Aayush Jindal

Key Highlights

- GBP/JPY started a fresh increase from the 133.03 low.

- It broke a key bearish trend line with resistance near 135.00 on the 4-hours chart.

- The UK GDP is likely to contract 20.4% in Q2 2020 (QoQ).

- The US ADP Employment could increase 648K in Sep 2020, up from the last 428K.

GBP/JPY Technical Analysis

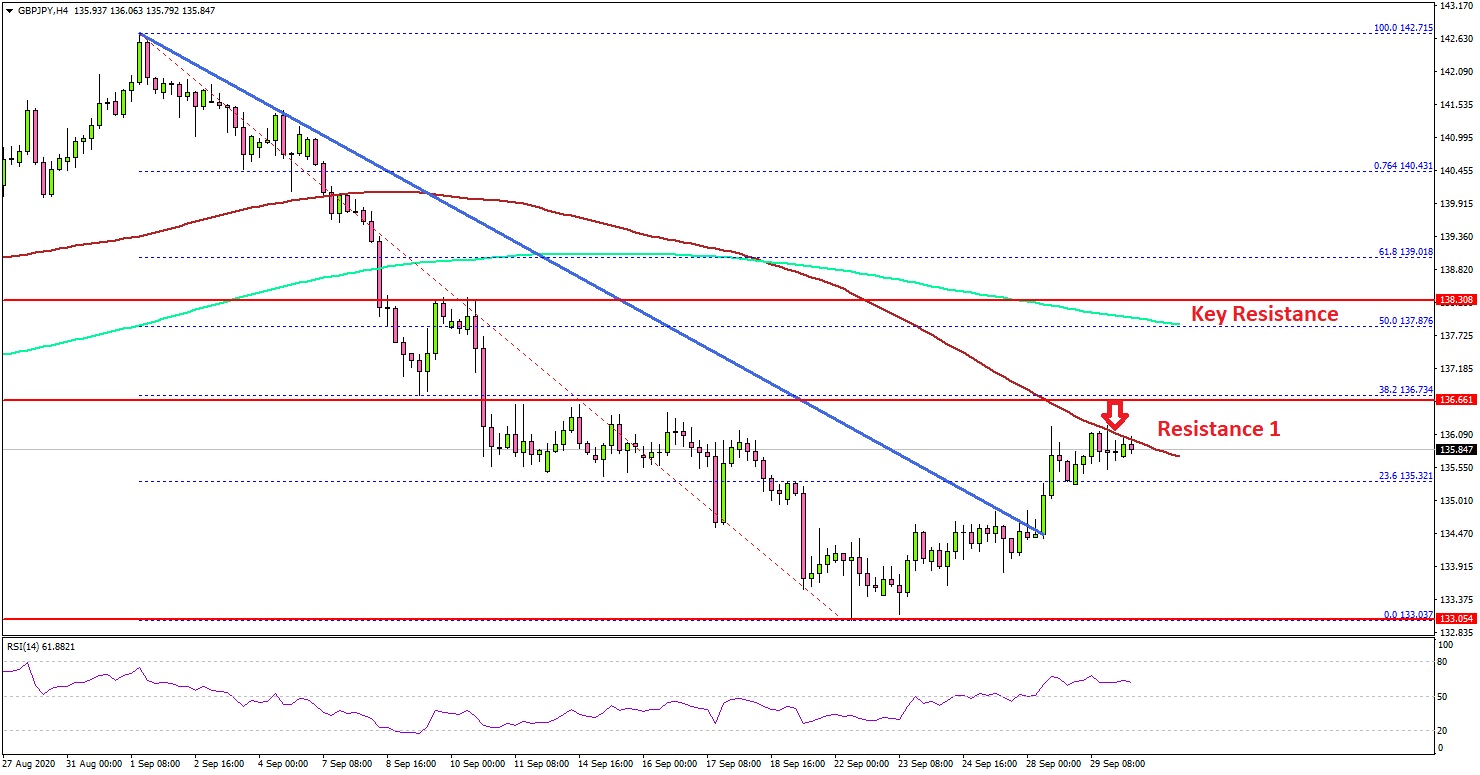

This past week, the British Pound traded to a new monthly low at 133.03 against the Japanese Yen. A support base was formed above 133.00 and GBP/JPY started a decent recovery wave.

Looking at the 4-hours chart, the pair recovered above the 133.50 and 134.00 levels. There was a break above a key bearish trend line with resistance near 135.00, opening the doors for a fresh recovery.

Recently, there was a break above the 23.6% Fib retracement level of the downward move from the 142.71 high to 133.03 low. However, the pair is now approaching a few important hurdles, starting with 136.00 and the 100 simple moving average (red, 4-hours).

The next resistance is near the 136.75 level (a multi-touch zone). The main resistance is near the 137.85 level and the 200 simple moving average (green, 4-hours). It is close to the 50% Fib retracement level of the downward move from the 142.71 high to 133.03 low.

If the pair struggles to continue higher above 136.00 or 136.75, there is a risk of a fresh decline. An initial support on the downside is near the 135.00 level, below which the pair could decline towards the 134.20 support or even 133.50.

Looking at GBP/USD, the pair is still facing a strong resistance near the 1.3000 level. Besides, EUR/USD is showing early signs of a decent recovery above the 1.1700 resistance.

Upcoming Economic Releases

- UK GDP Q2 2020 (QoQ) - Forecast -20.4%, versus -20.4% previous.

- US Pending Home Sales for August 2020 (MoM) - Forecast +3.2%, versus +5.9% previous.

- US ADP Employment Change for Sep 2020 - Forecast 648K, versus 428K previous.