Nick Goold

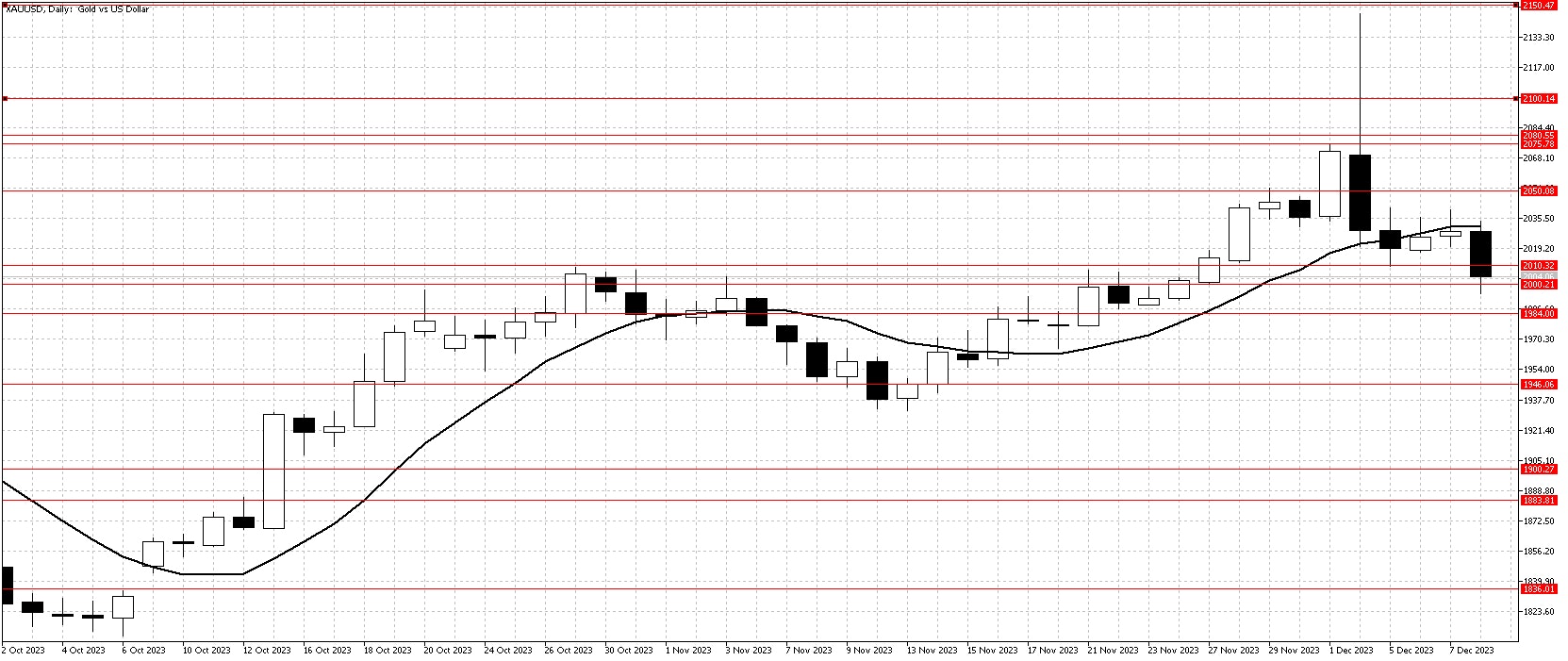

Gold

Last week, gold prices experienced dramatic fluctuations, making it a focal point in the financial markets. The week started with a sharp price spike during thin trading conditions on Monday, just before the Asian markets opened. This sudden surge was primarily driven by stop-loss buying, pushing gold prices to historic highs. However, this rally was short-lived as the market quickly reversed direction. The absence of fundamental factors supporting such a significant rise indicated that the market was overbought, leading to a swift downturn. This volatile start set the tone for the rest of the week as traders grappled with the market's unexpected movements.

Market participants were cautiously awaiting new economic data, particularly the U.S. employment report, which often influences gold prices due to its impact on the dollar and overall market sentiment. The market continued surprising traders on Friday as gold prices dropped below the $2,000 mark. This decline followed the release of better-than-expected U.S. employment and consumer sentiment data, which bolstered investor confidence in the economy and reduced the appeal of safe-haven assets like gold.

Despite Friday's close below the 10-day moving average, typically seen as a bearish signal, the trend of lower U.S. interest rates persists, suggesting it might be premature to declare an end to gold's uptrend. In the coming week, buyers are expected to re-enter the market, but with indicators pointing to a sideways movement, adopting a range-trading strategy could be more prudent.

Resistance: 2010, 2050, 2075, 2080, 2100, 2150

Support: 2000, 1984, 1946, 1900, 1884, 1836

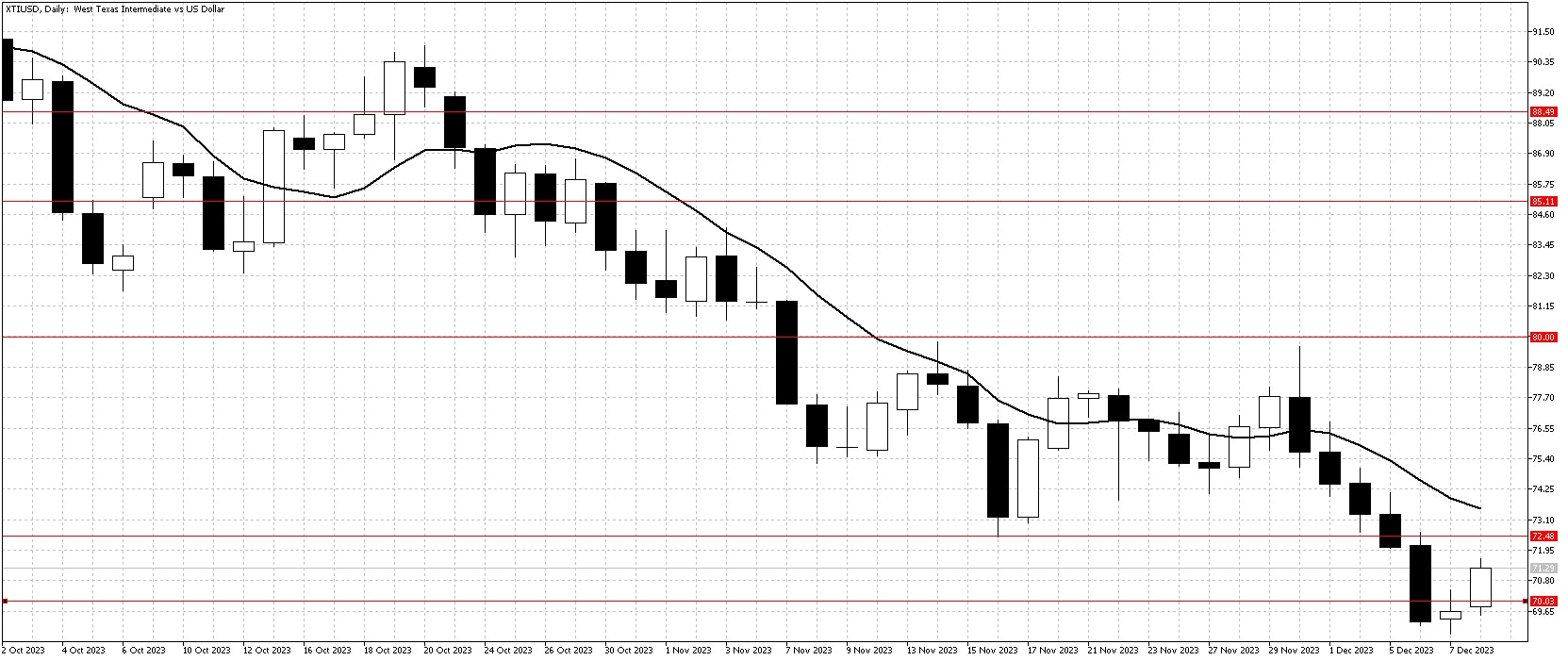

WTI

West Texas Intermediate (WTI) crude oil experienced a significant drop below $70 per barrel, a level not seen since June, marking its seventh consecutive weekly decline. This downward trend is mainly due to growing concerns among traders regarding the potential decrease in oil consumption by China, the world's largest importer of crude oil. The prospect of an increase in oil supply from the United States compounds these concerns. Recent Chinese customs data revealed a 9% year-over-year decline in November crude oil imports.

The Organization of the Petroleum Exporting Countries and its allies (OPEC+) have recently announced plans to cut oil production, but this has not alleviated market anxieties. Many market participants still need to be convinced about the implementation and effectiveness of these production cuts. Their concern stems from doubts about OPEC+'s commitment to and ability to enforce these cuts among member countries. This scepticism is fueled by the group's historical challenges in maintaining strict compliance with production quotas and its member states' varying economic needs and priorities.

Despite these challenges, the oil market experienced a slight rebound towards the end of the week, buoyed by unexpectedly strong employment and consumer sentiment data from the United States. These positive economic indicators helped push WTI prices back above the $70 mark. The closing prices on Friday provided a glimmer of hope, suggesting a possible halt to the significant price declines seen in the short term. However, with technical indicators still pointing towards a downward trend, potential buyers should exercise caution. Market analysts suggest waiting for WTI prices to rise above their 10-day moving average before considering new purchases, which could indicate a more sustained recovery in oil prices.

Resistance: 72.50, 80.00, 85.10, 88.50, 94.00

Support: 70.00, 66.75, 65.00