Nick Goold

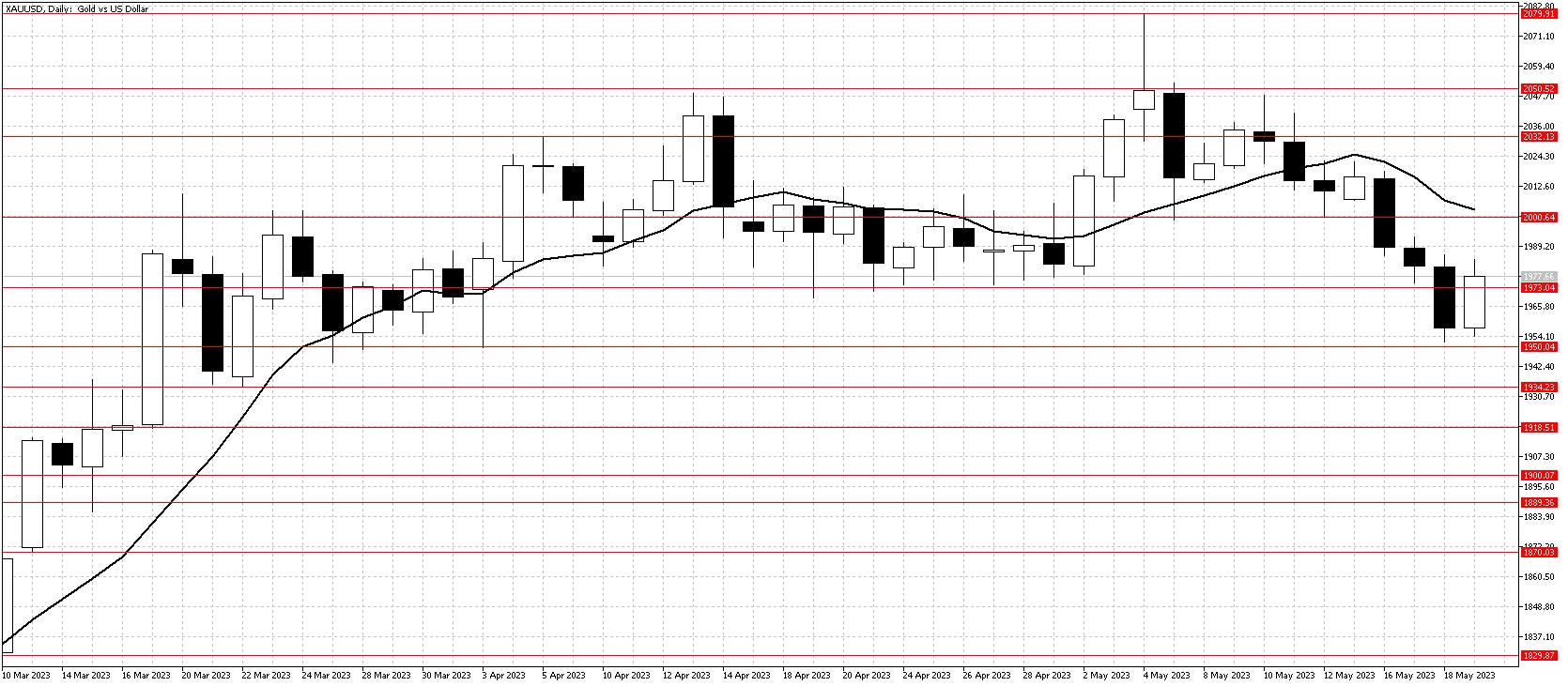

Gold

Gold broke below $2,000 as selling pressure increased as the USD strengthened last week. As usual, it was a quick and significant move when Gold broke support as traders rushed to exit their long positions. Support held at $1950 on two attempts resulting in a solid recovery to end the week.

Technical indicators like the 10-day moving average are now pointing lower, so last Friday's rise could prove short-lived. The $1973 level provided support multiple times in April, so there will be conflicting views this week on whether the uptrend is over or just a temporary setup. This week's most likely scenario is the market to trade sideways in a large range, presenting many great short-term trading opportunities.

Longer-term traders will still be hopeful that the US debt problem will continue, and if Gold could reclaim $2,000 again, then that could find the market holding too many short positions and trigger another substantial rise. Betting against Gold in the longer term remains difficult to recommend in present conditions.

Resistance: 2000, 2032, 2050, 2080

Support: 1973, 1950, 1935, 1918, 1900

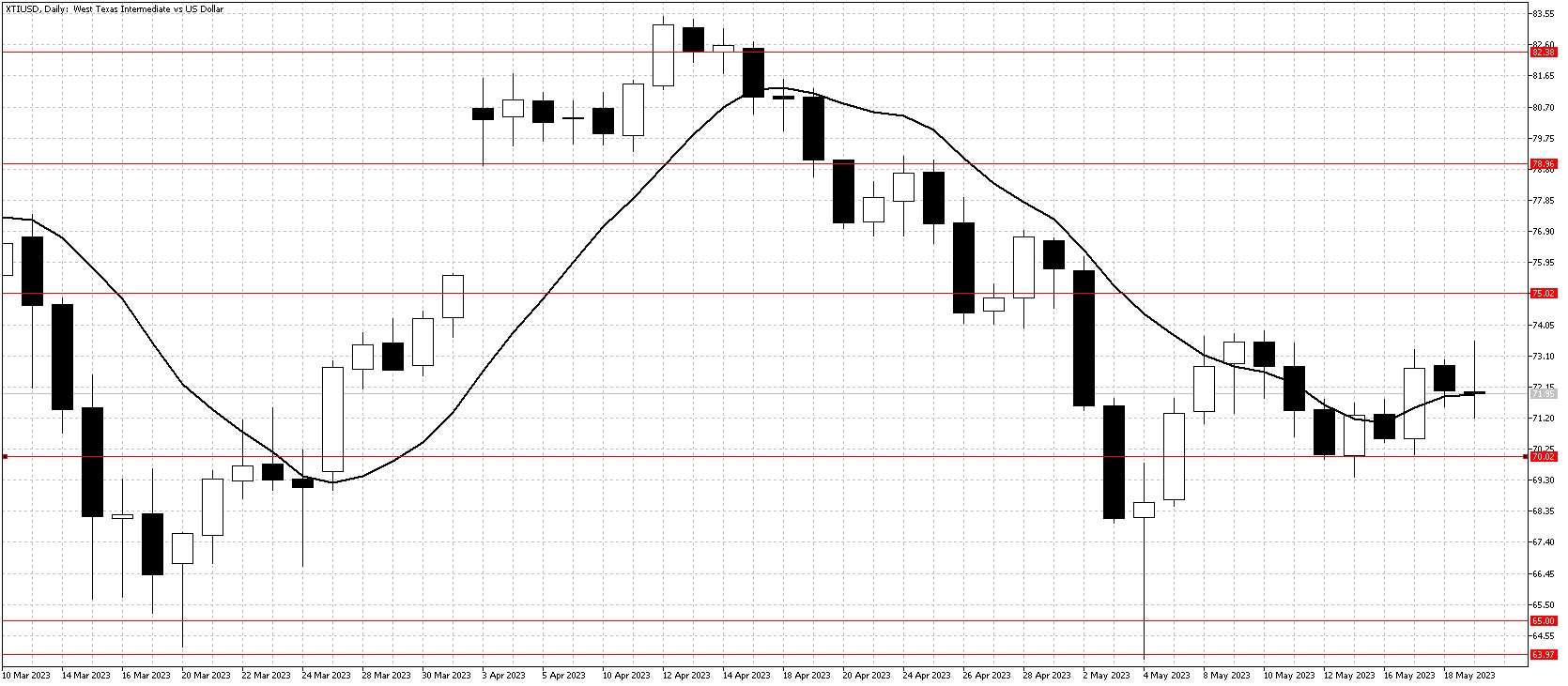

WTI

WTI enjoyed its first weekly rise since mid-April as progress in the US debt ceiling negotiations continued last week. The gains were limited, though, as a strong USD and resistance around $75.00 remains.

Other fundamental news was conflicting with the US government continuing to release Oil from their strategic reserves and economists predicting an increase in demand in summer as the US driving season starts.

In the week ahead, the market can continue the recovery and test the $75.00 resistance level. Few news releases are expected to move WTI prices in the week ahead so that technical analysis will gain importance, and the best strategy looks to range trade between $70 and $75 with a higher potential of a price rise.

Resistance: 75.00, 79.00, 82.50

Support: 70.00, 65.00, 64.00, 62.00