Aayush Jindal

Key Highlights

- GBP/USD started a fresh increase from the 1.2250 support area.

- The pair breached a key bearish trend line with resistance near 1.2360 on the 4-hours chart.

- There is a cluster of hurdles near the 1.2480 and 1.2500 levels.

- The US Wholesale Inventories could decline 0.1% in March 2020 (Prelim).

GBP/USD Technical Analysis

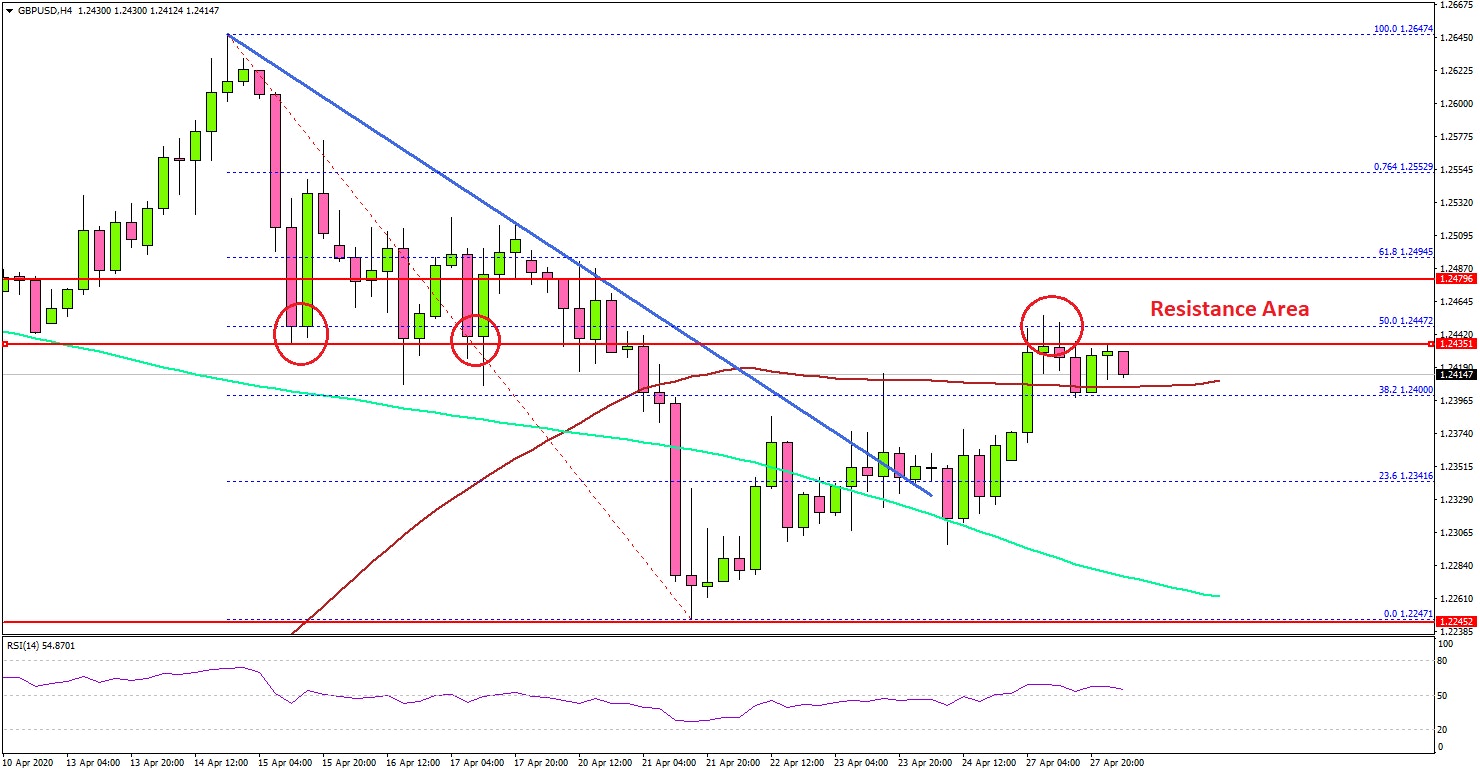

This past week, the British Pound declined sharply below the 1.2450 support against the US Dollar. GBP/USD traded towards the 1.2250 support before starting a fresh increase.

Looking at the 4-hours chart, the pair traded as low as 1.2247 and started a decent upward move. Initially, there was a break above the 1.2320 resistance and the 200 simple moving average (green, 4-hours).

Later, the pair breached a key bearish trend line with resistance near 1.2360. It opened the doors for more gains above the 1.2400 resistance level and the 100 simple moving average (red, 4-hours).

The pair tested the 50% Fib retracement level of the downward move from the 1.2647 high to 1.2247 low. On the upside, there is a cluster of hurdles near the 1.2480 and 1.2500 levels.

The 61.8% Fib retracement level of the downward move from the 1.2647 high to 1.2247 low is also near the 1.2494. Therefore, a clear break above the 1.2480-1.2500 zone is must for upside continuation.

The next key resistance is near the 1.2550, above which GBP/USD could rise towards 1.2620. Conversely, the pair might fail to continue above 1.2500 and it could start a fresh decline towards the 1.2320 and 1.2250 support levels.

Looking at EUR/USD, the pair remained well bid above the 1.0800 level, but struggling below 1.0880. More importantly, AUD/USD is gaining momentum and it surpassed the key 0.6450 resistance area.

Upcoming Economic Releases

- US Wholesale Inventories for March 2020 (preliminary) – Forecast -0.1%, versus -0.7% previous.

- S&P/Case-Shiller Home Price Indices for Feb 2020 (YoY) - Forecast +3.3%, versus +3.1% previous.