Nick Goold

Gold

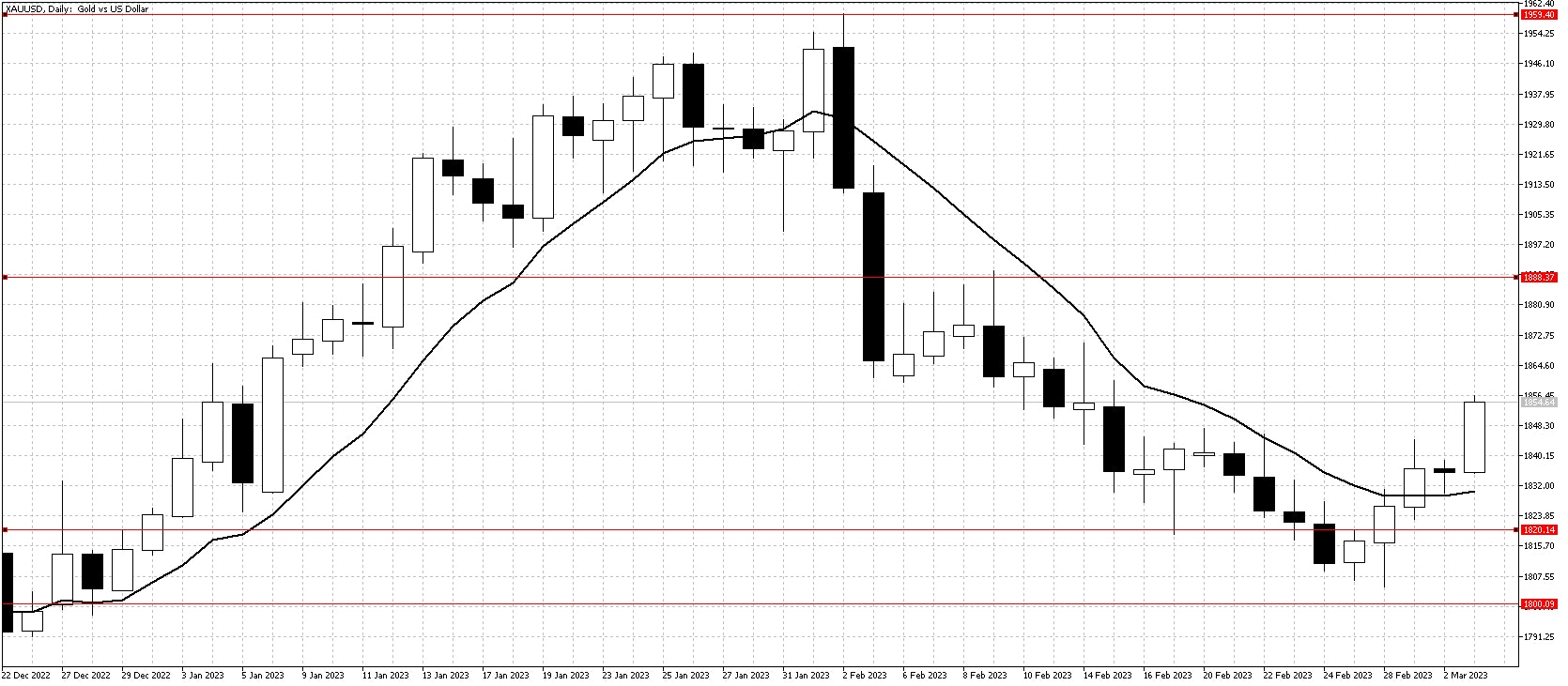

The downtrend from February finally broke last week when gold prices rose above the 10-day moving average. US 10-year interest rates falling from resistance at 4%, and the USD weakness encouraged speculators to enter the market as strong buyers. In addition, increased buying from China on the more robust economy also helped Gold prices push higher.

This week's leading event for Gold traders is the speech by Fed Chairman Powell on Tuesday and Wednesday, along with US employment figures Friday. Many analysts now predict prices have hit a short-term bottom, so any falls this week will likely see buyers support the market.

While the downtrend has ended, the technical indicators are pointing sideways, so expect a lower test at the start of the week. However, in the medium term, higher US interest rates remain, so Gold will likely struggle to move above $1,900.

Resistance: 1860, 1870, 1890, 1900

Support: 1830, 1820, 1805, 1800, 1775, 1760

WTI

WTI prices enjoyed an encouraging week buoyed by strong Chinese and US manufacturing figures. Chinese oil demand is one of the crucial measures to track for traders due to the high volatility of the Chinese economy. Chinese data has exceeded expectations, and Chinese officials are targeting growth of 6% for 2023.

Technically, WTI remains stuck in the $72.50/$82.50 range, but traders have increasing confidence in the outlook for WTI. Similar to Gold, in the short term, WTI is overbought, so buying closer to the 10-day moving average seems best. In the medium term, a break of nearby resistance at $80.50 and then $82.50 looks likely this month.

Resistance: 80.50, 82.70, 84.00, 90.00

Support: 75.00, 73.80, 72.50, 70.00, 66.00