Aayush Jindal

Key Highlights

- GBP/USD is facing a strong resistance near 1.3500.

- A key bearish trend line is forming with resistance near 1.3480 on the 4-hours chart.

- EUR/USD is declining, and it even broke the 1.1280 support zone.

- The US Manufacturing PMI could increase from 58.4 to 59.0 in Nov 2021 (Preliminary).

GBP/USD Technical Analysis

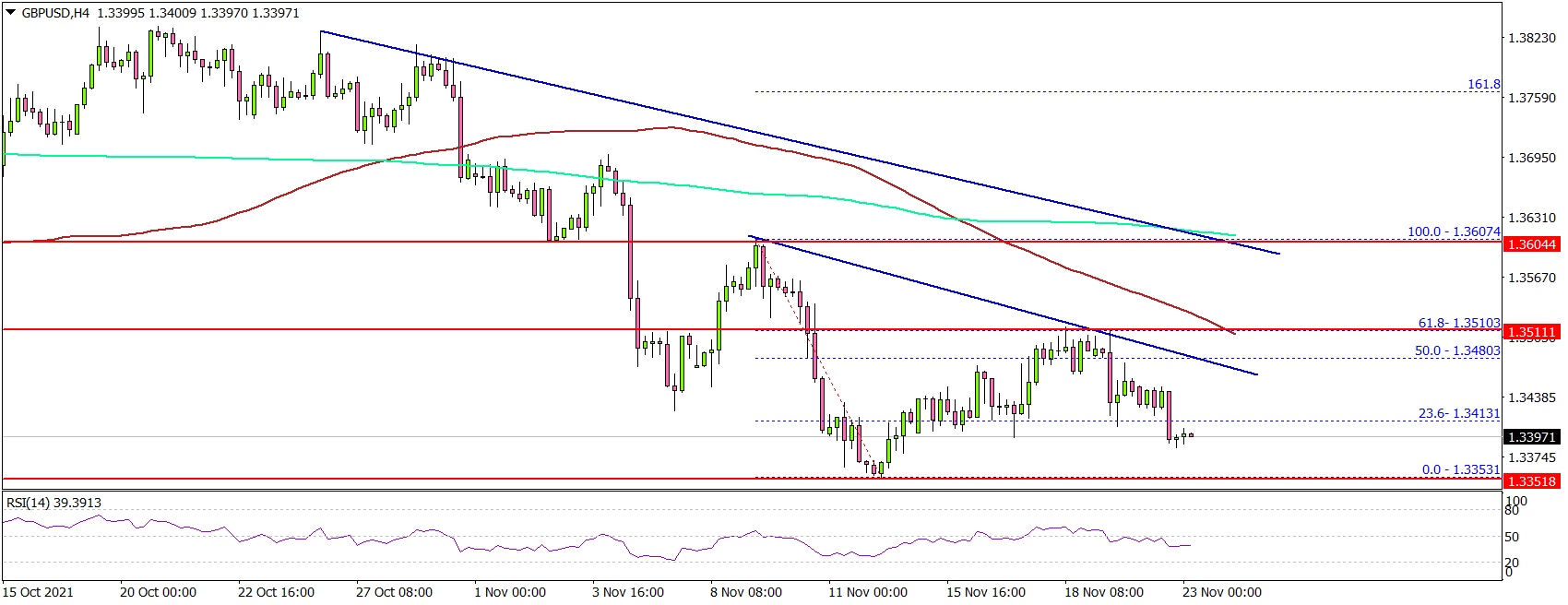

The British Pound traded as low as 1.3351 before starting an upside correction against the US Dollar. However, GBP/USD struggled to gain pace above 1.3500.

Looking at the 4-hours chart, the pair surpassed the 50% Fib retracement level of the recent decline from the 1.3607 swing high to 1.3351 low. The bears appeared near the 1.3500 zone, and the pair stayed well below the 100 simple moving average (red, 4-hours) and the 200 simple moving average (green, 4-hours).

The pair failed to clear the 61.8% Fib retracement level of the recent decline from the 1.3607 swing high to 1.3351 low. There is also a key bearish trend line forming with resistance near 1.3480 on the same chart.

A clear break above the 1.3480 and 1.3500 resistance levels could open the doors for more gains. The next key resistance could be 1.3600.

On the downside, an initial support is near the 1.3350 level. A downside break below 1.3350 may perhaps open the doors for a move towards 1.3300. The next major support sits at 1.3250, below which the pair could dive to 1.3200.

Besides, EUR/USD is facing an increase in selling pressure and it could continue to move down towards the 1.1200 support zone.

Economic Releases

- Germany’s Manufacturing PMI for Nov 2021 (Preliminary) - Forecast 56.7, versus 57.8 previous.

- Germany’s Services PMI for Nov 2021 (Preliminary) - Forecast 51.5, versus 52.4 previous.

- Euro Zone Manufacturing PMI for Nov 2021 (Preliminary) – Forecast 57.2, versus 58.3 previous.

- Euro Zone Services PMI for Nov 2021 (Preliminary) – Forecast 53.6, versus 54.6 previous.

- UK Manufacturing PMI for Nov 2021 (Preliminary) – Forecast 56.7, versus 57.8 previous.

- UK Services PMI for Nov 2021 (Preliminary) – Forecast 58.5, versus 59.1 previous.

- US Manufacturing PMI for Nov 2021 (Preliminary) – Forecast 59.0, versus 58.4 previous.

- US Services PMI for Nov 2021 (Preliminary) – Forecast 59.1, versus 58.7 previous.