Aayush Jindal

Key Highlights

- GBP/USD is holding a crucial support near the 1.2850 level.

- An important bearish trend line is forming with resistance near 1.2960 on the 4-hours chart.

- The UK Manufacturing PMI increased from 54.4 to 54.58 in Oct 2020.

- The US Factory Orders (to be released today) could rise 1% in Sep 2020 (MoM).

GBP/USD Technical Analysis

This past week, the British Pound declined heavily from well above the 1.3000 support against the US Dollar. GBP/USD is now holding a crucial support near the 1.2850 level and it could correct higher.

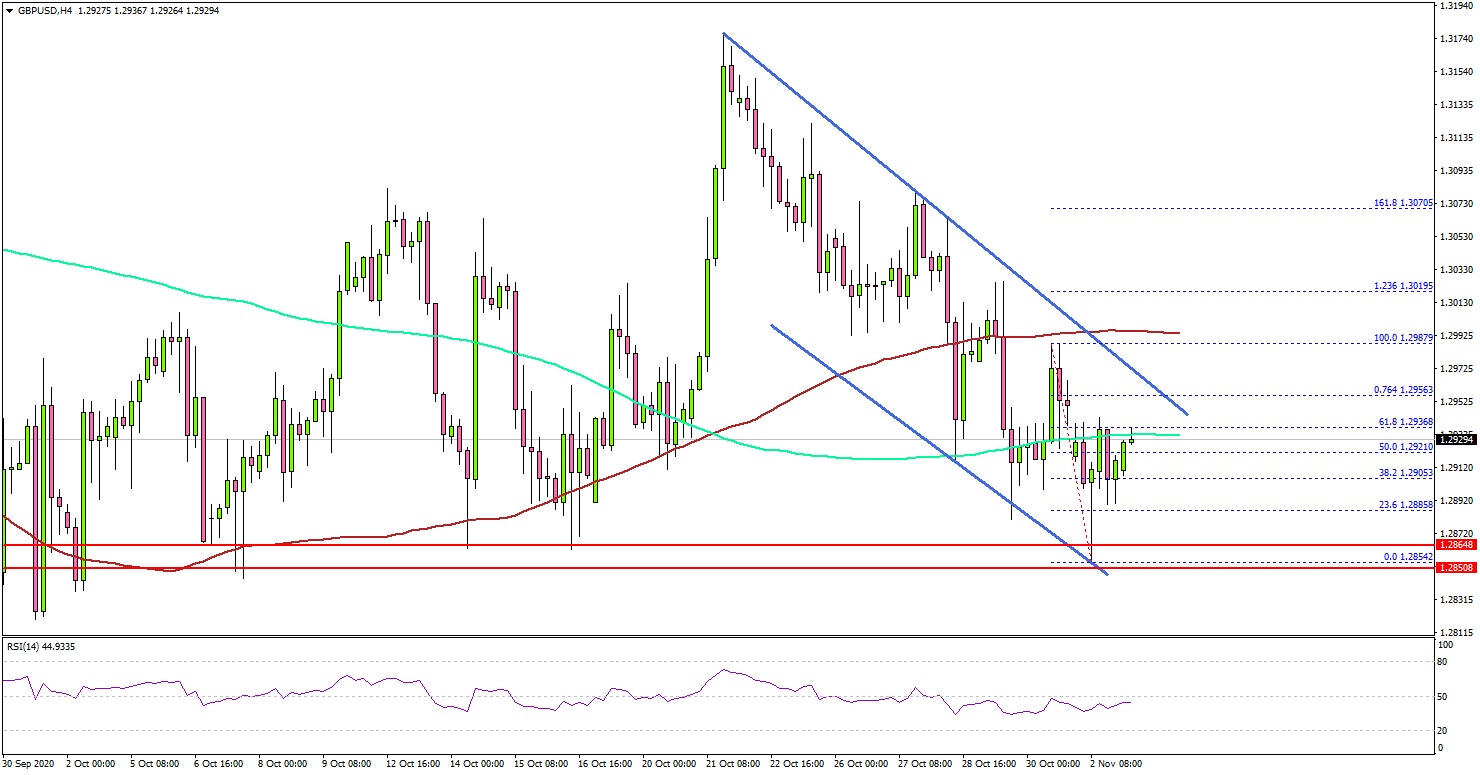

Looking at the 4-hours chart, the pair followed a strong bearish path from the 1.3175 zone and declined below many key supports. There was also a close below the 1.3000 support, the 100 simple moving average (red, 4-hours), and the 200 simple moving average (green, 4-hours).

Finally, the bulls were able to defend the main 1.2850 support zone (a multi-touch zone). A low is formed near 1.2854 and the pair is consolidating losses.

On the upside, there is a major hurdle forming near the 1.2950 level. There is also an important bearish trend line forming with resistance near 1.2960 on the same chart.

A successful break above the 1.2960 resistance and then a follow up move above the 1.3000 level could open the doors for a fresh increase. Conversely, a failure to clear 1.2960 or 1.3000 might spark another decline in the coming sessions.

Fundamentally, the UK Manufacturing PMI for Oct 2020 was released yesterday by both the Chartered Institute of Purchasing & Supply and Markit Economics. The market was looking for no change from 53.3 (prelim reading).

The actual result was above the market forecast, as the UK Manufacturing PMI increased from 53.3 to 53.7 in Oct 2020 (down from 54.1 in September but above the earlier flash estimate of 53.3).

The report added that:

The recovery in the UK manufacturing sector continued at the start of the final quarter, as output and new orders rose again supported by improved demand from both domestic and overseas sources.

Overall, GBP/USD must stay above 1.2850 to start a strong increase. More importantly, there could be volatile moves in the market considering the U.S will vote today for their next president (Donald Trump, the Republican incumbent, or Joe Biden, Democratic challenger). You can check polls tracker and see who is leading in swing states.

Upcoming Economic Releases

- The U.S. Presidential Election.

- US Factory Orders Sep 2020 (MoM) - Forecast +1.0%, versus +0.7% previous.