Nick Goold

Gold

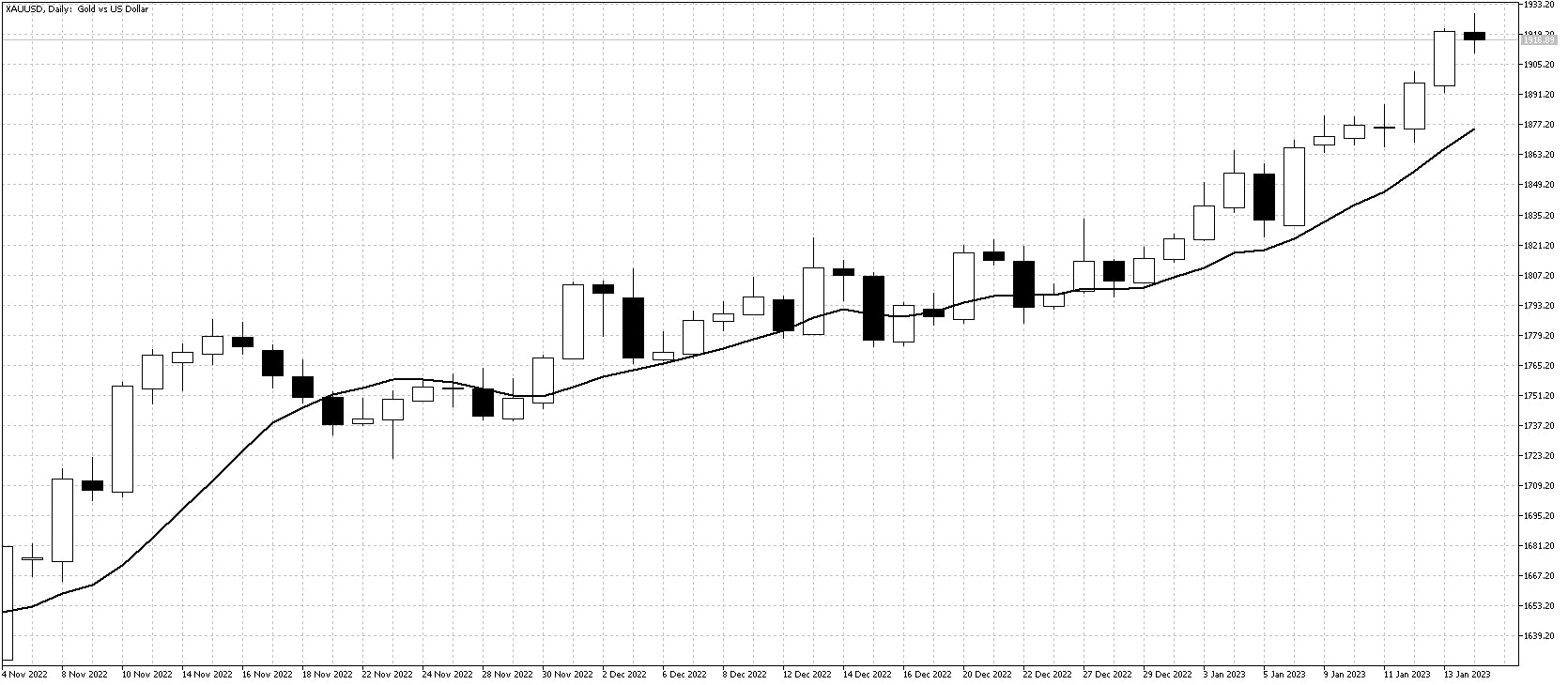

Gold's strong rise continued last week as weakness in the US dollar pushed prices higher. In addition, increasing concerns about the US government's debt levels make Gold a popular investment.

Gold can experience strong trends, so while the market is overbought at the moment, it is difficult to sell the moment. However, short-term traders could find profitable trading opportunities by selling at the start of the week. In contrast, swing traders are better off waiting until the market returns closer to the moving average to buy the market.

Movements in the US dollar will remain the focus for Gold traders as lower 10-year US interest rates are favorable for Gold. The most important economic announcement of the week is Wednesday's US retail sales release, where the expected figure is negative.

Resistance: 1950, 1980, 2000

Support: 1900, 1875, 1864, 1845, 1820, 1806, 1800

WTI

A recovery in Chinese demand for WTI helped push prices higher in the past week. Expectations of a weaker US economy remain, but increased Chinese market demand could help prices finally break the recent narrow range.

It is challenging to forecast the end of a trading range, so should prices move above $81 this week, it could be dangerous to buy. On the other hand, should prices push above resistance, it might be better to wait for a retracement and buy closer to the 10-day moving average.

Resistance: 81.50, 84.00, 90.00

Support: 77.00, 75.00, 70.00, 67.00, 62.30