day simple moving average (green). On the upside, a close above $1300 on the daily timeframe could ignite a bullish wave towards $1350.

It seems like there is a contracting triangle forming with support near $1260 and resistance at $1295. A break on the either side would open the doors for more the next move.On the downside, the next important support below $1260 sits near the 200-day simple moving average (green). On the upside, a close above $1300 on the daily timeframe could ignite a bullish wave towards $1350.Japanese Yen

The Japanese Yen remained under pressure in October 2017 and declined mainly against the US Dollar. The USD/JPY pair performed well and settled above the 112.00 handle.Looking back at fundamentals

- The Nikkei Manufacturing PMI in Sep 2017 posted a

rise from 52.6 to 52.9

rise from 52.6 to 52.9 - Japan’s Adjusted Merchandise Trade Balance in Sep 2017, released by the Ministry of Finance registered a

trade surplus of ¥240.3B, less than the forecast of ¥317.9B

trade surplus of ¥240.3B, less than the forecast of ¥317.9B - Japan’s National Consumer Price Index in Sep 2017 (YoY), released by the Statistics Bureau increased 0.7%, just as the market expected

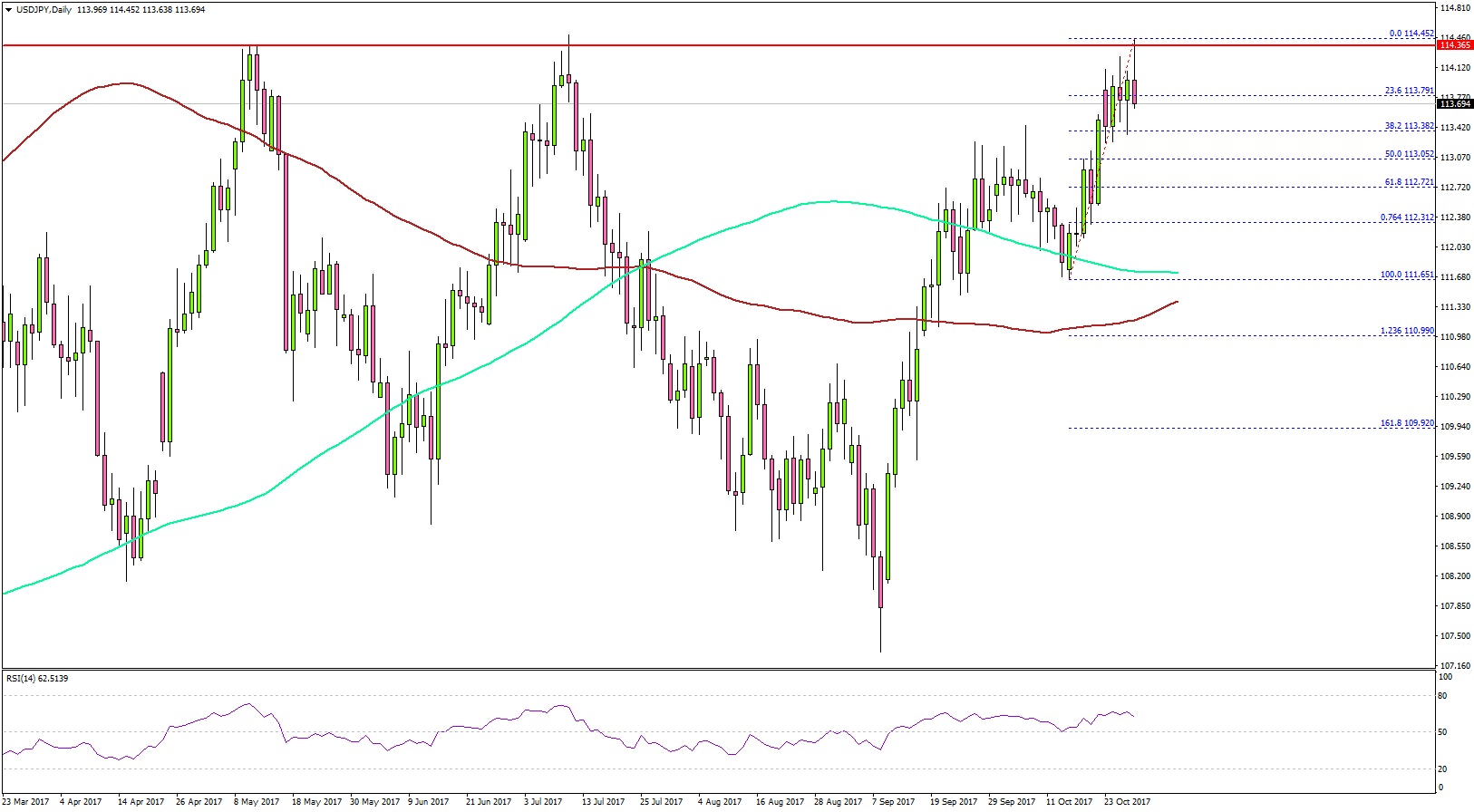

USD/JPY forming triple top?

The USD/JPY pair gained a lot of traction this past month and moved above the 112.50 resistance area. However, the pair is now approaching a monster resistance area at 114.50-115.00. The mentioned 114.50-115.00 acted as a major hurdle for buyers on two occasions earlier, and it seems like the pair is struggling for the third time. Looking at the daily chart, the pair is preparing for the third rejection near 114.50.Should there be a triple top formation in USD/JPY at 114.50-115.00, there could be nasty declines during the coming weeks. The main support on the downside is at 112.00-112.50. On the other hand, a successful close above 115.00 might ignite further gains. The next major hurdle for buyers should be near $118.00. Above 118.00, the 120.00 handle could play an important role.EUR/JPY and GBP/JPY - both other major Japanese Yen pairs are showing signs of a short-term top on the daily chart. Once there is a start of a decline in USD/JPY, both EUR/JPY and GBP/JPY might follow.Important supports for EUR/JPY are 129.00 and 128.00, and resistances are at 134.50 and 135.00. GBP/JPY has a strong buy zone near 147.50 and then at 146.00. On the upside, sellers are seen at 152.00 and 153.00.

The mentioned 114.50-115.00 acted as a major hurdle for buyers on two occasions earlier, and it seems like the pair is struggling for the third time. Looking at the daily chart, the pair is preparing for the third rejection near 114.50.Should there be a triple top formation in USD/JPY at 114.50-115.00, there could be nasty declines during the coming weeks. The main support on the downside is at 112.00-112.50. On the other hand, a successful close above 115.00 might ignite further gains. The next major hurdle for buyers should be near $118.00. Above 118.00, the 120.00 handle could play an important role.EUR/JPY and GBP/JPY - both other major Japanese Yen pairs are showing signs of a short-term top on the daily chart. Once there is a start of a decline in USD/JPY, both EUR/JPY and GBP/JPY might follow.Important supports for EUR/JPY are 129.00 and 128.00, and resistances are at 134.50 and 135.00. GBP/JPY has a strong buy zone near 147.50 and then at 146.00. On the upside, sellers are seen at 152.00 and 153.00.Euro

It was mostly a bearish period for the Euro and this past week’s ECB’s decision plus the central bank’s dovish stance pushed the EUR/USD pair down. The central bank mentioned that they will be halving the QE program to 30€ billion.Looking back at fundamentals

- Euro Zone’s Manufacturing Purchasing Managers Index (PMI) in Sep 2017

declined from 58.2 to 58.1

declined from 58.2 to 58.1 - ECB maintained the interest rates at -0.4% with dovish stance

- Germany’s consumer price index increased 1.8% (YoY) in Sep 2017, just as the market expected

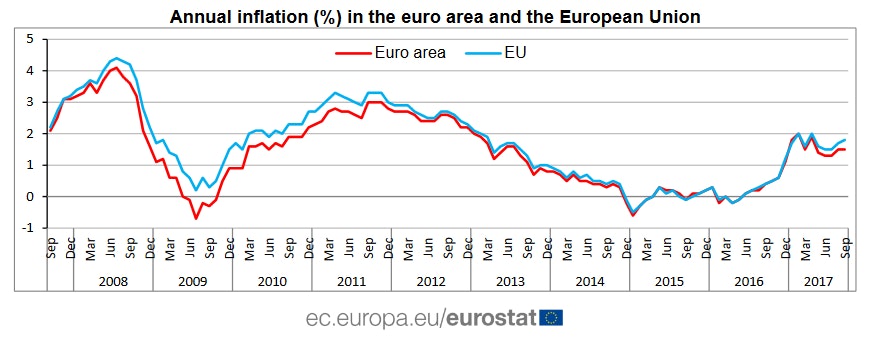

- Euro Area’s consumer price index increased 1.5% (YoY) in Sep 2017, just as the market expected

- Euro Area’s Industrial Production in August 2017

rose 3.8% (YoY), more than the +1.5% forecast

rose 3.8% (YoY), more than the +1.5% forecast - Germany’s ZEW Economic Sentiment in Oct 2017

increased from 17.0 to 17.6, but less than the forecast of 20.0

increased from 17.0 to 17.6, but less than the forecast of 20.0

It seems like the CPI in the Euro area is stable around 1.8%, but less than the ECB’s expectation. The central bank’s dovish tone might continue to weigh on the Euro, and EUR/USD’s decline will most likely extend during November 2017. The main economic releases in November 2017 would be Germany’s unemployment change of Oct 2017 (-11K forecast vs -23K previous), Euro Area’s CPI (forecasted to remain stable near 1.8%) and finally Germany’s Oct 2017 CPI.

It seems like the CPI in the Euro area is stable around 1.8%, but less than the ECB’s expectation. The central bank’s dovish tone might continue to weigh on the Euro, and EUR/USD’s decline will most likely extend during November 2017. The main economic releases in November 2017 would be Germany’s unemployment change of Oct 2017 (-11K forecast vs -23K previous), Euro Area’s CPI (forecasted to remain stable near 1.8%) and finally Germany’s Oct 2017 CPI.EUR/USD remains bearish

The Euro failed to move above the 1.1850 resistance against the US Dollar in October 2017 and started a downside move. The EUR/USD pair traded below the 23.6% Fib retracement level of the last wave from the 1.1189 low to 1.2091 high. The pair even broke the 100-day simple moving average (red), which is a bearish sign below 1.1750. It seems like the pair might continue to move lower and could even break the 1.1500 support during the coming days.On the upside, there is a major bearish trend line with resistance at 1.1770 on the daily chart. A proper close above the 1.1770 level and the 1.1800 handle is required for the Euro buyers to gain momentum.The daily RSI is well below 50 and heading south, which is a strong bearish signal for EUR/USD below 1.1750. The main supports on the downside are 1.1500 and 1.1420.

The pair even broke the 100-day simple moving average (red), which is a bearish sign below 1.1750. It seems like the pair might continue to move lower and could even break the 1.1500 support during the coming days.On the upside, there is a major bearish trend line with resistance at 1.1770 on the daily chart. A proper close above the 1.1770 level and the 1.1800 handle is required for the Euro buyers to gain momentum.The daily RSI is well below 50 and heading south, which is a strong bearish signal for EUR/USD below 1.1750. The main supports on the downside are 1.1500 and 1.1420.British Pound

Hardships in Brexit negotiations continue to weigh on the British Pound. Moreover, the positive sentiment around the US Dollar ignited sharp declines in GBP/USD.Looking back at fundamentals

- UK’s Consumer Price Index in Sep 2017 (YoY), released by the National Statistics

increased 3%, in line with the forecast, but more than the last 2.9%

increased 3%, in line with the forecast, but more than the last 2.9% - The Retail Sales in the UK

grew 1.2% (YoY) in Sep 2017, less than the forecast of +2.1%

grew 1.2% (YoY) in Sep 2017, less than the forecast of +2.1% - The preliminary Gross Domestic Product in the UK for Q3 2017

posted +1.5%, more than the forecast of +1.4% and similar to the last +1.5%

posted +1.5%, more than the forecast of +1.4% and similar to the last +1.5%

- UK’s Consumer Price Index in Sep 2017 (YoY), released by the National Statistics

BOE’s interest rate decision on Nov 3rd 2017 could have a huge impact on the British Pound and GBP/USD since the central bank is forecasted to increase the interest rates from 0.25% to 0.50%.

BOE’s interest rate decision on Nov 3rd 2017 could have a huge impact on the British Pound and GBP/USD since the central bank is forecasted to increase the interest rates from 0.25% to 0.50%.GBP/USD approaching crucial support

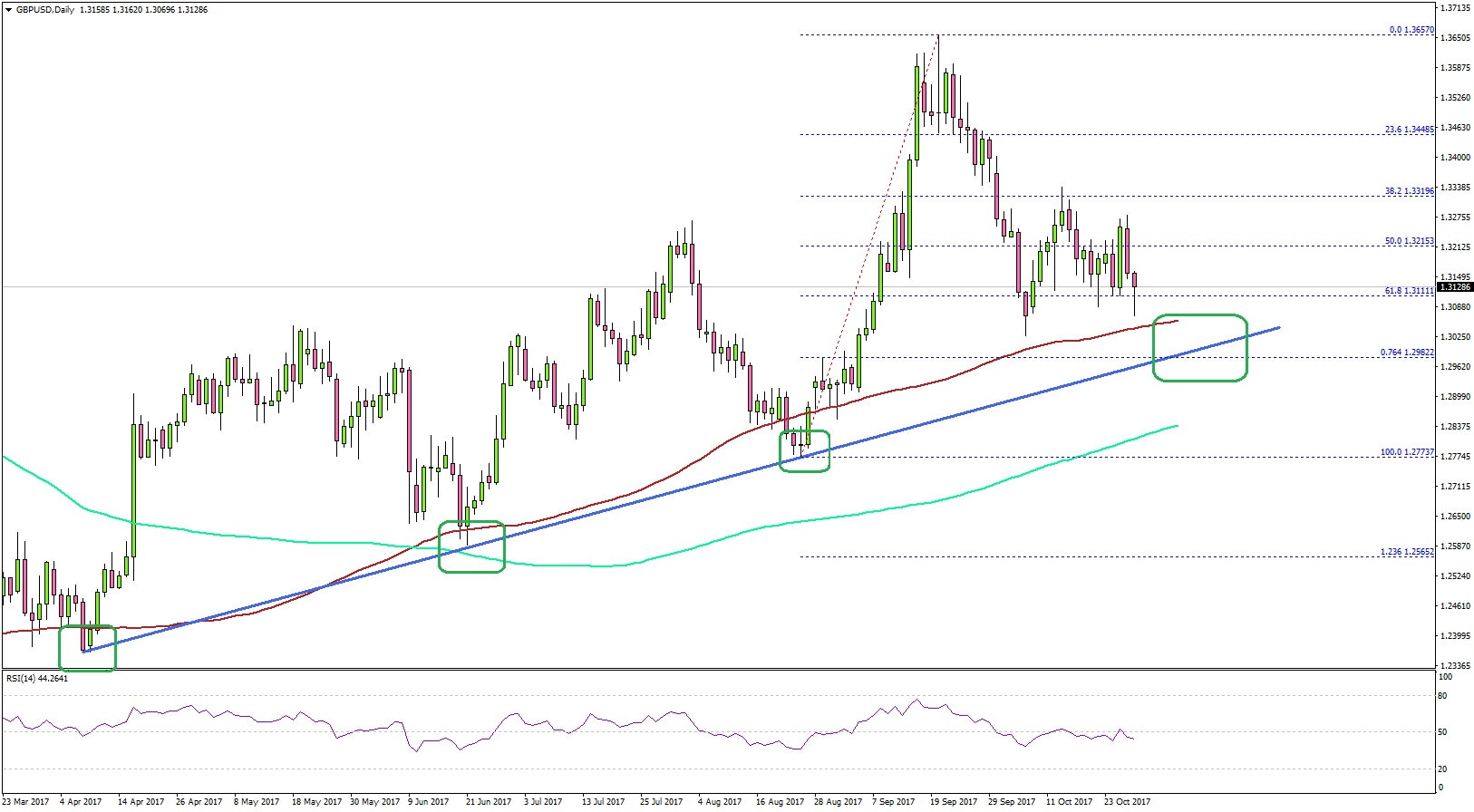

There was a steady decline in GBP/USD during the past few days. The pair attempted a break of the 1.3300 resistance this past week, but buyers failed to place the pair above 1.3300.As a result, there was a downside reaction below 1.3200. The pair declined and is currently trading near the 61.8% Fib retracement level of the last wave from the 1.2773 low to 1.3657 high. On the downside, an initial support is close to the 100-day simple moving average (red) at 1.3050. However, the most important support is near 1.3000 and a monster bullish trend line on the daily chart.The pair is likely to find strong bids near the 1.3000 handle. Should there be a rejection in GBP/USD near 1.3000, the pair could bounce back towards 1.3200 or even 1.3300. On the other hand, a break and close below 1.3000 would ignite further declines toward 1.2800.

On the downside, an initial support is close to the 100-day simple moving average (red) at 1.3050. However, the most important support is near 1.3000 and a monster bullish trend line on the daily chart.The pair is likely to find strong bids near the 1.3000 handle. Should there be a rejection in GBP/USD near 1.3000, the pair could bounce back towards 1.3200 or even 1.3300. On the other hand, a break and close below 1.3000 would ignite further declines toward 1.2800.Summary

Overall, the next few days are very important for the USD/JPY pair. It will either break 115.00 or start a bearish wave.

The EUR/USD pair is back in the bearish zone and downsides might extend towards 1.1400 if sellers remain in control over the next 2-3 weeks.

Finally, the GBP/USD pair must hold the 1.3000 support since it is very important for the long-term trend.