Aayush Jindal

Key Highlights

- GBP/USD extended its rally and traded above the 1.3400 level.

- The previous resistance near 1.3250 could provide strong support in the short-term.

- The UK Manufacturing PMI could remain at 55.3 in August 2020.

- The US ISM Manufacturing Index is likely to increase from 54.2 to 54.5 in August 2020.

GBP/USD Technical Analysis

This past week, the British Pound gained bullish momentum above 1.3200 against the US Dollar. GBP/USD even broke the 1.3280 resistance and traded to a new monthly high above 1.3350.

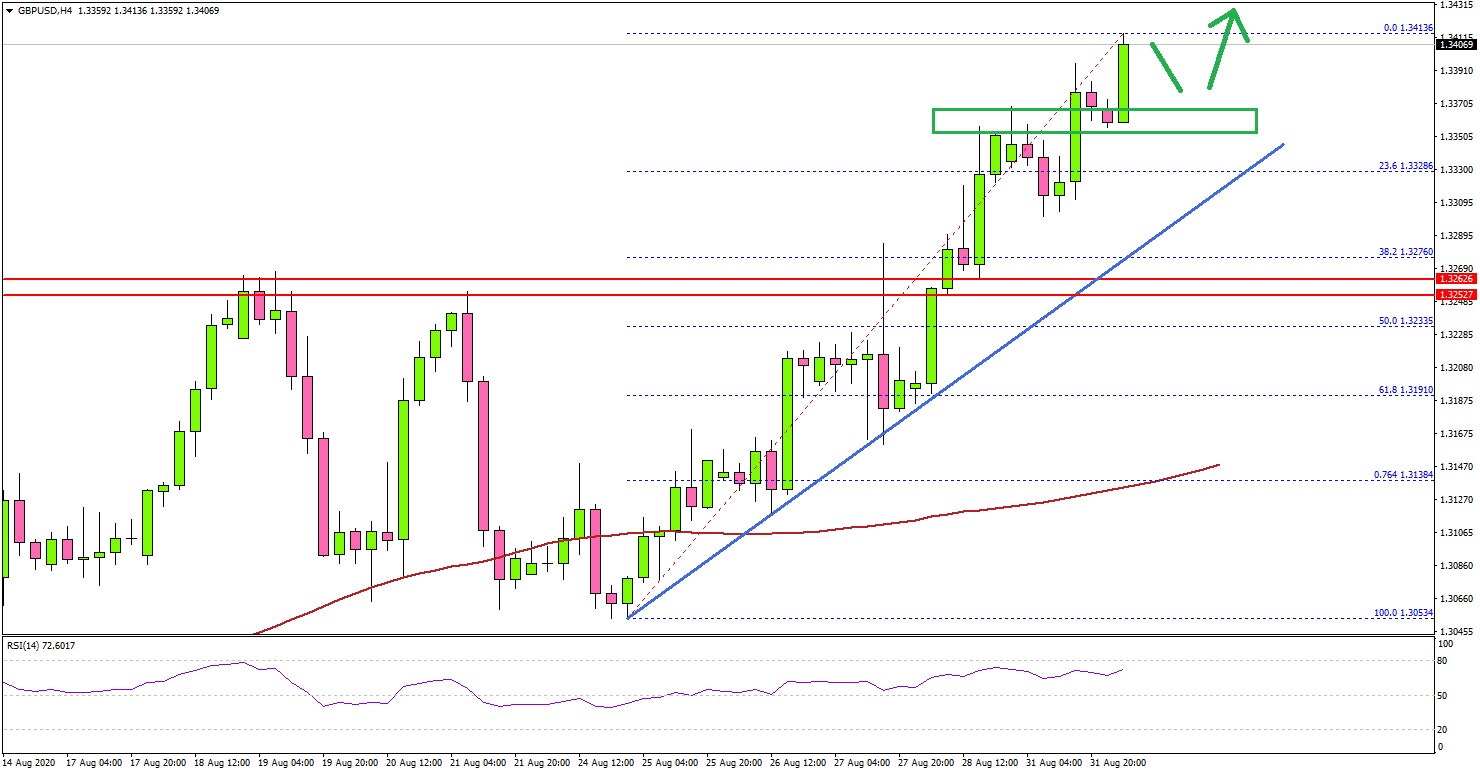

Looking at the 4-hours chart, the pair traded as high as 1.3413, and it settled well above both the 100 simple moving average (red, 4-hours) and the 200 simple moving average (green, 4-hours).

The pair is currently consolidating gains near 1.3400. An initial support is near the 23.6% Fib retracement level of the upward move from the 1.3053 low to 1.3413 high. The main support for the current wave could be near the 1.3260 and 1.3250 levels (resistance turned support).

There is also a key bullish trend line forming with support near 1.3320 on the same chart. If there is a downside break below the trend line and 1.3250, the pair might continue to move down.

Conversely, GBP/USD might continue to move up above 1.3420 and 1.3440 levels in the coming sessions. The next key resistance is near the 1.3500 level.

Looking at EUR/USD, the pair seems to be eyeing an upside break above the 1.1990 and 1.2000 levels.

Upcoming Economic Releases

- Euro Zone CPI for August 2020 (YoY) (Prelim) - Forecast +0.2%, versus +0.4% previous.

- Euro Zone Core CPI for August 2020 (YoY) (Prelim) - Forecast +0.9%, versus +1.2% previous.

- Germany’s Manufacturing PMI for August 2020 - Forecast 53.0, versus 53.0 previous.

- Euro Zone Manufacturing PMI August 2020 – Forecast 51.7, versus 51.7 previous.

- UK Manufacturing PMI for August 2020 – Forecast 55.3, versus 55.3 previous.

- US Manufacturing PMI for August 2020 – Forecast 53.6, versus 53.6 previous.

- US ISM Manufacturing Index for August 2020 – Forecast 54.5, versus 54.2 previous.